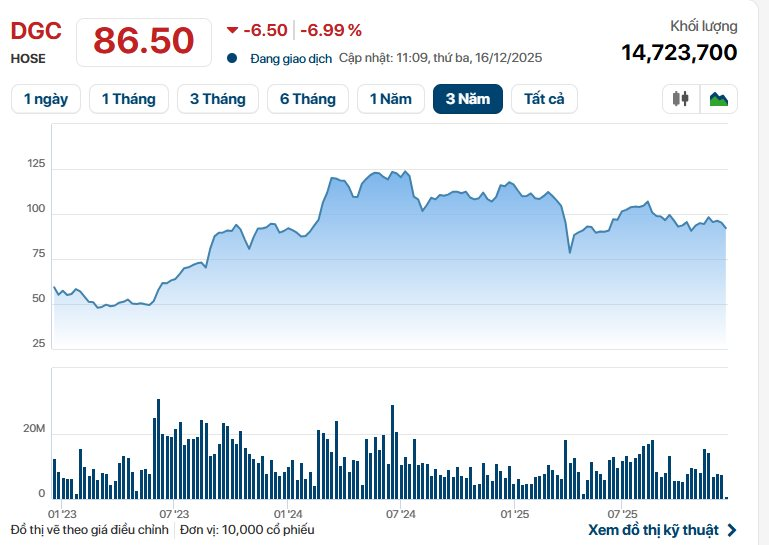

The VN-Index is undergoing a significant correction, leading to widespread cautious sentiment in the market. Amid this backdrop, shares of DGC, Duc Giang Chemical Group JSC, are also facing increased selling pressure, underperforming the broader market.

On the morning of December 16th, DGC’s stock price plummeted to its lower limit, closing at 86,500 VND per share, marking its lowest level in approximately 8 months. Notably, intense selling pressure at times resulted in millions of sell orders piling up at the floor price.

Additionally, the stock’s trading volume surged dramatically. As of 11:10 AM on December 16th, DGC’s matched volume reached around 14.7 million shares (equivalent to 4% of its outstanding shares), setting a new liquidity record since its listing.

Vietnam currently has five companies engaged in the production and trading of yellow phosphorus, primarily located in Lao Cai province. Among them, DGC boasts the largest yellow phosphorus production capacity in the country, with a total designed capacity of 69,800 tons/year, accounting for 56% of the national yellow phosphorus capacity. Furthermore, DGC is Vietnam’s leading producer and exporter of phosphoric acid.

Recently, Duc Giang Chemical announced a shareholder list closure on December 25th, 2025, for an interim cash dividend payment for 2025. The dividend rate is set at 30%, equivalent to 3,000 VND per share, with payment scheduled for January 15th, 2026.

With nearly 380 million outstanding shares, DGC is expected to disburse approximately 1.14 trillion VND for this dividend payment. This interim dividend is comparable to the company’s dividend plans for the consecutive years 2023–2024. In 2022, the company distributed a cash dividend of up to 40%, exceeding initial plans due to outstanding business performance.

In related news, on November 12th, 2025, the Hanoi People’s Committee issued Decision No. 5568/QD-UBND, approving the investment policy and designating the investor for the Duc Giang Public Works, School, and Housing Complex project.

This is a rare large-scale project in the Duc Giang – Viet Hung area, proposed by Duc Giang Chemical Group and directly implemented by Duc Giang Real Estate LLC, a subsidiary of the group.

Previously, in October 2025, the Hanoi People’s Committee issued Decision No. 4590/QD-UBND, approving the detailed 1/500 scale planning for the Duc Giang Public Works, School, and Housing Complex at 18/44 Duc Giang Street, Thuong Thanh Ward, Long Bien District.

The complex spans over 47,470 m² at 18, Alley 44, Duc Giang Street (Viet Hung Ward, Hanoi), featuring 60 townhouses, an 880-unit high-rise apartment building, a 1.1-hectare school, and a system of services, commerce, and sports facilities.

The total investment is estimated at 4.5 trillion VND, fully funded by Duc Giang’s equity. The project is scheduled to run from 2025 to 2030.

Regarding business operations, in 2025, Duc Giang Chemical set a revenue target of 10,385 billion VND, a 5% increase year-on-year, while after-tax profit is projected at 3,000 billion VND, down 3%.

In the first nine months, revenue reached 8,521 billion VND, up 14% year-on-year, and after-tax profit hit 2,532 billion VND, a 9% increase. Gross profit margins narrowed from 35.3% to 33.3%, causing profit growth to lag behind revenue growth.

As of the end of Q3/2025, DGC’s equity reached 16,011 billion VND, including 3,798 billion VND in share capital and 9,042 billion VND in undistributed after-tax profits. The company holds over 13,000 billion VND in cash and bank deposits, up 2,400 billion VND from the beginning of the year, accounting for approximately 68% of total assets. In the first nine months, interest income from deposits totaled 447 billion VND, an 11% year-on-year increase.

Should Investors ‘Buy the Dip’ After the VN-Index Turmoil?

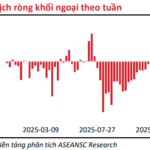

The VN-Index just endured a shocking week, plummeting over 94 points and erasing much of the gains accumulated over the previous month. As we enter the final trading weeks of the year, the market is anticipated to experience a technical rebound. Investors holding significant cash reserves are advised to consider gradual deployments during market fluctuations.