The stock market witnessed a dramatic reversal on December 16th. After spending most of the morning in the red, the VN-Index staged a remarkable comeback in the afternoon session, surging over 33 points (2.02%) to close at 1,679.18. This marked the strongest gain since early November and snapped a five-session losing streak.

The driving force behind this rebound was proprietary trading activity, despite foreign investors returning to net selling. Following a modest net sell of VND 65 billion on December 15th, proprietary traders at securities firms aggressively bought back on the HOSE, with net purchases totaling approximately VND 478 billion.

| Proprietary Trading Activity on HOSE in Recent Sessions |

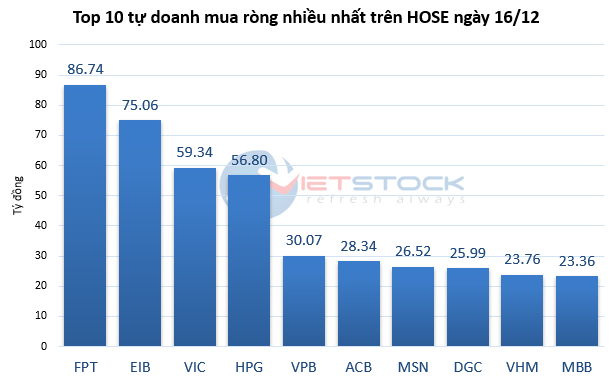

Proprietary traders focused their buying on large-cap stocks. FPT saw the strongest net buying, with nearly VND 87 billion. This was followed by EIB (over VND 75 billion), VIC (over VND 59 billion), and HPG (nearly VND 57 billion). Banks also attracted significant buying, with VPB (over VND 30 billion), ACB (over VND 28 billion), and MBB (over VND 23 billion) all seeing notable inflows.

|

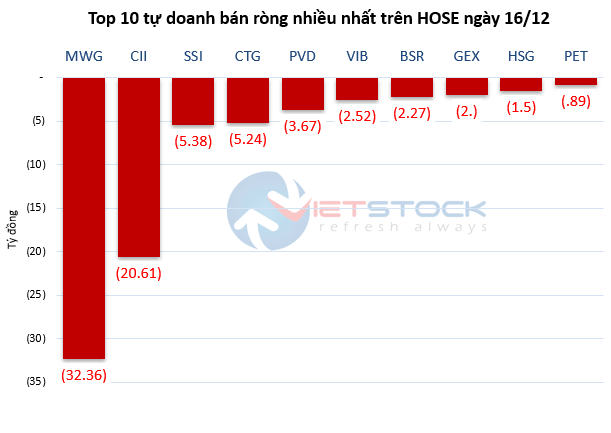

On the flip side, MWG faced the heaviest selling pressure from proprietary traders, with net sales exceeding VND 32 billion. CII saw nearly VND 21 billion in net selling, while SSI and CTG experienced more modest selling pressure, with each seeing over VND 5 billion in net sales.

|

Foreign Investors Return to Net Selling

In contrast to proprietary traders, foreign investors quickly reversed their buying trend from December 15th, returning to net selling on December 16th with a total of nearly VND 102 billion across the market.

| Foreign Trading Activity in Recent Sessions |

Notably, four stocks saw net selling exceeding VND 100 billion. VIC led with nearly VND 167 billion in net selling, followed by VCB (nearly VND 154 billion), DGC (over VND 122 billion), and VCK (nearly VND 108 billion). VCK, a new securities industry entrant, debuted on HOSE on December 16th but immediately fell over 15%, closing at VND 50,800 per share in its first trading session.

| Top Stocks Traded by Foreign Investors on December 16th |

On the buying side, foreign investors showed a clear preference for select stocks. TCX, another new securities industry entrant, saw the strongest net buying, with over VND 147 billion. TCX listed on HOSE on October 24th with a reference price of VND 46,800 per share and traded around VND 47,150 per share on December 16th.

Beyond TCX, the securities sector also saw foreign inflows into VIX (nearly VND 86 billion) and SSI (nearly VND 80 billion). Additionally, MWG attracted over VND 113 billion in net buying, and BSR saw over VND 83 billion.

– 17:40 16/12/2025

Market Experts: Stocks Feel Like a Massive “Sale Off” – Already “Cheap” Shares Could Get Even Cheaper

Amidst a steep market downturn, liquidity on HoSE has remained stagnant at a moderate level of approximately VND 22 trillion, attributed to systemic liquidity shortages and mounting pressure from rising interest rates.