Surge in Profits Amid Persistent Insurance Arrears

In the latest list of entities delinquent on insurance payments for over three months, released by the Ho Chi Minh City Social Insurance (BHXH), Hoa Binh Construction Group JSC (stock code: HBC, UPCoM) remains included.

As of November 2025, Hoa Binh Construction has accumulated 961 months of unpaid insurance contributions for its employees, totaling VND 56.7 billion.

Notably, this prolonged insurance debt coincides with the company’s extraordinary profit announcement for Q3/2025, reaching VND 188 billion—a significant surge from the VND 12.6 billion recorded in the same period last year.

Specifically, HBC achieved a net revenue of over VND 1,122 billion, a 15% increase year-on-year. The company attributes this growth primarily to the construction activities of its parent company, while revenue from other operations (land leasing, goods sales, real estate, etc.) at subsidiaries declined.

Additionally, a remarkable VND 230 billion in financial revenue was recorded, largely due to VND 228 billion in late payment interest as per a court ruling. The same ruling also contributed nearly VND 31 billion in other profits from the liquidation and sale of fixed assets.

Conversely, HBC incurred VND 15 billion in management expenses during this period, compared to a VND 52 billion refund in the previous year. Financial expenses and selling costs rose by 36% and 39%, respectively, reaching VND 98 billion and VND 11 billion.

Despite the sharp profit increase in Q3/2025, the company’s net profit for the first nine months of the year stood at approximately VND 240 billion, a 72% decline year-on-year, due to modest results in the first half. Net revenue for the period was VND 2,759 billion, down 42% from the previous year.

For 2025, Hoa Binh Construction set a total revenue target of VND 9,000 billion and an after-tax profit goal of VND 360 billion. With the current results, HBC has achieved 66% of its annual profit plan.

As of September 30, 2025, the company’s total assets amounted to VND 15,908 billion, a 3% increase from the beginning of the year. Short-term receivables dominated the asset structure at VND 10,228 billion, down 7% year-on-year.

The company reported nearly VND 742 billion in work-in-progress costs from real estate projects. Short-term cash holdings also increased by 13% to VND 319 billion.

On the liabilities side, total payables rose slightly by 2% to VND 13,945 billion. Customer prepayments increased by 23% to VND 2,804 billion.

Short-term financial debt decreased by approximately VND 300 billion to VND 3,521 billion, primarily bank loans. Long-term debt fell to VND 490 billion, including VND 376 billion in outstanding bonds held by MSB Ho Chi Minh City branch.

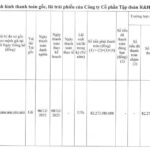

Recently, the Hanoi Stock Exchange (HNX) announced that Hoa Binh Construction has delayed the principal payment on its bonds.

According to the schedule, on October 31, 2025, the company was to pay VND 12.4 billion in principal for the HBCH2225002 bond series. However, due to insufficient funds, the payment has been postponed. The company is currently negotiating with investors regarding the bond’s outstanding balance.

The HBCH2225002 bond series, with a total issuance value of VND 94.6 billion, was issued on October 31, 2022, with a three-year term maturing on October 31, 2025. The bondholder is Vietnam Industrial and Commercial Securities (VBSE).

Previously, Hoa Binh Construction had repurchased a portion of this bond series ahead of maturity. Most recently, on June 30, 2025, the company repurchased VND 11.7 billion, reducing the outstanding balance to the current VND 12.4 billion.

Consecutive Legal Victories Yield Hundreds of Billions in Recoveries

In recent months, Hoa Binh Construction has gained attention for its consecutive legal victories, recovering hundreds of billions of dong.

On September 29, 2025, HBC announced receiving the appellate judgment from the Gia Lai People’s Court regarding a construction contract dispute with TMS Group JSC.

The court ordered TMS to pay HBC nearly VND 154 billion, including over VND 100 billion in outstanding construction costs, VND 8 billion in contractual penalties, and more than VND 45 billion in late payment interest. TMS is also responsible for court fees and HBC’s litigation costs.

This dispute pertains to two construction contracts for the TMS Luxury Hotel Quy Nhơn Beach project—Quy Nhơn’s tallest 5-star hotel complex—signed in May 2018 and August 2019. The court dismissed all of TMS’s appeals, upholding the previous ruling.

Just over a month earlier, Hoa Binh Construction also announced a legal victory against another company.

Novaland Group Delays Debt Payments

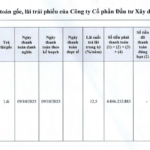

Introducing the NVLH2123011 bond issuance, launched on September 1, 2021, with a total issuance value of 1,000 billion VND and a 2-year maturity. As of now, Novaland remains obligated to repay approximately 816 billion VND in principal and nearly 72 billion VND in interest for this bond tranche.

Marina Tower Developer Delays Bond Interest Payments

Marina Tower’s developer has missed the scheduled interest payment for the DPJ12202 bond tranche and has communicated a revised payment timeline to investors.