Current Interest Rate Hike Differs from 2022

Speaking at the Vietnam Real Estate Conference 2025 (VRES 2025), Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, noted that in the final quarter of this year, interest rates began to rise as many commercial banks reported a decline in deposits, pushing the 12-month deposit interest rate to 5.3-5.5% per annum.

According to Mr. Quoc Anh, to accurately assess the impact of the year-end interest rate hike, it must be compared with the 2022 period.

Mr. Quoc Anh stated that current home loan interest rates remain within the transaction support range.

In 2022, the market faced a “double shock” as global inflation soared, exchange rates fluctuated sharply, and Vietnam was forced to raise interest rates in line with the Fed. Loan interest rates then surged to 11-15% amid a corporate bond crisis that abruptly tightened credit. At that time, the real estate market nearly stalled, and transactions plummeted. The pressure of loan interest forced many investors to sell at a loss, particularly in land plots.

This period also saw the real estate market overheating, with speculative products dominating. A significant portion of transactions relied on financial leverage, making the market fragile. When interest rates rose suddenly, many investors could no longer afford the interest payments, causing liquidity to plummet.

In contrast, the context in 2025 is entirely different. The current slight increase in deposit interest rates is a technical adjustment to restore the capital base after the deep reductions of 2024. Lending rates are around 6-7% per annum, higher than the bottom rate of 5-5.5% for youth incentive packages but still within the transaction support range.

Mr. Quoc Anh analyzed that the 2025 market is much “calmer,” with a shift toward products tied to actual housing needs. Although transaction interest has not returned to the 2022 peak, capital is now focused on products with transparent legal frameworks, reflecting a cautious mindset after the 2022 shock and a more sustainable market development trend. “Current market pressure primarily stems from capital demand for public investment and production, while low deposit interest rates continue to shift capital into real estate and stocks,” Mr. Quoc Anh emphasized.

The Deputy General Director of Batdongsan.com.vn believes that banks slightly increasing deposit interest rates at year-end is a positive development, as it helps the system better balance long-term capital, creating a stable foundation for the next cycle.

Mr. Quoc Anh noted that there are no signs of widespread land fever; hotspots are mainly linked to administrative boundary mergers, with transactions still concentrated in apartments and private houses in major cities. By 2026, the market will clearly differentiate and enter a more stable orbit.

Apartments Lead the Market

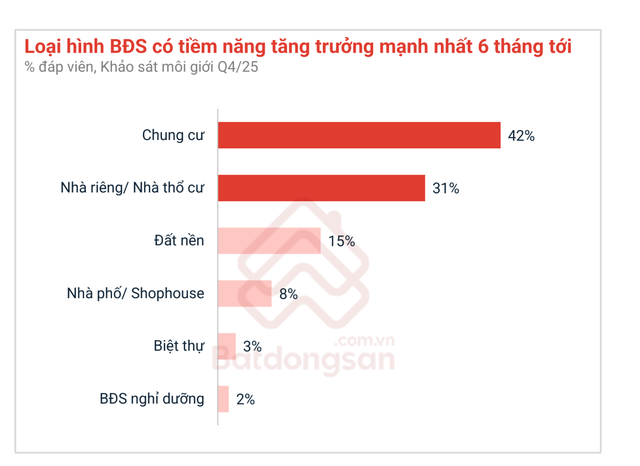

Discussing real estate segments, Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn in the Southern region, believes that apartments and private houses will remain the most promising segments in the first half of 2026. Apartments are projected to grow by 42%, while private houses and townhouses are expected to grow by around 31%.

The slight increase in apartment prices in 2026 is attributed to high-end supply raising the price floor, increased real demand, rising land and construction costs, unmet supply, and a trend of shifting from private houses to apartments.

Apartments lead the most promising segments in the next six months.

Notably, according to Mr. Tuan, buyer demand in Hanoi is shifting significantly away from the traditional market. Data shows that the proportion of Hanoi residents searching for real estate in the capital has dropped from 81% in Q1/2023 to 59% in Q4/2025. Conversely, capital is strongly moving south. Interest from Hanoi residents in Ho Chi Minh City real estate has risen from 6% to 20%. This shift indicates that northern investors are actively seeking markets with attractive price levels and higher growth potential.

Additionally, real estate companies’ year-end product launches with buyer support policies are driving market momentum. In Q4/2025, several real estate companies from North to South continued to release products with standout sales policies.

For example, in the North, the Masteri Era Landmark project offers a 1% discount on the selling price for new customers booking early, and 2% for Masterise Homes residents. Customers paying 100% within 30 days receive a discount of up to 15%.

For a 2-bedroom apartment priced at 5 billion VND with a 15% discount, buyers save 750 million VND. The developer’s policy allows buyers to split payments into 5-10% installments; for loans of 50-70%, they receive a 0% interest rate, a 34-36 month grace period on principal, and 12 months of free management fees.

Another Hanoi project, Rivea Hanoi by Tan A Dai Thanh, is attracting attention with a sales policy offering up to 14% discounts on apartment values for early payments. The bank also supports 0% interest rates and a 24-month grace period on principal.

In the South, An Gia Group is offering the remaining units of The Gio Riverside (Dong Hoa Ward, Ho Chi Minh City) with a notable sales policy. Buyers need only pay 21% of the apartment value in installments, equivalent to about 600 million VND for a 65m² unit. The bank finances the remainder, with the developer covering all interest for 36 months, including 24 months before handover and 12 months after receiving the house. The developer also grants a 60-month grace period on principal.

Buyers paying quickly receive a discount of up to 23.5%—a rare discount level in the 2025 year-end market.

Similarly, The Emerald Garden View project is set to launch in Ho Chi Minh City with a policy requiring only 20% of the apartment value upfront, with the remainder payable at 0.5% per month (approximately 7 million VND/month) over 30 months.

Amid rising interest rates, developer support in the year-end period has boosted market liquidity. According to Mr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, the real estate market has passed its most challenging phase and is recovering.

“Rising interest rates will certainly reduce short-term investment, especially speculative transactions. However, in the long term, this adjustment benefits the market by filtering out financially weak investors, directing capital into segments with real demand and feasible projects. Reducing speculation is not a negative sign. On the contrary, it is a necessary step for sustainable market development,” Mr. Dinh analyzed. “I believe that by the end of this year and into 2026, the real estate market will shape up to be of higher quality, more stable, and more sustainable,” Mr. Dinh emphasized.

Proposed Special Allowances for 5 Teacher Groups, Up to 150% of Salary

The Ministry of Education and Training is currently seeking public input on a draft decree detailing specific provisions of the Law on Educators. This draft outlines five distinct groups of educators eligible for attractive retention and utilization policies. Notably, the highest-tier group will receive a substantial allowance equivalent to 150% of their current salary for a period of five years.

Vietnam Set to Witness Record-Breaking 3.4 Quadrillion Dong Milestone This Week

According to the Ministry of Construction’s report, as of December 14th, the Ministry has compiled a list of 237 projects and constructions from various ministries, sectors, localities, corporations, and companies across 34 provinces and cities that are eligible for groundbreaking and inauguration ceremonies.

Electric Vehicle Battery Swapping Model Confirmed for Vietnam Deployment by 2026, Backed by Major Industry Player

Following VinFast, another electric vehicle giant, Honda, has confirmed the implementation of a battery-swapping system for electric motorcycles in Vietnam starting from 2026, addressing the most significant infrastructure challenge related to charging.