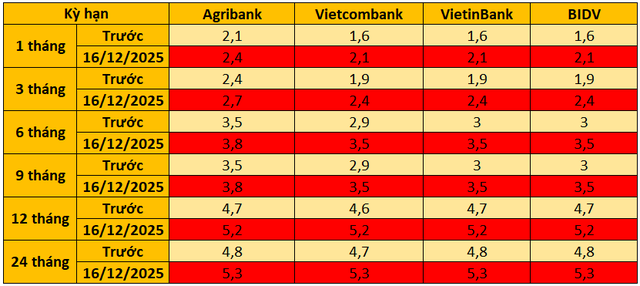

As of the latest update this morning (December 16), four state-owned commercial banks—Agribank, Vietcombank, VietinBank, and BIDV—have collectively raised their over-the-counter savings interest rates across all terms, from short to medium and long-term deposits. This move marks a significant shift in the deposit interest rate landscape for these state-owned banks, which are often considered the market benchmark.

For short-term deposits, the adjustments are quite noticeable. Agribank increased the 1-month term rate from 2.1% per annum to 2.4% per annum. Meanwhile, Vietcombank, VietinBank, and BIDV raised their rates from 1.6% per annum to 2.1% per annum. Post-adjustment, the interest rate gap between Agribank and the other three banks remains, but the overall rate has increased by 0.3% per annum.

Similarly, for the 3-month term, Agribank raised its rate from 2.4% per annum to 2.7% per annum. Vietcombank, VietinBank, and BIDV collectively increased their rates from 1.9% per annum to 2.4% per annum. The increase ranges from 0.3% to 0.5% per annum.

The 6 to 9-month terms saw more substantial increases. For the 6-month term, Agribank raised its rate from 3.5% per annum to 3.8% per annum; Vietcombank increased from 2.9% per annum to 3.5% per annum; and VietinBank and BIDV adjusted from 3% per annum to 3.5% per annum. A similar trend was observed for the 9-month term, with all four banks setting new rates: Agribank at 3.8% per annum and the other three at 3.5% per annum.

For long-term deposits, there was a significant increase of 0.5% to 0.6% per annum. For the 12-month term, Agribank raised its rate from 4.7% per annum to 5.2% per annum. Vietcombank, VietinBank, and BIDV also increased their rates from the 4.6% to 4.7% per annum range to a uniform 5.2% per annum. Post-adjustment, the 12-month savings interest rates at the counters of these four state-owned banks have been “leveled” to the same rate.

This trend continued for the 24-month term. Agribank increased its rate from 4.8% per annum to 5.3% per annum, while Vietcombank, VietinBank, and BIDV adjusted from 4.7% to 4.8% per annum to 5.3% per annum. This is also the highest interest rate in the over-the-counter rate table for these banks following the adjustment.

The Big4 group currently holds nearly half of the total deposits in the entire system. The collective increase in over-the-counter savings interest rates by Agribank, Vietcombank, VietinBank, and BIDV highlights the growing pressure to mobilize capital, especially amid accelerating credit demand and intensifying competition in the market. As market leaders, every move by these state-owned banks not only directly impacts depositors but also has the potential to create a ripple effect, influencing the overall interest rate landscape across the system in the near future.

Unlock Double-Digit Growth: Beyond Bank Capital

The demand for medium and long-term capital to fund critical national projects is immense, placing significant strain on the credit system’s ability to supply funds. This challenge is compounded by the heightened maturity risk, as the primary source of lending capital remains short-term deposits.

Unlocking Vietnam’s Green Future: Where Will the $700 Billion in Green Capital Come From?

Deputy Governor of the State Bank of Vietnam, Nguyen Ngoc Canh, revealed that by 2050, the total long-term investment demand for green and sustainable economic development is projected to reach between $670 billion and $700 billion. This staggering figure underscores the urgent need to mobilize and strengthen all resources to achieve the nation’s green growth objectives.

Novaland Group Secures Financing

As of September 30th, Novaland Group’s total outstanding loans amounted to over 64 trillion VND, with short-term debt accounting for approximately 32 trillion VND. Despite this, Novaland is planning to execute a convertible loan with a maximum limit of 2.5 trillion VND, which can be converted into equity.

Unlocking Major Capital Inflows: Experts Call for More State-Owned Enterprise IPOs and Listings to Boost Market Supply

According to Mr. Hoang, the critical issue is not merely the flow of capital, but whether the market possesses sufficient “commodities” to effectively absorb this capital. In this context, the privatization of state-owned enterprises plays a particularly vital role.