Ms. Nguyen Thi Cuc – Chairwoman of the Vietnam Tax Consultancy Association.

Renting out properties has become a significant income source for many individuals and families, especially retirees or those without a steady salary. However, questions about tax obligations often arise, particularly when rental income is substantial.

At the seminar “Decoding Business Model Transition and Tax Declaration: Insights from Household Businesses” held on December 16, Ms. Nguyen Thi Cuc – Chairwoman of the Vietnam Tax Consultancy Association – addressed common tax concerns related to property rentals.

One attendee asked about a couple earning over 500 million VND annually from rentals, both aged over 65 with no pension.

Ms. Cuc explained that rental income is classified as business income, taxed separately from salaries. Notably, no personal deductions apply, even for seniors without pensions or regular income. This differs from previous personal income tax rules for wages.

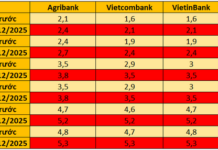

Tax obligations include a 5% VAT and 5% personal income tax, totaling 10% of gross rental revenue, regardless of expenses or actual profit. For example, 60 million VND in taxes is due on 600 million VND in annual rent.

To simplify compliance, tenants can agree to declare and pay taxes on behalf of landlords, treating the 10% tax as a deductible expense. This arrangement benefits seniors by sparing them complex tax procedures.

Experts advise landlords to monitor annual revenue for accurate tax thresholds and clarify tax responsibilities in rental agreements. Full compliance ensures legal safety and long-term transparency in property rentals.

Proposed Regulation: Sole Proprietors Must Declare All Business and Production-Related Accounts

The Ministry of Finance is seeking public input on a draft decree regarding tax declaration, calculation, deduction, and the use of electronic invoices for business households and individual entrepreneurs.

Seamless Digital Tax Solutions for Small Businesses: Complying with Regulations Made Easy

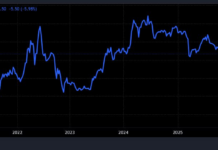

Transitioning from lump-sum tax to declaration-based tax is presenting numerous small businesses with unprecedented challenges. To comply with regulatory requirements and ensure accurate tax declarations, businesses must meet three critical criteria: transparent revenue reporting, standardized electronic invoicing, and automated data transmission systems.

Latest Update: Ministry of Finance Proposes Principles for Tax Declaration, Calculation, and Use of E-Invoices by Household Businesses and Individual Entrepreneurs

The Ministry of Finance has recently proposed a draft decree outlining regulations for tax declaration, calculation, deduction, and the use of electronic invoices by business households and individual entrepreneurs.