Mr. Nguyen Nhu So – Chairman of Dabaco Group’s Board of Directors

In response to market inquiries, Mr. Nguyen Nhu So, Chairman of Dabaco’s Board of Directors, forecasts that pork prices during the Lunar New Year will fluctuate between 65,000 and 70,000 VND/kg. This is due to a market shortage of approximately 5 million pigs caused by disease outbreaks and natural disasters, prompting companies to rebuild their herds.

For 2026, Dabaco sets a target price range of 54,000 to 55,000 VND/kg. The leadership believes that actual prices are unlikely to drop below 50,000 VND/kg.

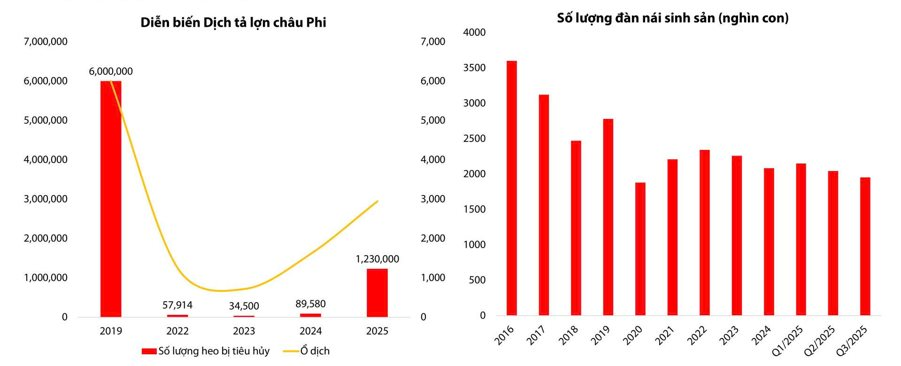

Analyzing the year-end pork price outlook, Ms. Le Thuy Tuong Vy, Analyst at Dragon Capital Securities (VDSC), reported that as of November 2025, 1.23 million pigs were culled due to African Swine Fever (ASF), accounting for over 4% of the total herd.

Coupled with the impact of storms in the North and Central regions, supply has significantly decreased. Notably, the breeding sow population as of Q3/2025 dropped by 6% compared to 2024.

The trend of panic selling pigs during the disease outbreak, which drove prices down sharply between July and October 2025, is gradually cooling. Looking ahead, demand is expected to recover in the final months of the year, particularly during festive seasons and as students return to school. Given current dynamics, VDSC predicts that pork prices could rebound to nearly 80,000 VND/kg, influenced by stronger disease impacts compared to 2024.

“No one can sustainably produce pork at 42,000 VND/kg if all costs are factored in.”

Long-term, Dabaco emphasizes its competitive edge through an upgraded closed-loop value chain model: Feed – Farm – Food – Future.

Notably, at the conference, production costs were candidly discussed, comparing Dabaco’s figures with those of Hoa Phat Agriculture (42,000 VND/kg) and BAF (43,000-44,000 VND/kg).

Dabaco’s leadership clarified that their actual average production cost ranges from 47,600 to 48,000 VND/kg. They assert that no producer can sustainably achieve 42,000-43,000 VND/kg if all expenses—including depreciation, interest, labor, utilities, and other critical yet often overlooked costs—are fully accounted for.

Dabaco maintains efficient farming operations with key technical metrics: a feed conversion ratio (FCR) of 2.28 across the group and a mortality rate controlled below 5%.

Additionally, the company has achieved self-sufficiency in vaccine production, with an annual capacity of 1 million doses. The Vaccine Institute and R&D Center are being accelerated to meet export goals by late 2028.

In processing, Phase 2 of the oil extraction plant is slated for Q1/2026 launch, increasing capacity to 1,500 tons/day. The new facility will diversify product offerings—from crude oil to refined oil, Lecithin, and soy meal—boosting processing segment revenue.

To achieve the 2 million commercial pigs/year target by 2028, Dabaco plans to expand its sow herd to 82,000.

In 2027, four new farms will commence operations in Thanh Hoa, Quang Ninh, Lao Cai, and Quang Tri. Concurrently, a 200,000-ton/year feed mill in Ha Tinh is on track for completion and operation by July-August 2026.

Real Estate Investment

Dabaco unveiled specific investment figures for its commercial projects. The Dabaco Ly Thai To project, featuring a shopping center, offices, and luxury apartments, is budgeted at 2.7 trillion VND, with execution from Q4/2025 to Q1/2029.

The Van An Urban Area, another flagship project, is allocated 1.875 trillion VND, slated for completion by 2028-2029. This project offsets investments in two BT initiatives: the Van Mieu Lake Park (695 billion VND) and the H2 Road (1.18 trillion VND). Dabaco has approved capital increases for relevant subsidiaries to ensure resource availability.

Financially, in the first nine months of 2025, net revenue reached 12,271 billion VND, up 23% year-on-year. After-tax profit hit 1,358 billion VND, 2.5 times higher than the previous year. These results surpass annual targets, achieving 134.9% of the profit goal (1,007 billion VND).

Urban Fringe Land Transforms into Highly Sought-After Mega Cities

Urban megacities on the outskirts are increasingly attracting residents and investors due to their excellent infrastructure connectivity and the development of green, fully-equipped living environments.

Anlac Green Symphony Shophouse: The Golden Key to Unlocking Prosperity

Nestled along the prime dual frontage of Ring Road 3.5, these shophouses are emerging as the ultimate investment hotspot in West Hanoi. Offering a rare blend of advantages, they seamlessly combine a luxurious green living environment with unparalleled commercial potential, ensuring steady cash flow and robust appreciation prospects.