The luxury and high-end real estate market is experiencing a robust and sustained price surge.

A Clear Disparity

At a recent housing seminar, Mr. Vo Huynh Tuan Kiet, Residential Market Director at CBRE Vietnam, revealed that primary apartment prices in Ho Chi Minh City and Hanoi have risen by 35%-45% over the past year.

In Q3 alone, apartment prices in Ho Chi Minh City continued to climb by 15%-18%, pushing the average price to approximately VND 90 million per square meter. Notably, around 70% of new supply this year falls within the luxury and high-end segments, highlighting a significant mismatch with the actual housing needs of the majority of the population.

A luxury apartment project for the ultra-wealthy in downtown Ho Chi Minh City

Data from Knight Frank Vietnam also reflects this trend, with the average primary apartment price in Ho Chi Minh City nearing VND 96 million per square meter, up nearly 9% year-on-year. Approximately 60% of newly launched units are priced above VND 100 million per square meter, with the remainder primarily above VND 60 million per square meter. The dominance of luxury supply over mid-range and high-end segments has consistently pushed prices to new heights in 2025.

Observations show that since the beginning of the year, major developers have continuously launched high-end projects in central Ho Chi Minh City. Within a 4-5 km radius of the Thu Thiem New Urban Area and the city center, there are virtually no projects priced below VND 100 million per square meter. This has significantly narrowed housing opportunities for middle-class buyers.

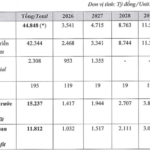

In Hanoi, a report by One Mount Group indicates that in the first nine months of 2025, the market recorded approximately 20,000 new apartments with an average price of VND 86 million per square meter (excluding VAT and maintenance fees). High-end units accounted for 62% of supply, while luxury units made up 38%.

Notably, five major developers—Masterise Homes, MIK Group, Mitsubishi, TSQ Vietnam, and Sun Group—accounted for 74% of newly launched units. Their primary absorption rate averaged 86%, reflecting strong demand for established brands.

In Ho Chi Minh City, the polarization is evident, with over 80% of new supply dominated by Dat Xanh Group, Gamuda Land, and Masterise Homes. These three brands not only control supply but also drive significant liquidity, with an average absorption rate of around 84%. However, experts caution that strong short-term liquidity is insufficient to mitigate long-term risks if the market remains skewed toward high-end segments, while affordable housing remains scarce.

Not a Random Development

Mr. Vo Huynh Tuan Kiet warns that a “real estate bubble” could emerge even in a supply-constrained market if speculative capital inflows are excessive, investors hoard properties, and short-term profit expectations far exceed actual absorption capacity. He recalled the 2007-2011 period, when soaring property prices, tightened credit, and a prolonged market freeze occurred. “Currently, with the upward trajectory of high-end and luxury segments, saturation risks will materialize if prices are pushed to irrational levels, such as VND 200-250 million per square meter,” he cautioned.

According to Mr. Tran Minh Tien, Director of Market Research and Customer Insights at One Mount Group, the concentration of housing supply among major developers is not coincidental. Amid stricter legal frameworks, high capital costs, and increasingly stringent project quality requirements, only financially robust companies with proven project development expertise and strong risk management capabilities can undertake high-end and luxury projects.

Conversely, mid-range and affordable housing supply remains scarce. Most new projects fall into the high-end and luxury categories, leaving real buyers, particularly middle-income earners, with limited options. This has driven up overall housing prices and widened the gap between actual demand and affordability.

In this context, economist Dr. Can Van Luc emphasizes that to stabilize the real estate market, the government and relevant ministries must continue refining land, planning, and real estate regulations. Vigorously implementing social housing solutions, including Decree 261/2025/ND-CP and Decree 302/2025/ND-CP on establishing the National Housing Fund, is crucial to cooling housing prices, especially for middle- and low-income earners.

Additionally, diversifying capital sources for the real estate market, expediting the establishment of the National Housing Fund and Real Estate Investment Trusts (REITs), and exploring a suitable property tax roadmap are essential to curb speculation and foster sustainable housing development.

For developers, Dr. Can Van Luc advises continued operational restructuring, tight cash flow and debt management, and cost control. Companies should also proactively engage with government support programs, particularly those for social housing and infrastructure development, to diversify their product portfolios and reduce reliance on high-end segments.

“An urgent issue is for developers to collectively bring property prices to more reasonable levels. Currently, Vietnam’s residential real estate prices have risen by approximately 59% from 2019 to 2024. As of 2025, Vietnamese need an average of 25.8 years of income to purchase an apartment, ranking 9th among over 100 surveyed countries, indicating increasingly difficult housing access,” Dr. Can Van Luc stressed.

Buyers Moving Away from “Flipping”

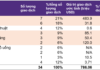

A One Mount Group survey also reveals that real estate investors are shifting from short-term speculation to long-term asset accumulation. Instead of “flipping” for quick profits, buyers increasingly prioritize safe, stable, and less volatile properties.

In this environment, developer reputation is critical, assessed through three criteria: transparent legal frameworks and full project execution capability; a reputable ecosystem of partners, from contractors and consultants to guarantor banks; and post-handover operational competence. This means that while high prices are necessary, efficient operation is the key to a project’s enduring appeal.

CapitaLand Development Sweeps Top Honors at PropertyGuru Asia Property Awards 2025

CapitaLand Development (CLD) Vietnam has been honored with the prestigious “Outstanding Sustainable Real Estate Developer” award, alongside five other distinguished accolades at the PropertyGuru Asia Property Awards (APA) 2025 Grand Final. This marks the fourth consecutive year CLD Vietnam has been recognized at APA, a platform celebrating the region’s most exceptional real estate enterprises and projects.

SOLA Peninsula – Masterise Homes’ Next Landmark in Villa Compound Living

As the market increasingly demands stringent standards and living experiences become the benchmark for luxury living, the value of a project extends beyond its architectural design. It is now fundamentally defined by the capabilities and vision of its developer.

Serene Living Amidst Urban Bustle: The New Standard for Hanoi’s Elite

Amidst the relentless pace of Hanoi, the pursuit of tranquility has become a coveted lifestyle choice for the elite. In this context, GIA22 – GIA by KITA emerges as a rare gem in the West of West Lake: a meticulously crafted sanctuary designed exclusively for those who appreciate the value of serenity amidst urban vibrancy.