Mobile World Investment Corporation (Stock Code: MWG, HoSE) has recently submitted a report detailing its share buyback results.

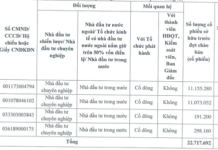

Between November 19, 2025, and December 12, 2025, Mobile World successfully repurchased 10 million MWG shares to reduce its charter capital.

The company will proceed with the necessary legal procedures to decrease its charter capital in line with the total par value of the repurchased shares.

With an average repurchase price of VND 80,969 per share, Mobile World is expected to allocate nearly VND 809.7 billion for this buyback. The funding will be sourced from the company’s equity and undistributed after-tax profits, as reflected in the audited 2024 financial statements (consolidated and separate).

Following this transaction, Mobile World’s treasury shares will increase from over 1.2 million to more than 11.2 million. Conversely, its charter capital will decrease from approximately VND 14,797 billion to nearly VND 14,697 billion.

Illustrative image

In other developments, Mobile World recently announced the approval of an initial public offering (IPO) and listing plan for its subsidiary, Dien May Xanh Joint Stock Company, on the stock exchange.

The Board of Directors of Mobile World has thoroughly reviewed and approved Dien May Xanh’s IPO and listing plan. Dien May Xanh operates in the retail sector for mobile phones, electronics, and home appliances, with the IPO expected to launch in 2026.

The IPO marks a strategic shift, ushering in a new growth phase aimed at sustaining double-digit profit growth through quality-driven expansion. This includes broadening value-added products and services, optimizing the multi-service Super App platform, and scaling operations in the Indonesian market.

Additionally, Mobile World has decided not to participate in Dien May Xanh’s private placement, allocating the entire offering to individual investors who directly contribute to value creation and play a pivotal role in Dien May Xanh’s sustainable development strategy.

Dien May Xanh plans to privately issue 1% of its charter capital to key management individuals who have significantly contributed to the company’s growth. These shares will be subject to an 18-month transfer restriction from the completion of the offering to ensure long-term commitment.

In November 2025, Mobile World approved a restructuring plan for its subsidiaries, focusing on specialized business operations.

Segments such as mobile phone and electronics retail (Thegioididong, TopZone, Dien May Xanh, Tho Dien May Xanh, and Erablue joint venture), pharmaceuticals (An Khang), and mother & baby products (AVAKids) will be managed and operated by independent legal entities. This restructuring aims to enhance focus, autonomy, and operational efficiency.

Alongside restructuring, the Board of Directors has outlined tailored development strategies for each business segment, emphasizing the cultivation of a capable leadership succession pipeline with independent operational capabilities.

The company is standardizing its governance and operational systems to ensure transparency, efficiency, and accountability, thereby strengthening its core competitive edge and laying a robust foundation for future growth.

Breaking: MWG Set to IPO Dien May Xanh by 2026

Elevating Điện Máy Xanh into an independent public company marks a pivotal strategic shift, unlocking a new era of growth for the enterprise. This move is poised to sustain double-digit profit growth in both the medium and long term.

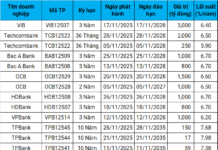

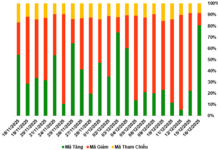

What is the Purpose of a Series of Corporate Share Buybacks?

Recently, several companies have been repurchasing treasury shares. Notably, under the Securities Law 2019 (effective from January 1, 2021), treasury shares must be canceled upon repurchase, and the company’s chartered capital must be reduced accordingly. This raises the question: what is the purpose of companies engaging in such share buybacks?