Following a robust recovery session, the stock market opened with a slight uptick on December 17th. However, heightened selling pressure on high-priced stocks caused the VN-Index to reverse course. By the close, the VN-Index had fallen by 5.52 points (-0.33%) to 1,673.66 points. Foreign trading activity remained balanced, with a slight net buying trend across the market.

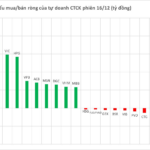

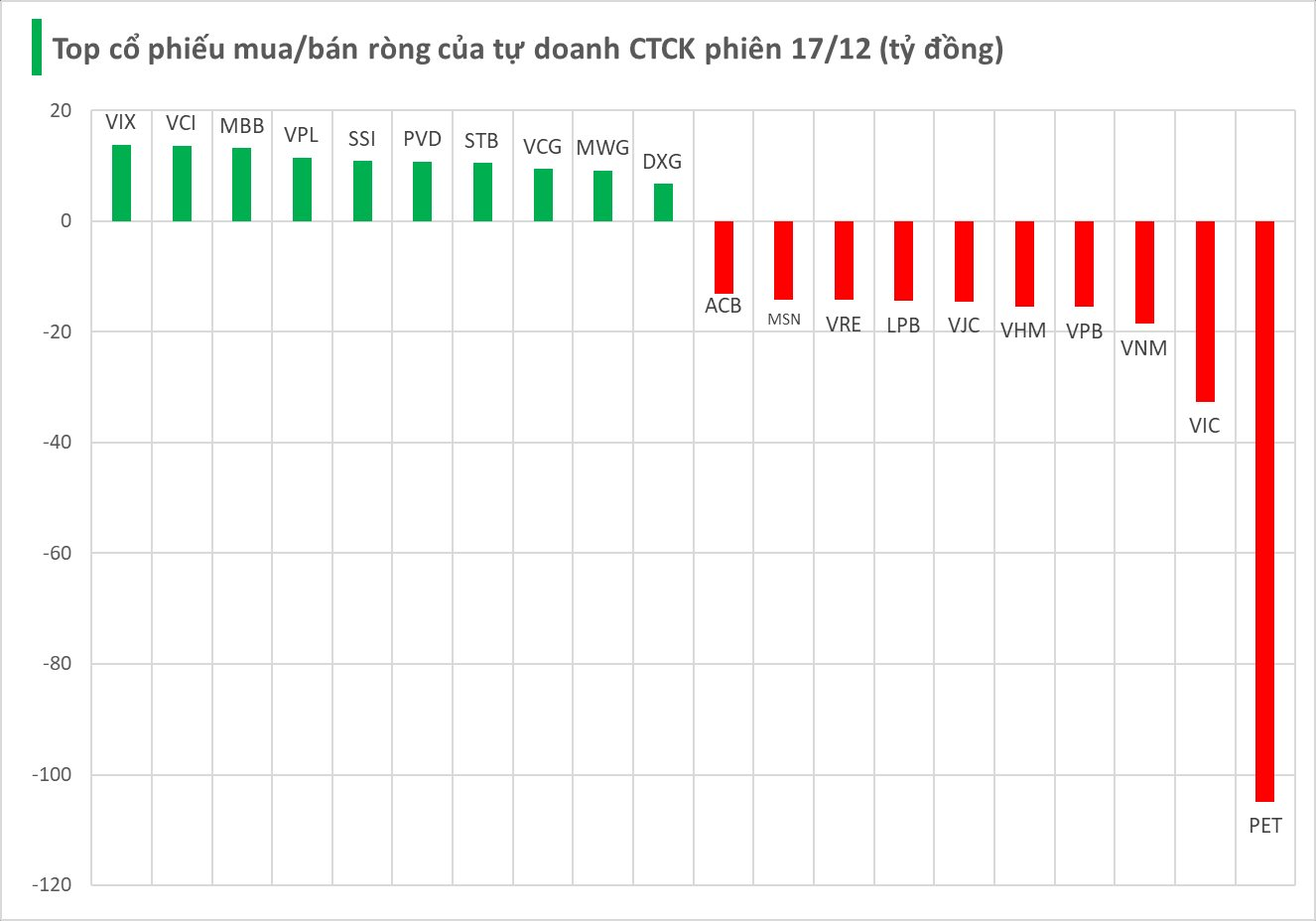

Securities firms’ proprietary trading desks net sold VND 192 billion on HOSE.

Specifically, securities firms’ proprietary trading desks were most active in net selling PET, with a value of -VND 105 billion, followed by VIC (-VND 33 billion), VNM (-VND 18 billion), VHM (-VND 15 billion), and VPB (-VND 15 billion). Other stocks also saw significant net selling pressure, including VJC (-VND 14 billion), LPB (-VND 14 billion), VRE (-VND 14 billion), MSN (-VND 14 billion), and ACB (-VND 13 billion).

Conversely, VIX and VCI were the top net buys, both at VND 14 billion, trailed by MBB (VND 13 billion), VPI (VND 12 billion), SSI (VND 11 billion), PVD (VND 11 billion), STB (VND 11 billion), VCG (VND 10 billion), MWG (VND 9 billion), and DXG (VND 7 billion).

Foreign Block “U-Turn” Sells Off as VN-Index Surges, Countering Massive Inflow into Single Stock

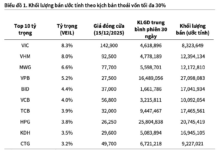

On the sell side, VIC witnessed the most significant offloading by foreign investors, with a value of approximately VND 167 billion.