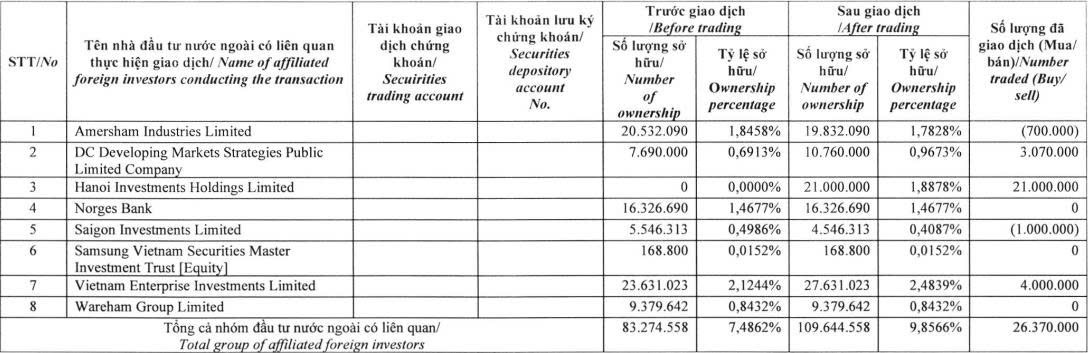

Dragon Capital, a leading foreign investment group, recently released a report detailing changes in ownership among its affiliated foreign investors who hold significant stakes (5% or more) in Dat Xanh Group Joint Stock Company (Stock Code: DXG, listed on HoSE).

On December 9, 2025, three member funds of Dragon Capital participated in the private placement of 93.5 million shares by Dat Xanh Group.

Specifically, DC Developing Markets Strategies Public Limited Company acquired 3.07 million DXG shares, Hanoi Investments Holdings Limited purchased 21 million shares, and Vietnam Enterprise Investments Limited bought 4 million shares.

Source: DXG

Conversely, two other Dragon Capital member funds sold a combined 1.7 million DXG shares. Amersham Industries Limited sold 700,000 shares, while Saigon Investments Limited sold 1 million shares.

Following these transactions, Dragon Capital’s total holdings in DXG increased from approximately 83.3 million shares to over 109.6 million shares, raising its ownership stake from 7.4862% to 9.8566% of Dat Xanh Group’s capital.

Regarding Dat Xanh Group’s private placement, the offering concluded on December 9, 2025, with 93.5 million shares sold to four foreign investors.

In addition to the three Dragon Capital funds, Victory Holding Investment Limited (VHIL), a VinaCapital affiliate, acquired the largest portion with 65.43 million shares, securing a 5.87% stake and becoming a major shareholder of Dat Xanh.

At a sale price of VND 18,600 per share, Dat Xanh raised a net total of VND 1,738.6 billion. These proceeds will be allocated to Ha An Real Estate Investment and Business Joint Stock Company (a DXG subsidiary), which will invest in its subsidiary, Phuoc Son Investment Joint Stock Company.

Upon completion of the offering, DXG’s chartered capital increased from VND 10,206.3 billion to VND 11,141.3 billion.

Individual Becomes Major Shareholder of BMS After Acquiring Over 30 Million Shares in Private Placement

On December 9th, Mrs. Truong Thi Thanh Truc significantly increased her stake in Bao Minh Securities (UPCoM: BMS) by acquiring 30.64 million shares in a private placement. This purchase elevated her ownership from 255,300 shares (0.32%) to nearly 30.9 million shares (15.15%), officially making her a major shareholder.

Technical Analysis Afternoon Session 11/12: Testing the Middle Line of Bollinger Bands?

The VN-Index is poised to retest the middle band of the Bollinger Bands following its recent consolidation. Meanwhile, the HNX-Index remains locked in a tug-of-war at its November 2025 lows.