Blockbuster Series Falters

New legal frameworks enable businesses to significantly shorten their journey to listing. Previously, after an IPO, companies typically required an additional 3-6 months to finalize financial report audits and listing procedures. However, under Decree No. 245/2025/NĐ-CP, amending Decree 155/2020/NĐ-CP, this timeframe has been reduced to approximately 30 days.

The process for registering to purchase IPO shares is relatively straightforward, conducted online directly through the investor’s securities account.

TCX is one of the first deals to apply Decree 245. Just 30 days after announcing its IPO results, the stock was approved for listing and began trading on HoSE from October 21st, with a reference price of 46,800 VND per share. Interest in TCX during its IPO was substantial. Investors subscribed for over 575 million shares, 2.5 times the offered amount, with participation from over 26,000 investors, including 78 prestigious financial institutions and investment funds, totaling over 500 million USD in registered value.

The stock market is witnessing a strong surge in IPO activities.

However, the anticipated “sweet fruit” for many investors failed to materialize. After an initial price increase upon listing, TCX continuously adjusted, dropping to a low of 42,800 VND per share in mid-November. To date, after nearly two months of trading, the stock has only returned to the 47,000 VND range.

Not only TCX, but most newcomers to the market recently have been securities companies, and their post-listing performance has generally been disappointing. VPX of VPBankS Securities, listed on December 11th, immediately fell over 9% in its first session and lost approximately 15% within a week. Selling pressure was intense, with over 7.2 million shares traded on the first day.

Similarly, VCK of VPS Securities, listed on December 17th, dropped 15% in its debut session with a trading volume of over 14.8 million shares. Today, the stock continued to adjust, closing the morning session down an additional 4.3%. Investors who bought VCK’s IPO have lost approximately 19% after just two trading days.

Should Individual Investors Buy IPOs?

Ms. Ngoc Loan, an individual investor in Hanoi, shared that this was her first time participating in an IPO, after following investment groups on social media with high expectations of “selling for a profit immediately upon listing.” She deposited to buy VPX shares, thinking she could “breathe a sigh of relief” given the market’s recent sharp decline, with many stocks in the same sector already down over 20%. Buying IPOs helped her avoid the market adjustment.

However, her investment is currently down over 15%. “In investment groups, many people are in a similar situation, some blame the broker, others choose to hold their losses because they didn’t use leverage, but disappointment is widespread,” Ms. Loan said.

Explaining why IPO stocks in Vietnam often drop significantly compared to their offering price, Mr. Bui Van Huy, Deputy General Director of FIDT, attributed the issue to the lack of a “price stabilization” mechanism. In developed markets, investment banks often use the Greenshoe option to buy back shares during market sell-offs, thereby stabilizing post-listing prices.

The Greenshoe option provides additional price stability for stock issuances because the underwriter can increase supply and reduce price volatility. This is the only price stabilization measure permitted by the U.S. Securities and Exchange Commission (SEC).

“In Vietnam, this gap is largely unaddressed. We lack a legal coordinating force. Due to concerns about price manipulation, coupled with inadequate investor relations (IR) activities, investors don’t see anyone ‘supporting the price,’ so they are quick to sell at the slightest profit or loss,” Mr. Huy commented. He believes that without this mechanism, IPOs can easily become “abandoned children.”

From a market perspective, according to Mr. Huy, IPO stocks dropping 20-30% is not unusual. Most IPOs occur when the market is favorable and valuations are high. Meanwhile, many long-listed securities stocks like SSI, VCI, or VIX have fallen 30-40% from their peaks, creating comparative pressure and adjusting price levels.

So, should individual investors buy IPOs? The expert believes that IPOs are not inherently “bad”; the issue lies in valuation and expectations. Investors need to carefully assess the company’s prospects, the offering price, and market conditions. If reasonably priced, IPOs can still offer long-term opportunities, rather than just “day-trading upon listing.”

In reality, not all stocks that rise after listing result in profits. Some companies deliberately list at lower prices to create room for growth, as seen with F88 previously on the OTC market. Conversely, IPOs with overly high valuations in a changing market can easily lead to investor “disillusionment.”

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, emphasized that the best investor protection mechanism is knowledgeable and informed investors. A smart investor who can assess risks and their risk tolerance will protect themselves against market fluctuations.

The development strategy for the stock market must balance legal frameworks, incentives, and investor education. Only when these three elements work together will the market be truly sustainable and attractive.

Nationwide Affordable Housing Projects Break Ground on Special Occasion

On December 19th, a wave of groundbreaking ceremonies will sweep across the nation as numerous social housing projects are set to commence simultaneously. This unprecedented surge in development marks a significant milestone for affordable housing, catering specifically to low-income individuals. The initiative is a celebratory gesture in honor of the 14th National Congress of the Communist Party of Vietnam.

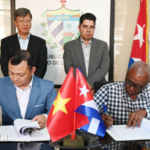

Cuba’s Underground Secret: Vietnam’s Bold Move to Cultivate 2,500 Hectares and Transform It into a “Capital”

Beneath Cuba’s surface lies a treasure far more valuable than oil or rare minerals: a rich, fertile layer of red basalt soil that has captured the attention of Vietnamese agricultural engineers. This natural bounty, teeming with potential, promises to revolutionize farming practices and foster sustainable growth.

Surprising Surge in ‘Mountain Tycoon’ Stocks

The VN-Index has stabilized following a sharp decline, leaving the overall market sentiment subdued. Meanwhile, a surprising development emerged with shares of Quoc Cuong Gia Lai, which surged to their upper limit for four consecutive sessions.