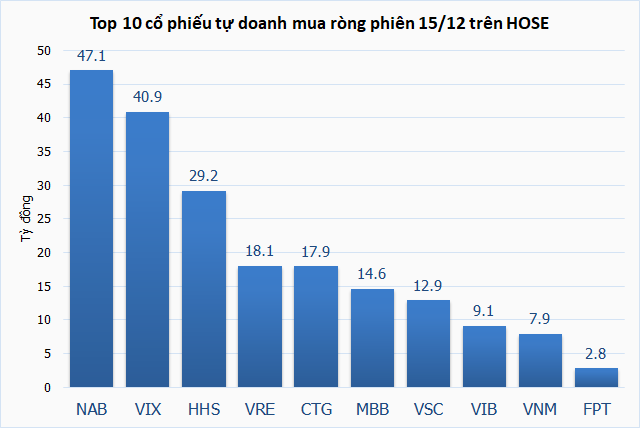

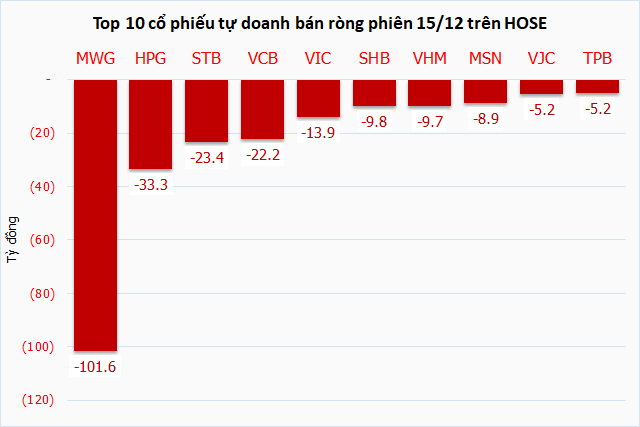

During the December 15th session, proprietary trading desks net sold VND 60 billion on the HOSE exchange. The most heavily sold stock was NAB, with a value of VND 47 billion, followed by VIX, HHS, and VRE. Conversely, MWG saw the largest net selling, reaching nearly VND 102 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

Foreign investors recorded their first net buying session on December 15th after six consecutive net selling sessions. The total trading value today also reached a high compared to recent sessions.

Securities sector stocks were the most net bought, including TCX (VND 169 billion) and VIX (VND 154 billion). Meanwhile, VIC was the most net sold stock, with nearly VND 245 billion, significantly outpacing others.

| Foreign trading trends in December 2025 |

| Top stocks with the highest net trading by foreign investors on December 15th |

– 6:33 PM, December 15, 2025

Vietstock Daily 17/12/2025: Bottom-Fishing Demand Triggered?

The VN-Index staged a robust reversal in the afternoon session, reclaiming its position above the 100-day SMA. However, with both the Stochastic Oscillator and MACD trending downward, and the index lingering below the Bollinger Bands’ Middle Line, the market remains susceptible to unexpected volatility in upcoming sessions.

Should Investors ‘Buy the Dip’ After the VN-Index Turmoil?

The VN-Index just endured a shocking week, plummeting over 94 points and erasing much of the gains accumulated over the previous month. As we enter the final trading weeks of the year, the market is anticipated to experience a technical rebound. Investors holding significant cash reserves are advised to consider gradual deployments during market fluctuations.

HOSE Adds Two Stocks to Margin Cut List

On December 12th, the Ho Chi Minh City Stock Exchange (HOSE) announced the addition of two stocks to its margin trading ineligible list. These include HID, issued by Halcom Vietnam JSC, due to delayed financial report submissions, and the newly listed VPX, issued by VPBank Securities JSC.