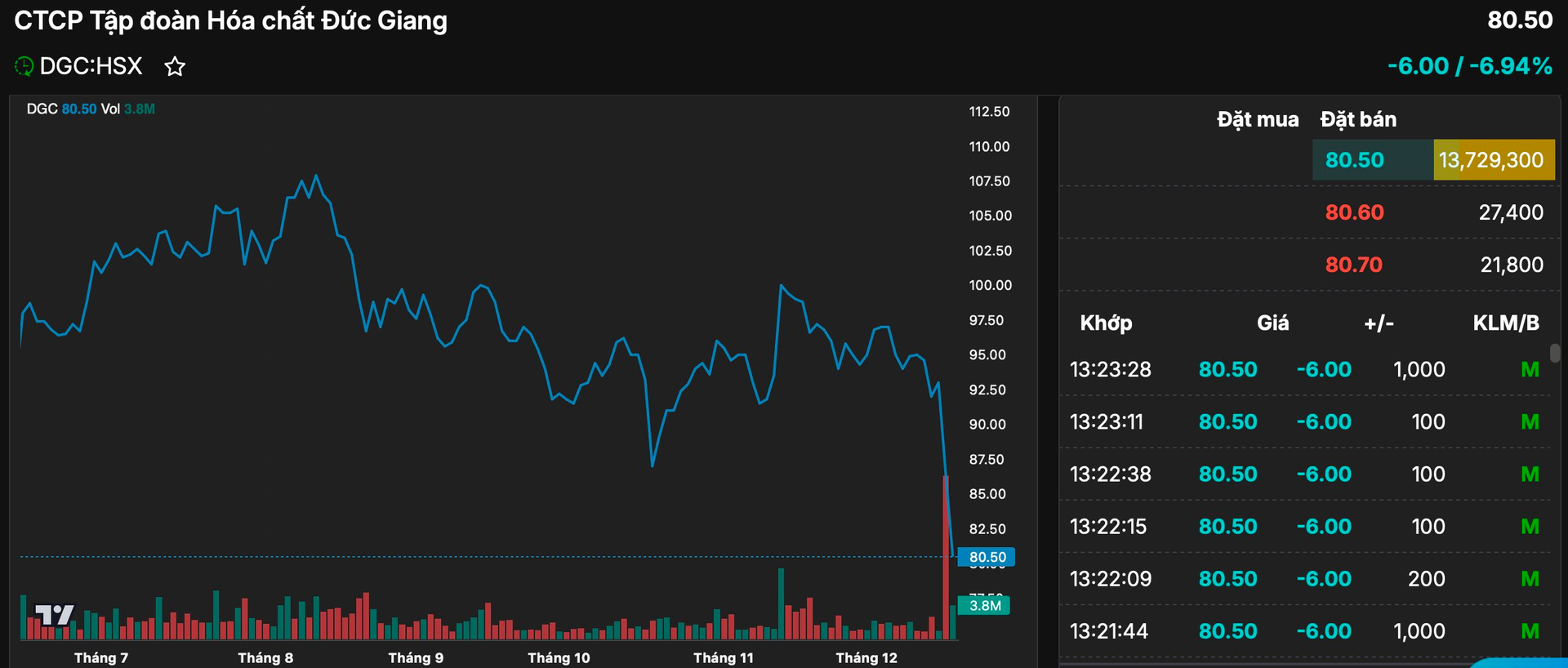

Following a record-volume sell-off, Duc Giang Chemicals’ (DGC) shares continued their freefall on December 17th, with no buyers in sight. The stock has plummeted to levels not seen since early April, marking a 30% decline since the year’s start. Market capitalization now stands at just over VND 30 trillion.

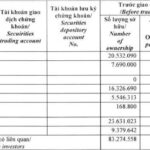

Many investors are trapped in DGC, with over 13 million sell orders (over 3% of outstanding shares) awaiting execution, while only 4 million shares traded hands during the morning session on December 17th. Notably, Dragon Capital funds breathed a sigh of relief, having exited their major shareholder position beforehand.

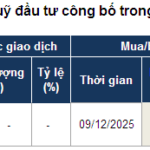

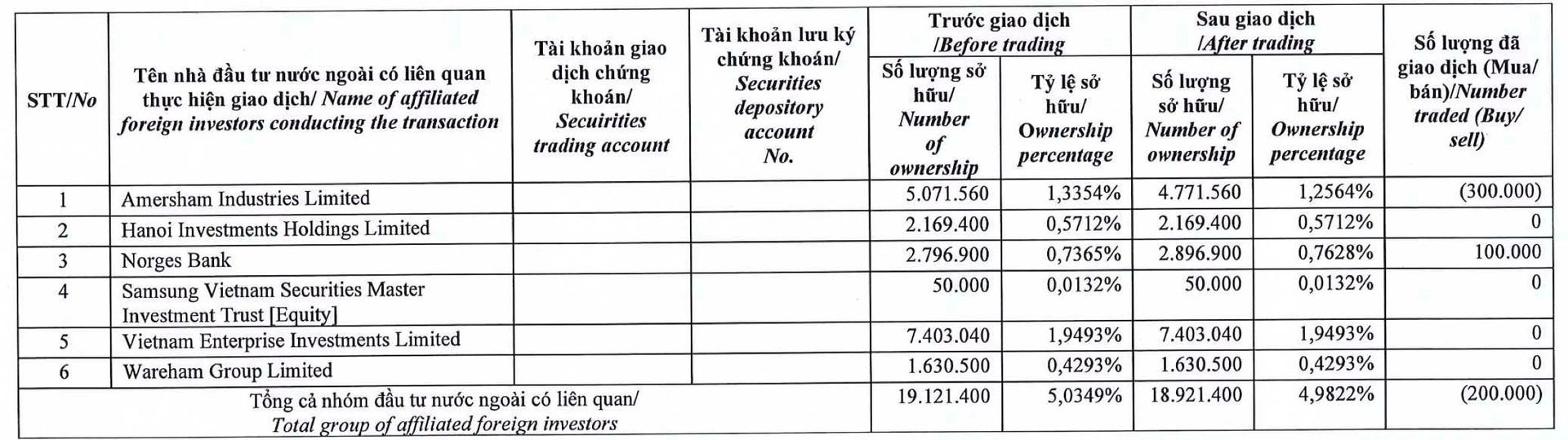

On November 11th, Dragon Capital-managed funds sold 200,000 DGC shares, reducing their ownership below 5% and officially relinquishing major shareholder status as of November 13th. This transaction freed them from disclosure obligations for future DGC sales.

Dragon Capital’s DGC transactions on November 11th

DGC’s sharp decline precedes Duc Giang Chemicals’ planned 30% cash dividend for 2025 (VND 3,000 per share), totaling VND 1.14 trillion. The record date is December 25th, with payment scheduled for January 15th, 2026.

In the first nine months of 2025, Duc Giang Chemicals reported VND 8.521 trillion in net revenue, a 14.4% increase, and VND 2.532 trillion in net profit, up 9%. This performance achieved 84.4% of the company’s annual VND 3 trillion profit target.

A key project is the VND 12 trillion Duc Giang Nghi Son Chemical Complex in Thanh Hoa, divided into three phases. Products include caustic soda, HCl, Javel, PAC, Chloramine B, PVC, and various industrial chemicals, with chlorine derivatives produced domestically for the first time.

Additionally, at the recent Lam Dong Investment Promotion Conference, Duc Giang Chemicals signed a memorandum to study and propose a VND 58 trillion (USD 2.3 billion) bauxite-alumina-aluminum complex project.

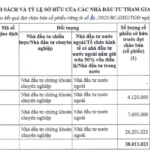

Dragon Capital Increases Stake to Nearly 10% in Dat Xanh Group

Dragon Capital acquired 28.07 million shares in Dat Xanh Group’s private placement while divesting 1.7 million shares. Post-transaction, Dragon Capital holds a 9.8566% stake in Dat Xanh Group.

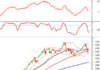

Technical Analysis Afternoon Session 11/12: Testing the Middle Line of Bollinger Bands?

The VN-Index is poised to retest the middle band of the Bollinger Bands following its recent consolidation. Meanwhile, the HNX-Index remains locked in a tug-of-war at its November 2025 lows.