Year-End Review Conference 2025 and Work Plan Deployment for 2026 Held on December 15, 2025

|

According to the conference report, despite the impact of international political and economic fluctuations in 2025, Vietnam’s stock market (VNSE) maintained a positive growth trend compared to regional markets. This was attributed to the flexible leadership of the government, consistent policies from the Ministry of Finance, and the State Securities Commission’s (SSC) efforts in implementing reforms and modernizing technological infrastructure. A significant milestone was achieved when FTSE Russell officially upgraded Vietnam from a frontier market to a secondary emerging market.

Under the close guidance of government and Ministry of Finance leaders, the SSC achieved notable results in 2025. Key legal frameworks were strengthened with the issuance of 2 Decrees, 1 Resolution, 7 Circulars, and 3 major projects. The SSC proactively implemented synchronized measures, engaged in regular policy dialogues, and demonstrated Vietnam’s commitment to reforms for market upgrades. Additionally, the SSC enhanced market supervision, international cooperation, and administrative reforms, ensuring a safe, stable, transparent, and efficient market.

Addressing the conference, Deputy Minister of Finance Nguyen Duc Chi highlighted that 2025 presented significant challenges due to complex global economic conditions and severe natural disasters. However, under the Party’s leadership, National Assembly’s oversight, and the government’s flexible management, Vietnam’s macroeconomy remained stable, with state budget revenues exceeding targets. This macroeconomic stability laid the foundation for the stock market’s positive performance in 2025.

The Deputy Minister identified five key achievements of the securities sector in 2025:

First, the VNSE sustained positive growth, with notable increases in indices, liquidity, market capitalization, and investor numbers, reflecting its expanding scale, depth, and attractiveness.

Second, the securities legal framework was further reviewed, consolidated, and improved. The amended Securities Law and related legal documents issued in 2025 established a more synchronized and transparent framework, supporting efficient and healthy market operations.

Third, the new IT system’s launch provided a critical foundation for long-term market development, enabling the introduction of new products to meet growing market demands.

Fourth, FTSE Russell’s upgrade of Vietnam to a secondary emerging market reinforced the VNSE’s global financial standing.

Fifth, market discipline was strengthened, with violations detected and penalized according to the law, ensuring transparency, protecting investor rights, and promoting a healthy and sustainable market.

Looking ahead to 2026, Deputy Minister Nguyen Duc Chi noted that Vietnam faces new development opportunities as the year marks the beginning of the 2026-2030 term. This creates a favorable environment for growth but also requires the VNSE to better meet the economy’s needs.

For 2026, the Deputy Minister urged the SSC to focus on: refining legal frameworks to support market development; implementing measures to maintain and improve Vietnam’s market ranking; ensuring the safe and efficient operation of the IT system; and enhancing technology application for market supervision.

Additionally, the SSC should develop new products, improve investor quality by focusing on institutional investors, enhance investor education, and strengthen international cooperation in the securities sector.

Deputy Minister of Finance Nguyen Duc Chi

|

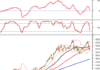

In 2025, the equity market continued to outperform regional peers in index growth and liquidity. The VN-Index rose 38% year-on-year, with average trading value reaching nearly VND 29.44 trillion per session. Market capitalization exceeded VND 9.68 quadrillion, equivalent to 84.1% of the estimated 2024 GDP.

The bond market grew steadily, with over 473 listed bonds valued at more than VND 2.6 quadrillion, or 22.8% of the estimated 2024 GDP. Trading value increased by nearly 27% year-on-year, averaging nearly VND 15 trillion per session.

In the derivatives market, the introduction of VN100 futures contracts provided investors with new options. Average trading volume reached over 241,000 contracts per session, up 14.3% year-on-year.

Investor accounts surpassed 11 million, a 24.7% increase from 2024.

Capital mobilization through the VNSE surged, with equity and corporate bond issuances totaling over VND 142.33 trillion, nearly doubling from 2024. State budget mobilization reached approximately VND 313 trillion.

– 09:06 16/12/2025

VPS Securities’ VCK Stock Officially Lists on HOSE

The successful listing of VPS shares on Vietnam’s largest stock exchange marks a pivotal milestone, ushering in a new era of heightened transparency, corporate governance, and financial disclosure standards for the company.

Vietnam Stocks Plunge Over 50 Points on Black Friday, Defying Asian Market Trends

A 3% drop made Vietnamese stocks the biggest decliner in Asia on December 12th, even bucking the region’s overall trend.