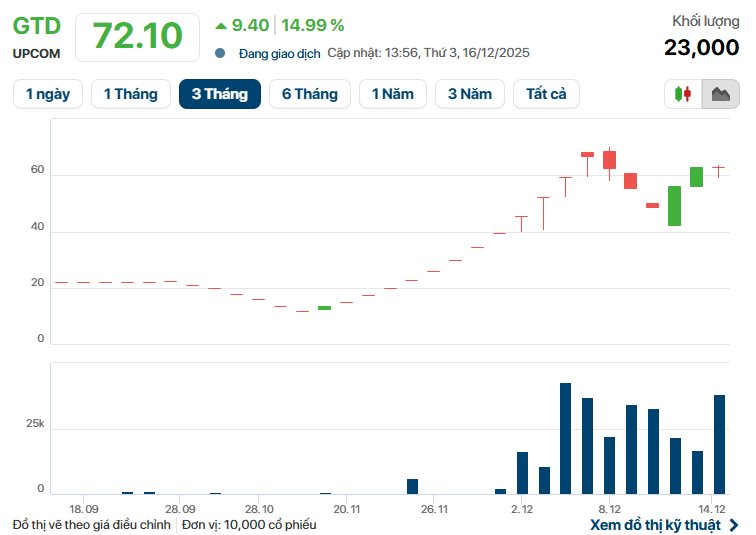

The Hanoi Stock Exchange (HNX) has announced the results of the auction for the shares of Thuong Dinh Shoe Joint Stock Company (stock code: GTD), owned by the Hanoi People’s Committee.

This represents the entire stake of the Hanoi People’s Committee in the company, equivalent to nearly 69% of its charter capital. Consequently, the investor replacing the Hanoi People’s Committee in Thuong Dinh Shoe could gain controlling interest in the company.

Specifically, 6.38 million GTD shares were offered at a starting price of VND 20,500 per share. The auction attracted 15 investors, all individuals.

The highest bid reached VND 216,000 per share, over 10 times the starting price.

Ultimately, two investors won the auction, with all offered shares fully allocated.

The highest winning bid was VND 216,000 per share, the lowest was VND 134,000 per share, and the average winning price was nearly VND 215,999 per share. The highest volume bid was 6.3 million shares, and the lowest was 2,000 shares.

With this outcome, the Hanoi People’s Committee is expected to earn approximately VND 1,379 billion from the divestment. The payment deadline for the shares is set from December 16 to 22, 2025.

Notably, the winning auction price is about three times the market price of GTD shares on December 16 and approximately 14 times higher than the pre-divestment announcement price of around VND 15,000 per share.

With 9.3 million outstanding shares, Thuong Dinh Shoe’s valuation exceeds VND 2,000 billion.

After over 60 years, Thuong Dinh Shoe now exports to the EU, Australia, and several Asian countries. However, in the past five years, the influx of global brands like Adidas, Puma, and Nike has intensified competition, significantly marginalizing Thuong Dinh Shoe in the domestic market.

According to the 2024 audited financial report, Thuong Dinh Shoe’s revenue was only VND 78.8 billion, the lowest in a decade. Rising costs led to a net loss of nearly VND 13 billion, more than double the 2023 loss. Accumulated losses by year-end exceeded VND 67 billion.

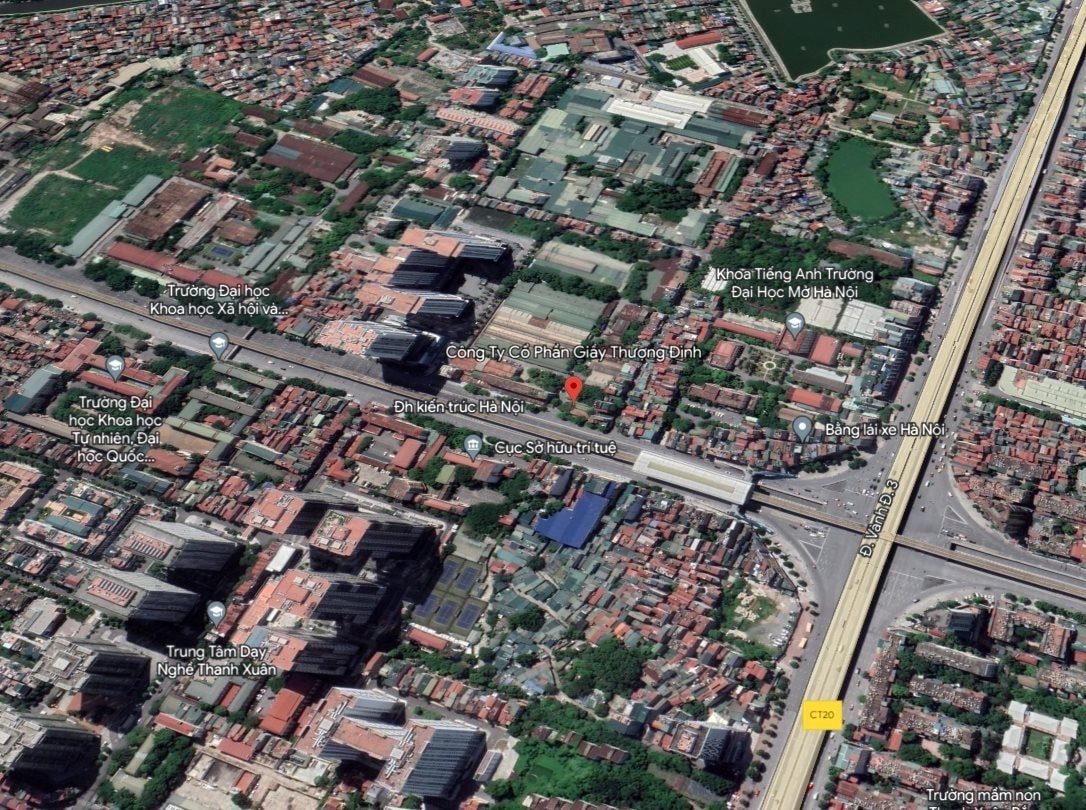

A notable asset of Thuong Dinh Shoe is its 36,105 m² land plot at 277 Nguyen Trai, Hanoi. This 3.6-hectare site, with significant frontage on Nguyen Trai Street, is slated for relocation under Hanoi’s urban planning policy.

Approved plans designate this land for the Thuong Dinh Commercial-Office-Service-School Complex, with Thuong Dinh Shoe as the developer. The project’s total investment is VND 1,600 billion, targeting completion by 2030 after the factory relocation.

CMN Shares Hit Ceiling Ahead of 20% Stake Auction, Four Institutions Vie for Purchase

Vinataba’s divestment of a 20% stake in Colusa – Miliket Foodstuff JSC (UPCoM: CMN) has sparked a frenzy, with purchase registrations surpassing the offering by a factor of four. This overwhelming demand propelled CMN’s stock price to its daily limit on December 15th, inching closer to its all-time high.

Six Individual Investors Spend Over VND 900 Billion to Acquire Petrosetco Shares from PVN

Six domestic individual investors have acquired the entire 24.9 million shares of PET from PVN, securing a 23.21% stake in Petrosetco’s chartered capital.