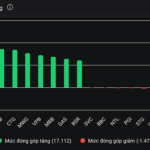

The stock market faced continued adjustment pressure on December 16th, closing around 1,630 points. Low liquidity in the morning session indicated weak selling pressure, as many stocks had entered oversold territory following a sharp decline in the previous session. However, the market rebounded strongly, driven by increased buying interest and improved liquidity as prices recovered. At the close, the VN-Index gained 33.17 points (+2.02%), settling at 1,679.18 points. Foreign investors turned net sellers, offloading approximately VND 75 billion across all three exchanges.

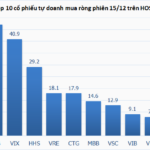

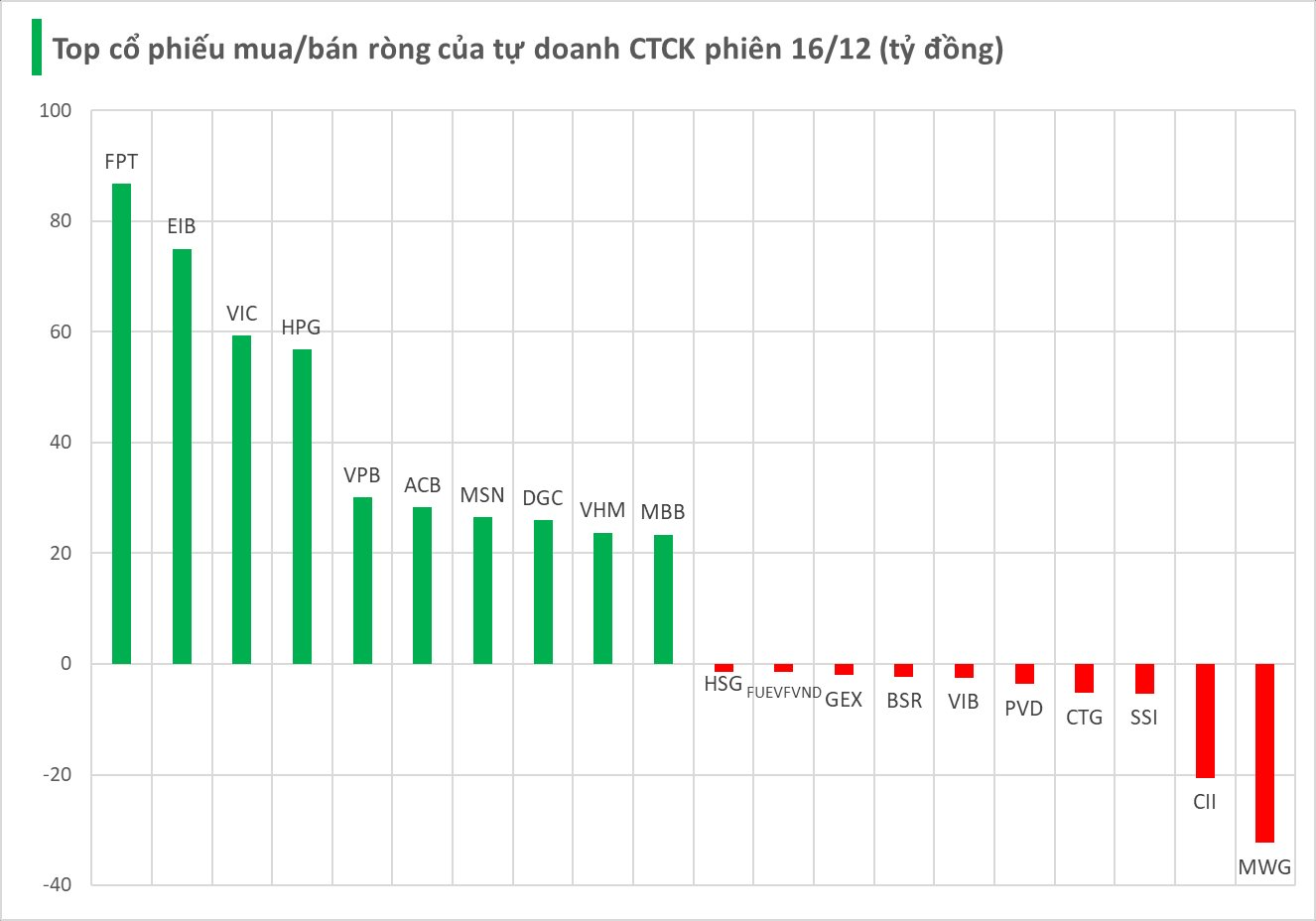

Securities firms’ proprietary trading desks were net buyers of VND 478 billion on HOSE.

Specifically, FPT saw the strongest net buying at VND 87 billion, followed by EIB (VND 75 billion), VIC (VND 59 billion), HPG (VND 57 billion), VPB (VND 30 billion), ACB (VND 28 billion), MSN (VND 27 billion), DGC (VND 26 billion), VHM (VND 24 billion), and MBB (VND 23 billion) – all actively purchased by securities firms’ trading desks.

Conversely, MWG experienced the heaviest net selling at VND -32 billion, followed by CII (VND -21 billion), SSI (VND -5 billion), CTG (VND -5 billion), and PVD (VND -4 billion). Other stocks with notable net selling included VIB (VND -3 billion), BSR (VND -2 billion), GEX (VND -2 billion), FUEVFVND (VND -2 billion), and HSG (VND -1 billion).

Market Volatility Intensifies: A Sharp 60-Point Swing Rocks the Stock Market

The VN-Index surged dramatically in the afternoon session on December 16, with a trading range of nearly 60 points. Strong bottom-fishing demand and the leadership of Vin Group stocks, particularly VPL, helped the market break its five-session losing streak. Meanwhile, VPS Securities’ VCK shares disappointed on their debut, falling over 15%.

Technical Analysis for the Afternoon Session of December 16: Downtrend Persists

The VN-Index extended its decline, breaching the 100-day SMA, signaling heightened risk ahead. Meanwhile, the HNX-Index experienced intense volatility, culminating in the formation of a Doji candlestick pattern.

Market Pulse 12/16: Spectacular Comeback as VN-Index Surges Over 30 Points

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”a7a554af-917f-4105-8a7f-1986e1c24ef9″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Ex”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”cit”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ement”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” persisted”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” throughout”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” today”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”‘s”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” session”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” with”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” numerous”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” stocks”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” even”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” closing”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” at”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” their”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” upper”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” limits”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” The”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” VN”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Index”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” surged”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” to”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” nearly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”8″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” points”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” marking”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” gain”}

Tracking the Whale Money Flow on December 15th: Foreign Investors Net Buy Amid Market Volatility

Amidst a volatile trading session marked by subdued liquidity, proprietary trading desks on the Ho Chi Minh Stock Exchange (HOSE) maintained a cautious stance. Meanwhile, foreign investors demonstrated robust appetite, recording a net buy value of VND 644 billion across all three major Vietnamese exchanges: HOSE, HNX, and UPCoM.