Three individuals nominated for recognition are Mr. Le Quang Vinh, CEO of Vietcombank; Mr. Nguyen Manh Hung, Board Member; and Ms. Nguyen Thi Kim Oanh, Board Member.

Feedback can be submitted directly to the Human Resources Department, State Bank of Vietnam, via email at [email protected] before December 18, 2025.

Mr. Le Quang Vinh, born in 1976 in Hanoi, holds a Bachelor’s degree in Economics – Banking and Finance from the National Economics University and a Master’s degree in Economics – Finance from the University of New South Wales (Australia). He began his career at Vietcombank in 1999, serving in various key roles such as credit analyst, department head, Director of Risk Management Division, Deputy CEO, and Acting Executive Director. In March 2025, he was appointed CEO of Vietcombank, while also serving as a Board Member and Deputy Secretary of the Party Committee.

Mr. Le Quang Vinh – CEO of Vietcombank

Mr. Nguyen Manh Hung, born in 1974 in Hanoi, graduated from the National Economics University and holds a Master’s degree in Economics. He started his career at the Bank for Foreign Trade of Vietnam in 1998, progressing through roles such as Project Officer, Credit Management Officer, Deputy Head and Head of Credit Policy Department. In 2012, he was appointed Deputy Director and later Director of Vietcombank’s Hanoi Branch. With extensive expertise, he was elected to the Board of Directors in December 2014.

Mr. Nguyen Manh Hung – Board Member of Vietcombank

Ms. Nguyen Thi Kim Oanh, born on May 10, 1975, in Nghe An Province, holds a Master’s degree in Finance – Banking from the University of New South Wales (Australia). She joined the Bank for Foreign Trade of Vietnam in 1997, holding positions such as Project Officer, Deputy Head and Head of Credit Risk Management, and Head of Credit Policy Department.

Ms. Nguyen Thi Kim Oanh – Board Member of Vietcombank

From 2013 to 2014, she served as a Board Member of Vietcombank and was appointed Deputy CEO in December 2014. With her extensive experience in risk management and credit operations, she was elected to the Board of Directors in November 2023 and continues to serve in this role.

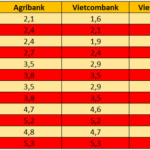

December 16: Agribank, Vietcombank, VietinBank, and BIDV Jointly Hike Savings Interest Rates Across All Terms

The four largest banks in the system—Agribank, Vietcombank, VietinBank, and BIDV—have collectively raised their over-the-counter savings interest rates, particularly for long-term deposits. This move not only elevates the overall deposit interest rate landscape but also serves as a significant indicator in the deposit market.

Upcoming Government Review: Green Project Proposal with 2% Annual Interest Rate Funding

Mrs. Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors at the State Bank of Vietnam, announced that this week, the State Bank will submit to the Government a draft Decree guiding the implementation of a 2% annual interest rate subsidy for loans supporting green, circular projects that adhere to ESG standards.

Central Bank Officially Launches 32 Fully Digital Public Services

On December 15th, the State Bank of Vietnam (SBV) launched its centralized Administrative Procedure Resolution Information System. This system now offers 32 fully online public services (DVCTT) for businesses, with certain application components replaced by data from the National Public Service Portal (https://dichvucong.gov.vn).