On December 15th, shares of Phat Dat Real Estate Development Corporation (PDR) closed at VND 19,000 per share, marking a 3.55% decline.

Previously, on August 29th, 2025, Nguyen Van Dat, Chairman of Phat Dat’s Board of Directors, registered to sell 88 million PDR shares.

The transaction was executed via a negotiated agreement between September 5th and September 18th, 2025. During this period, 88.4 million PDR shares were traded through negotiated agreements, totaling approximately VND 2,121 billion, with an average price of VND 23,992 per share. It is estimated that Mr. Dat earned over VND 2,100 billion from this transaction.

Prior to the transaction, Mr. Dat held over 359 million shares (equivalent to 36.72%). Post-transaction, his ownership decreased from 359.8 million shares (36.7% of capital) to 271.8 million shares (27.7%), still making him the largest shareholder. The combined ownership of Mr. Dat and Phat Dat Holdings in PDR stands at 36.45%.

Phat Dat stated that this transaction was a proactive decision. Mr. Dat transferred a small portion of his ownership through negotiated agreements to convert personal assets into readily available financial resources, enabling immediate support for Phat Dat’s larger business plans.

Mr. Dat emphasized, “I am willing to sacrifice short-term gains for the long-term, sustainable benefits of Phat Dat and its shareholders.”

However, PDR shares have fallen nearly 23% since August 29th, resulting in a market capitalization loss of over VND 5,400 billion.

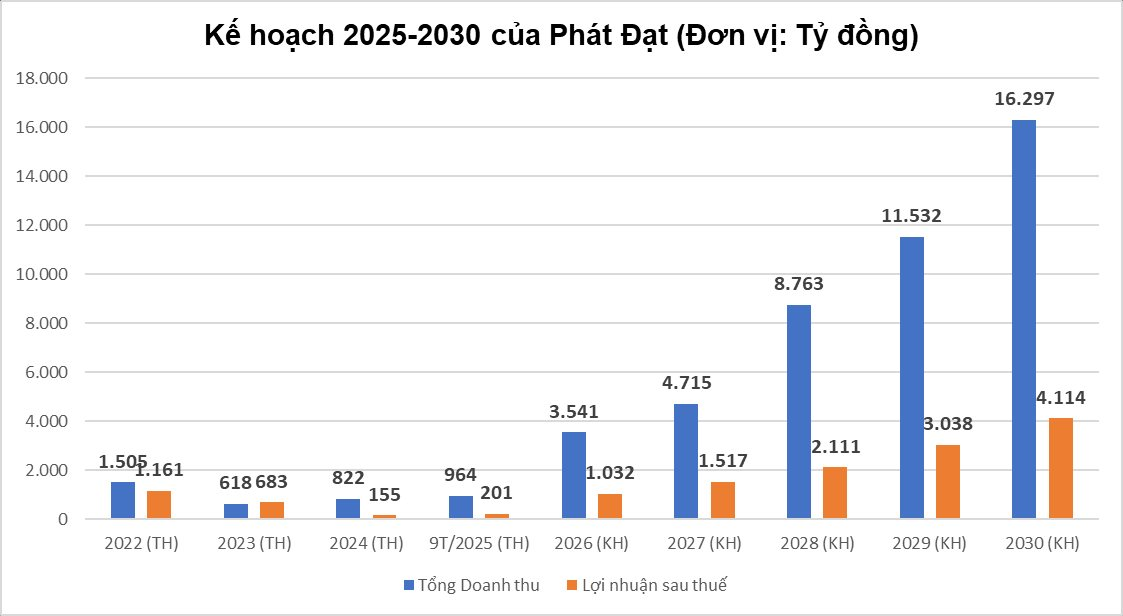

In terms of business performance, Phat Dat recorded VND 964.4 billion in net revenue and VND 201.3 billion in post-tax profit for the first nine months, representing increases of over 450% and 31% respectively compared to the same period in 2024.

According to the 2026-2030 business plan resolution, Phat Dat aims to achieve a total revenue of VND 44,848 billion (over USD 1.5 billion) and post-tax profit of VND 11,812 billion over the next five years.

The plan targets revenue of VND 3,541 billion in 2026, a slight increase from the 2025 plan. However, higher growth rates are expected in subsequent years, with projected revenue of VND 16,297 billion in 2030 (4.6 times that of 2026) and post-tax profit of VND 4,114 billion (four times the initial year).

To achieve the USD 1.5 billion revenue target, Phat Dat relies on six key projects, expected to generate VND 35,525 billion. Currently, only two projects—Bac Ha Thanh and Thuan An 1—are generating revenue, while the others are still in the legal completion or pre-construction phases.

The Bac Ha Thanh Urban Redevelopment Project (Gia Lai), commercially known as ICONIC Quy Nhon, is the only project with active sales, recording over VND 400 billion in revenue in Q3 2025.

For the Thuan An 1 project (Binh Duong), expected to complete in December 2025, Phat Dat has transferred most of its capital contribution, converting it into an associate company. Thus, revenue primarily stems from financial income.

Meanwhile, major projects like Han River (Da Nang) are slated for the construction of an inland waterway port phase 1 from 2025-2030.

Projects such as Poulo Condor Resort (Con Dao) and Phuoc Hai Complex (Ba Ria – Vung Tau) remain in the legal completion or pre-construction stages.

The new project at 239 Cach Mang Thang Tam (Ho Chi Minh City) has only recently completed share acquisition procedures and requires time for implementation, with an estimated total value of VND 5,500 billion.

In late 2022, amidst a widespread bond market crisis, Mr. Dat sold personal assets worth over VND 2,000 billion to help Phat Dat settle debts and honor commitments to bondholders. This bold decision enabled Phat Dat to swiftly emerge from the crisis, maintain stakeholder trust, and regain momentum.

Spring Mai Corp’s Leadership Resigns Amid Change in Ownership

A wave of resignations from the Chairman of the Board of Directors and key leaders at Xuan Mai Investment and Construction Joint Stock Company (Xuan Mai Corp, UPCoM: XMC) coincides with a major shareholder’s divestment. Meanwhile, a new group of shareholders is steadily consolidating its controlling position.