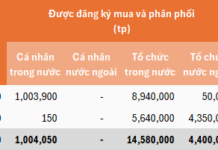

The Hanoi Stock Exchange (HNX) has announced the results of the auction for a block of shares in Thuong Dinh Shoe Joint Stock Company (stock code: GTD), owned by the Hanoi People’s Committee. This represents the entire state-owned capital in the enterprise, equivalent to nearly 69% of its charter capital.

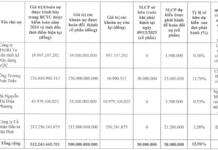

Specifically, the Hanoi People’s Committee offered 6.38 million GTD shares with a starting price of VND 20,500 per share. The auction attracted 15 investors, all individuals. Two investors successfully bid for the entire offering.

The highest winning bid reached VND 216,000 per share, while the lowest was VND 134,000 per share. The average winning price was VND 215,999 per share, over 10 times the starting price and approximately three times the market price of GTD shares as of December 16.

At this price, the Hanoi People’s Committee is expected to raise approximately VND 1,379 billion. The payment deadline for the shares is set from December 16 to December 22, 2025.

Thuong Dinh Shoes was once a renowned brand, famous for its canvas and fashion footwear.

The auction gained attention as GTD shares had experienced a significant price surge on the stock market before the divestment announcement. On the exchange, Thuong Dinh Shoes’ shares consistently hit the ceiling, trading around VND 82,800 per share, a 500% increase compared to the pre-auction announcement period.

Established in 1957, Thuong Dinh Shoes was once one of Vietnam’s most famous footwear brands, known for its canvas and fashion shoes. With simple designs, thin fabric, soft soles, and an affordable price of around VND 100,000 per pair, Thuong Dinh shoes were ubiquitous, from football fields and construction sites to factories, farms, and schools.

The brand’s golden era spanned from 1992 to 2006. During this period, Thuong Dinh Shoes frequently topped Vietnamese high-quality product polls and earned the affectionate title of “the people’s shoes.” The company’s products were not only popular domestically but also exported to Europe, Australia, and several Asian countries.

In 2023, the brand resurfaced in popularity due to a social media frenzy sparked by Instagram and Facebook posts from artist HIEUTHUHAI and the GERDNANG group.

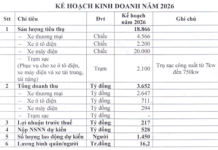

For 2025, Thuong Dinh Shoes aims to produce between 700,000 and 900,000 pairs of shoes. The company targets revenue and other income of around VND 100 billion, with a profit goal of VND 100 million. Management plans to focus on securing more export orders, boosting domestic consumption, and diversifying products.

In addition to footwear, the company also plans to manufacture bags and cases to create more jobs and improve revenue.

According to the 2024 audited financial report, Thuong Dinh Shoes’ revenue was only VND 78.8 billion, the lowest in a decade. Rising costs led to a loss of nearly VND 13 billion, more than double the 2023 loss. Accumulated losses by the end of 2024 exceeded VND 67 billion.

Hanoi City Secures Nearly VND 1.4 Trillion from Capital Withdrawal, Winning Bid 10 Times Higher Than Starting Price for 3.6-Hectare Nguyen Trai Road Land Plot

With this outcome, the Hanoi People’s Committee anticipates generating approximately VND 1,379 billion from the capital divestment. The payment deadline for purchasing shares is set from December 16 to 22, 2025.

CMN Shares Hit Ceiling Ahead of 20% Stake Auction, Four Institutions Vie for Purchase

Vinataba’s divestment of a 20% stake in Colusa – Miliket Foodstuff JSC (UPCoM: CMN) has sparked a frenzy, with purchase registrations surpassing the offering by a factor of four. This overwhelming demand propelled CMN’s stock price to its daily limit on December 15th, inching closer to its all-time high.

Upper Dinh Shoe Stock Surges with 11 Consecutive Circuit Limits: Leadership Responds

At the close of trading on December 3rd, GTD shares hit their upper limit for the 11th consecutive session, reaching 52,200 VND per share, a staggering 342% surge compared to the November 18th session.