I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

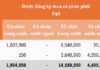

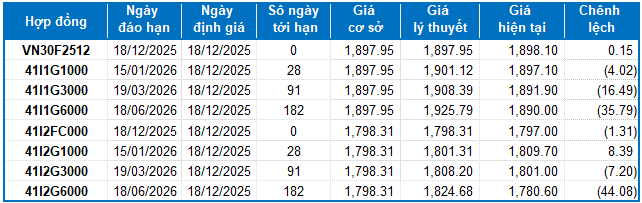

On December 17, 2025, VN30 futures contracts experienced a collective decline. Specifically, VN30F2512 (F2512) dropped by 0.76% to 1,898.1 points; 41I1G1000 (I1G1000) fell by 0.57% to 1,897.1 points; 41I1G3000 (I1G3000) decreased by 0.66% to 1,891.9 points; and 41I1G6000 (I1G6000) declined by 0.76% to 1,890 points. The underlying index, VN30-Index, closed at 1,897.95 points.

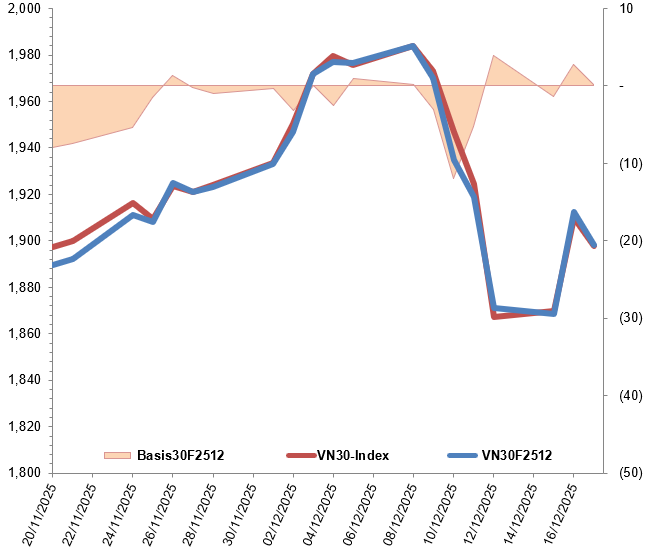

Meanwhile, VN100 futures contracts showed mixed movements. Notably, 41I2FC000 (I2FC000) decreased by 0.79% to 1,797 points; 41I2G1000 (I2G1000) rose by 0.76% to 1,809.7 points; 41I2G3000 (I2G3000) increased by 0.31% to 1,801 points; and 41I2G6000 (I2G6000) climbed by 0.88% to 1,780.6 points. The underlying index, VN100-Index, closed at 1,798.31 points.

During the December 17, 2025 session, VN30F2512 experienced prolonged volatility in the morning session. In the afternoon, short sellers gained dominance, causing F2512 to plummet despite buyers’ efforts to regain control. Consequently, the contract closed at 1,898.1 points, down by 14.5 points.

Intraday Chart of VN30F2512

Source: https://stockchart.vietstock.vn/

At the close, the basis of the F2512 contract narrowed compared to the previous session, reaching 0.15 points. This indicates a less optimistic sentiment among investors.

Fluctuations of VN30F2512 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

Meanwhile, the basis of the I2FC000 contract reversed from the previous session, reaching -1.31 points. This reflects a return to pessimism among investors.

Fluctuations of 41I2FC000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

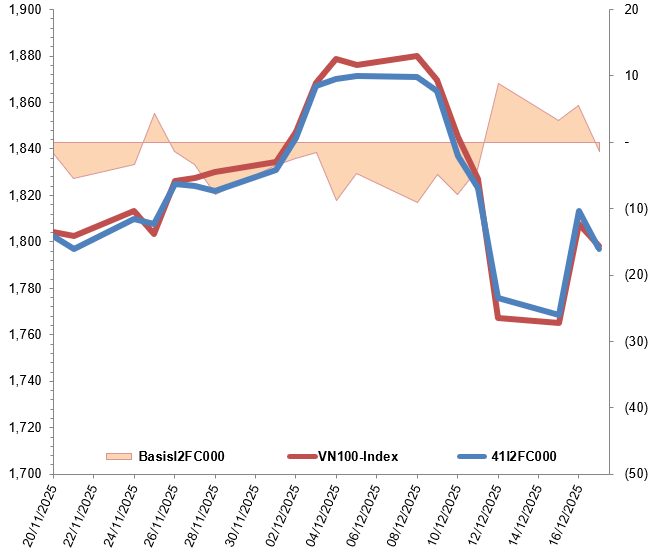

Trading volume and value in the derivatives market decreased by 36.11% and 35.36%, respectively, compared to the December 16, 2025 session. Specifically, F2512 trading volume dropped by 37.52% to 251,639 contracts. I2FC000 trading volume fell by 82.11% to 17 contracts.

Foreign investors resumed net selling, with a total net selling volume of 1,720 contracts on December 17, 2025.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

I.2. Valuation of Futures Contracts

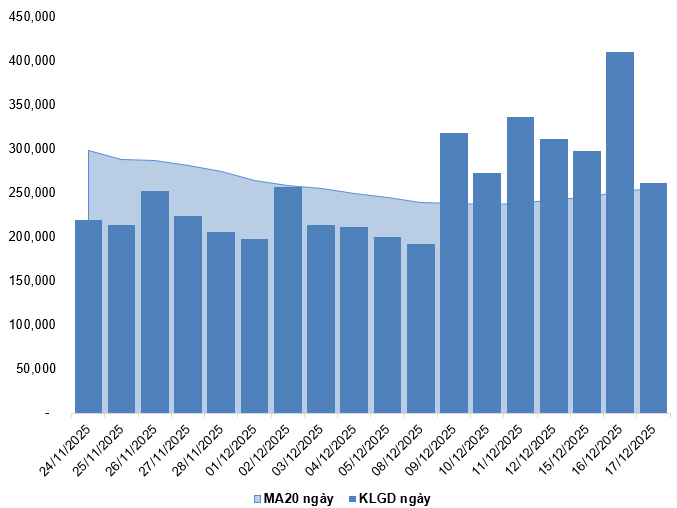

Based on the fair pricing method as of December 18, 2025, the reasonable price range for futures contracts currently trading in the market is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity cost in the pricing model is adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

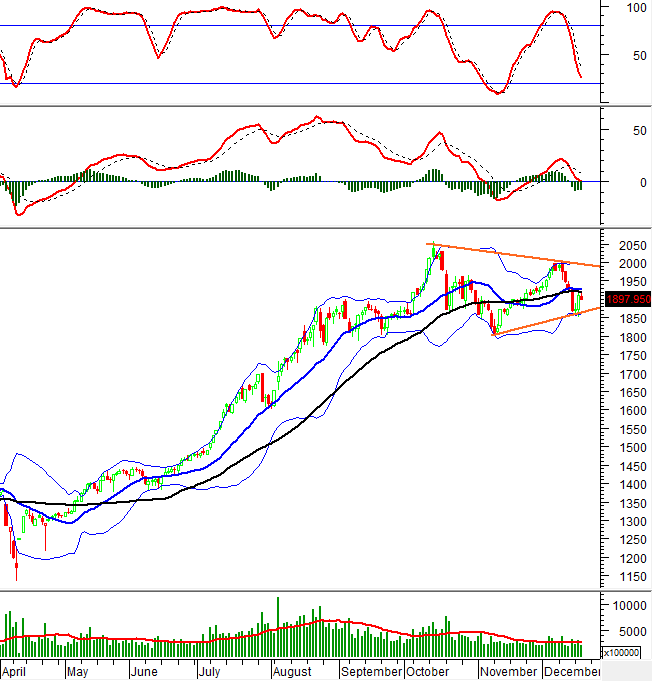

I.3. Technical Analysis of VN30-Index

On December 17, 2025, VN30-Index experienced a slight decline, accompanied by a small-bodied candlestick pattern and reduced trading volume below the 20-session average. This indicates a cautious sentiment among investors.

Currently, the index remains below the Middle line of the Bollinger Bands, while the distance between the MACD line and the Signal line continues to widen after a sell signal, approaching the zero level.

Additionally, the Stochastic Oscillator continues to decline after issuing a sell signal. This suggests a bearish short-term outlook.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

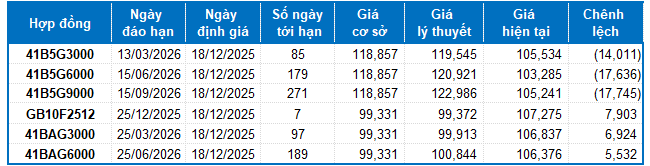

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of December 18, 2025, the reasonable price range for futures contracts currently trading in the market is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity cost in the pricing model is adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments suitable for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, and 41B5G9000 are currently attractively priced. Investors may focus on and consider buying these futures contracts in the near future, as they present a favorable opportunity in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:28 17/12/2025

Derivatives Market Update: Mixed Signals Emerge on December 17, 2025

On December 16, 2025, both the VN30 and VN100 futures contracts surged in a synchronized rally. The VN30-Index extended its gains, forming a prominent Big White Candle pattern on the charts. This bullish signal was further reinforced by trading volumes surpassing the 20-session average, indicating a notable shift in investor sentiment away from pessimism.

Derivatives Market on December 16, 2025: Persistent Tug-of-War

On December 15, 2025, both VN30 and VN100 futures contracts experienced declines during the trading session. The VN30-Index exhibited a tug-of-war pattern, forming a near-Doji candlestick shape. This was accompanied by a drop in trading volume, falling below the 20-session average, indicating investor hesitation and uncertainty.

Vietstock Weekly: December 15-19, 2025 – Rising Risks Ahead?

The VN-Index plunged dramatically, marked by the emergence of a Big Black Candle pattern, while slicing below the Middle line of the Bollinger Bands. Trading volume persistently remained below the 20-week average, indicating investors are still gripped by caution. With the MACD indicator widening its gap from the Signal line following a sell signal since late October 2025, market volatility is likely to persist in the near term.