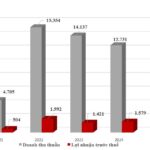

Binh Son Refining and Petrochemical Joint Stock Company (BSR) has reported impressive business results for 2025. The company achieved a production volume of 7.9 million tons (108% of the plan), revenue of VND 142,298 billion (102% of the plan), pre-tax profit of VND 4,541 billion (262% above the plan), and contributed VND 14,250 billion to the state budget (110% of the plan).

According to BSR, 2025 was marked by significant volatility in the global energy market, closely tied to geopolitical shifts and changing global demand. Brent crude oil prices dropped nearly 20%, from $79 per barrel to approximately $64 per barrel by year-end, with weekly fluctuations exceeding 16% at times.

Additionally, product pricing structures were impacted by intense competition from regional refining complexes. The high USD/VND exchange rate also added pressure to BSR’s raw crude oil imports. The energy transition and the expansion of E10 fuel policies further compelled BSR to adapt its production and business strategies flexibly.

In 2025, BSR faced a “dual challenge”: On one hand, it had to ensure the completion and exceedance of growth targets while maintaining its domestic market share and strengthening its position in both domestic and international markets. On the other hand, it needed to proactively adapt to unpredictable financial market fluctuations and the emerging energy wave reshaping the global competitive landscape.

Amid these challenges, BSR safely and stably operated the Dung Quat Oil Refinery at an average capacity of 120%. The company effectively capitalized on opportunities when crude oil prices fell while product prices remained stable or even increased, optimizing profits.

Notably, BSR proactively managed production and sales, closely following business scenarios updated based on oil price trends and crack spreads. This allowed the company to adjust capacity and boost sales during favorable market conditions.

In the second half of 2025, BSR maintained an average refinery capacity of 122% and intensified product sales. As a result, profits surged by 113% compared to the first half, despite a 7% drop in crude oil prices and harsh weather conditions.

BSR also completed its capital increase from VND 31,005 billion to VND 50,707 billion.

Furthermore, BSR diversified its product portfolio, introducing high-value plastics such as F3030, T3045, P3034, TF4035, sustainable aviation fuel (SAF), granulated sulfur, and E10 RON 95 gasoline. These new products contributed approximately VND 1,920 billion to total revenue, a 34% increase from 2024.

BSR also expanded its international business activities, with products like DO oil, FO oil, and RFCC Naphtha generating around VND 2,050 billion in revenue, a 37% increase from 2024.

In financial solutions, BSR optimized cash flow by expanding its banking partnerships beyond the Big Four state-owned banks, increasing financial revenue and profits. The company also minimized energy consumption, losses, and operational costs, saving VND 828 billion in 2025, 35% above the plan.

According to market research firms Wood McKenzie and Platts, Dated Brent crude oil prices are expected to fall below $60 per barrel in 2026 due to prolonged oversupply from OPEC+ countries. BSR’s consolidated revenue for 2026 is projected to fall short of the plan by over VND 32,000 billion.

BSR’s General Director, Nguyen Viet Thang, stated that the company will focus on two key solution groups. For traditional solutions, BSR will prioritize managing volatility to ensure stable, safe, and continuous refinery operations at high capacity, optimize costs and product structures, and resume operations at the Dung Quat Biofuel Plant to increase E100 supply for E5 and E10 gasoline production. The company will also optimize cash flow to boost financial revenue and actively seek external service opportunities and business development through subsidiaries.

For breakthrough solutions, BSR aims to research and test increasing refinery capacity to 123%-125% of design capacity, potentially adding VND 6,472 billion to VND 8,763 billion in revenue across various oil price scenarios. The company will also drive innovation, develop new products, and target revenue of approximately VND 57,000 billion. Additionally, BSR will enhance international sales and trade to increase revenue by VND 8,197 billion. The company will also explore external production expansion (through processing, trading, and mergers) and develop external services, aiming to add VND 500 billion to VND 3,000 billion in 2026.

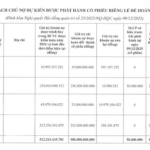

Hoang Quan Real Estate Issues 50 Million Shares in Debt-to-Equity Swap for Four Creditors

Hoàng Quân Real Estate plans to issue 50 million shares to convert a total of VND 500 billion in debt owed to four creditors, including Chairman Trương Anh Tuấn.