Specifically, the congress approved the continued implementation of the plan to issue nearly 8.6 million shares under the Employee Stock Ownership Plan (ESOP), part of the three capital increase schemes approved at the 2025 Annual General Meeting in April.

Previously, the company executed two schemes: issuing over 68.7 million rights shares to existing shareholders (at a ratio of 100:12) and distributing nearly 17.2 million bonus shares (at a ratio of 100:3).

|

MBS will proceed with the ESOP plan in the coming period

Source: Resolution of the 2025 Extraordinary General Meeting of MBS

|

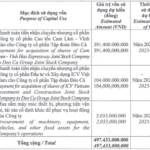

Another highlight of the meeting was the approval of a plan to issue up to 333.7 million shares to the public (at a ratio of 2:1) following the completion of the ESOP. If successful, MBS’s chartered capital will surpass 10,000 billion VND.

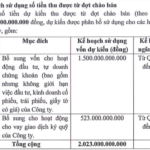

With an offering price of 10,000 VND per share, the company expects to raise nearly 3,337 billion VND, prioritizing 1,000 billion VND for proprietary trading and approximately 2,337 billion VND for margin lending activities.

At the meeting, MBS’s leadership emphasized that capital increase is essential given the company’s modest chartered capital. This move will enhance financial capacity, expand business operations, and position MBS among the market’s leading securities firms.

The capital increase plan is expected to be completed by mid-2026. The company will focus on effectively utilizing the additional capital to improve operational quality and profitability.

In the 2027-2028 period, based on market conditions, MBS will consider further capital increase options. Gradually scaling up capital is crucial for strengthening long-term competitiveness.

Addressing shareholder concerns about the rationale for raising capital to 10,000 billion VND shortly after a 12% increase, an MBS representative explained that the previous capital raise only met a small portion of the company’s needs.

“The continued capital increase aims to enhance financial capacity, expand margin and proprietary trading, comply with legal requirements, and prepare for upcoming business opportunities within the MB Group,” the representative stressed.

Regarding shareholder concerns about dilution and share price stability, the company’s leadership stated their focus is on improving operational efficiency and effective capital utilization, without intervening in share price movements.

In the first nine months of 2025, MBS achieved a record profit of over 1,000 billion VND, with ROE ranking second among the top 10 securities firms by market share. This reflects the collective efforts of employees in meeting AGM targets and ensuring long-term shareholder value.

– 13:58 17/12/2025

Female TVC Chairwoman Sells 1.45 Million Shares

Ms. Nguyen Thi Hang, Chairwoman of TVC’s Board of Directors, successfully completed the sale of 1.45 million TVC shares between December 3rd and 4th, 2025.