Year-End Review Conference 2025 and Work Plan Deployment for 2026 Held on December 15, 2025

|

According to the conference report, despite the impact of international political and economic fluctuations in 2025, Vietnam’s stock market maintained a positive growth trend compared to regional markets. This was attributed to the flexible leadership of the government, consistent policies from the Ministry of Finance, and the State Securities Commission’s (SSC) efforts in implementing reforms and modernizing technological infrastructure. A significant milestone was achieved when FTSE Russell officially upgraded Vietnam’s market status from Frontier to Secondary Emerging.

Under the close guidance of government and Ministry of Finance leaders, the SSC achieved notable results in 2025. Key legal frameworks were strengthened with the issuance of 2 Decrees, 1 Resolution, 7 Circulars, and 3 major projects. The SSC proactively implemented synchronized measures, engaged in regular policy dialogues, and demonstrated Vietnam’s commitment to market reforms. Additionally, the SSC enhanced market supervision, international cooperation, and administrative reforms, ensuring a safe, stable, transparent, and efficient market.

Addressing the conference, Deputy Minister of Finance Nguyen Duc Chi highlighted the complex global economic landscape and severe natural disasters in 2025, which posed challenges to Vietnam’s economy and stock market. However, under the Party’s leadership, the National Assembly’s oversight, and the government’s flexible management, macroeconomic stability was maintained, with state budget revenues exceeding targets. This macroeconomic foundation supported the stock market’s significant achievements in 2025.

Deputy Minister Chi identified five key highlights of the securities sector in 2025:

First, Vietnam’s stock market sustained positive growth, with notable increases in indices, liquidity, market capitalization, and investor numbers, reflecting its expanding scale, depth, and attractiveness.

Second, the legal framework for securities and the stock market was further reviewed, consolidated, and improved. The amended Securities Law and related legal documents issued in 2025 established a more synchronized and transparent framework, supporting efficient and healthy market operations.

Third, the new IT system’s launch provided a critical foundation for long-term market development, enabling the introduction of new products to meet the market’s growing scale.

Fourth, FTSE Russell’s upgrade of Vietnam’s market status affirmed its global financial standing.

Fifth, market discipline was strengthened, with violations detected and penalized, ensuring transparency and protecting investors’ rights for sustainable market development.

Looking ahead to 2026, Deputy Minister Chi noted that Vietnam faces new development opportunities and challenges as it begins the 2026-2030 term. He urged the SSC to focus on key tasks: refining legal frameworks, maintaining and improving market rankings, enhancing IT system safety and efficiency, and leveraging technology for market supervision.

Additionally, the SSC should develop new products, enhance investor quality by focusing on institutional investors, and strengthen international cooperation in securities.

Deputy Minister of Finance Nguyen Duc Chi

|

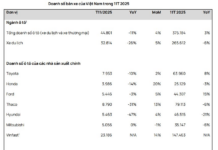

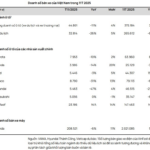

In 2025, the equity market saw robust index growth and liquidity, outperforming many regional markets. The VN-Index rose 38% year-on-year, with average trading value reaching nearly VND 29.44 trillion per session. Market capitalization exceeded VND 9.68 quadrillion, equivalent to 84.1% of the estimated 2024 GDP.

The bond market grew steadily, with over 473 listed bonds valued at more than VND 2.6 quadrillion, or 22.8% of the estimated 2024 GDP. Trading value increased by nearly 27% year-on-year, averaging nearly VND 15 trillion per session.

In the derivatives market, the VN100 futures contract provided investors with new options. Trading volume averaged over 241,000 contracts per session, up 14.3% year-on-year.

Investor accounts surpassed 11 million, a 24.7% increase from 2024.

Capital mobilization through the stock market surged, with equity and corporate bond issuances totaling over VND 142.33 trillion, nearly double the 2024 figure. State budget mobilization reached approximately VND 313 trillion.

– 09:06 16/12/2025

Striving for a Transparent, Healthy, and Internationally Aligned Gold Market

The establishment of a gold trading exchange is gaining significant attention from regulators, experts, and the business community, particularly following the National Assembly’s approval of the amended Investment Law. A key development is the removal of gold jewelry from the list of conditional business sectors. Representatives from the State Bank of Vietnam emphasize the need for a cautious roadmap in developing this model to achieve a dual objective: fostering market growth while safeguarding monetary security.

CNBC: Vietnam’s Stock Market Boom May Just Be the Beginning

“Step aside, China. Vietnam is seizing a piece of the spotlight from Asia’s largest market,” CNBC highlights.