Bao Minh Securities Corporation (BMSC, stock code: BMS, listed on UPCoM) has recently announced a revised plan for utilizing the proceeds from its private placement of shares.

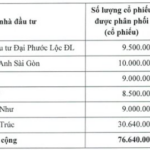

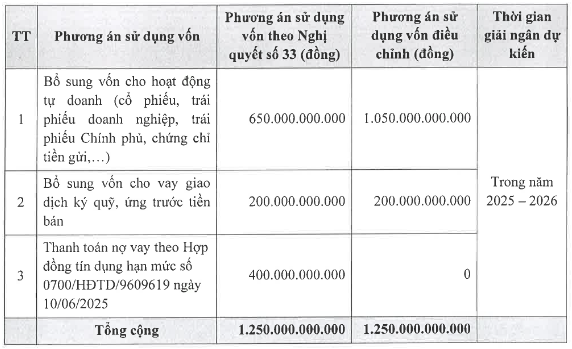

Specifically, BMSC will allocate the 1.25 trillion VND raised from the private placement as follows:

Source: BMS

Notably, BMSC has decided not to use 400 billion VND for debt repayment as previously announced. This decision stems from the fact that the outstanding debts under the Debt Acknowledgment Notes attached to the Credit Line Contract No. 0700/HĐTD/9609619 dated June 10, 2025 (as per the capital utilization plan approved by the Board of Directors in Resolution No. 33/2025-BMSC/NQ-HĐQT on July 29, 2025) had already matured before the funds from the private placement were available.

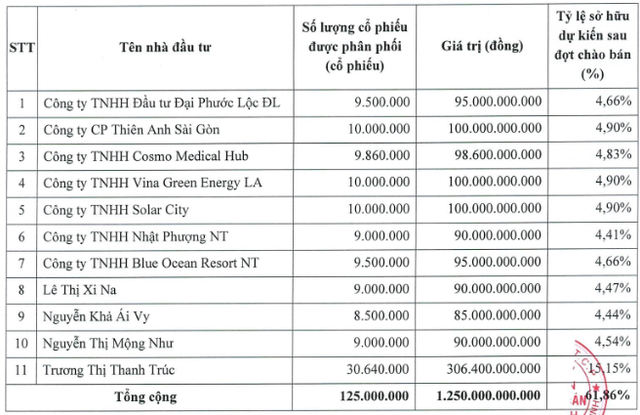

On December 9, Bao Minh Securities successfully distributed 125 million shares to 11 investors, including 7 corporate entities and 4 individuals. The offering price was set at 10,000 VND per share.

Following the placement, these 11 investors collectively hold 61.86% of BMS’s charter capital. Among them, Ms. Truong Thi Thanh Truc emerged as a major shareholder with a 15.15% stake, while the remaining 10 investors each hold less than 5%.

Source: BMS

With the completion of this issuance, Bao Minh Securities has increased its charter capital to over 2,039 billion VND.

In other developments, Bao Minh Securities has scheduled an Extraordinary General Meeting of Shareholders for the morning of January 10, 2026. The shareholder list was closed on December 8, 2025.

A key agenda item is the Board of Directors’ proposal to continue pursuing the listing of the company’s shares on the Ho Chi Minh City Stock Exchange (HoSE), as previously approved at the 2025 Annual General Meeting in April.

The Board of Directors confirmed that the company is actively completing the necessary procedures for HoSE listing. Preparation of documentation and coordination with relevant parties are ongoing, with updates to be provided at subsequent shareholder meetings.

On the personnel front, the meeting will address the resignation of one Board member and two Audit Committee members. Replacements will be elected to fill these vacancies.

Mr. Do Van Ha has resigned from his position as an Independent Board Member due to work commitments. Mr. Ha was appointed to this role in April 2023.

Two Audit Committee members, Ms. Moc Thi Lan Uyen and Ms. Truong Thi Bich Ngan, have also submitted their resignations. Ms. Uyen and Ms. Ngan, both holding Bachelor’s degrees in Accounting and Auditing, were appointed in April 2022 and April 2023, respectively.

Additionally, the meeting will review and approve several key documents, including the Company’s Charter, Internal Governance Rules, Board of Directors’ Operating Regulations, and Audit Committee Operating Regulations.

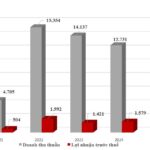

How is GELEX Infrastructure Performing on the Eve of its IPO?

In 2025, GELEX Infrastructure is poised to achieve remarkable business results, targeting a revenue of VND 15,445 billion, a 21.5% increase, and pre-tax profit of VND 1,925 billion, up 18.5% compared to 2024 performance.

Individual Becomes Major Shareholder of BMS After Acquiring Over 30 Million Shares in Private Placement

On December 9th, Mrs. Truong Thi Thanh Truc significantly increased her stake in Bao Minh Securities (UPCoM: BMS) by acquiring 30.64 million shares in a private placement. This purchase elevated her ownership from 255,300 shares (0.32%) to nearly 30.9 million shares (15.15%), officially making her a major shareholder.

Masan Consumer Sets HoSE Listing Date, Plans Bonus Share Issue

Masan Consumer’s MCH stock will have its final trading day on UPCoM on December 17, 2025, and is expected to officially list on HoSE on December 25, 2025.