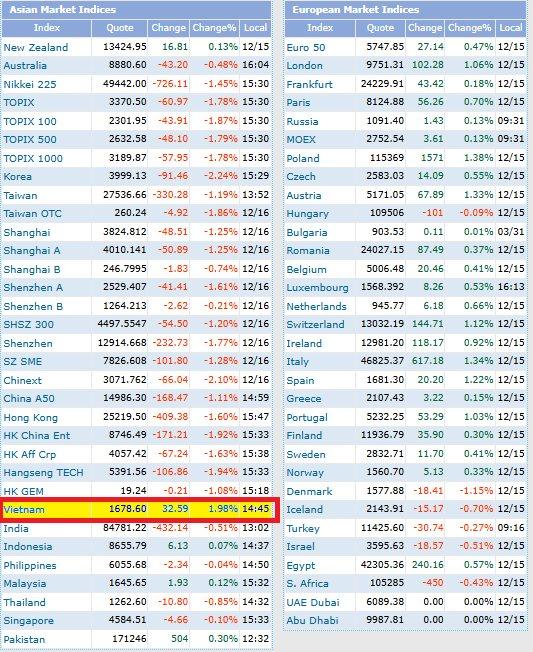

Optimism is returning to Vietnam’s stock market. After five consecutive sessions of decline, the VN-Index surged unexpectedly on December 16th, driven by a robust recovery in blue-chip stocks.

At the close, the VN-Index jumped 33.17 points to nearly 1,680 points (a 2.02% increase). This gain positioned Vietnam’s stock market as the strongest performer in Asia, bucking the region’s downward trend.

Market breadth was positive, with 491 advancing stocks, 2.5 times the number of decliners. Liquidity also improved significantly from the previous session, with trading value on HoSE reaching nearly VND 20.6 trillion.

Investor sentiment was undeniably buoyant, with excitement palpable across social media, forums, and investment groups. The strong rally provided much-needed relief after a frustrating period of adjustment. Prior to December 16th, the VN-Index had shed over 100 points from its recent peak, pushing many stocks into attractive discount territory and triggering bottom-fishing demand.

Even SSI Chairman Nguyen Duy Hung weighed in on his personal Facebook page, noting, “While gains are concentrated in a few large-cap stocks, many others are trading at very low valuations.”

Echoing this sentiment, a report by MBS Securities observed that excluding the Vingroup stocks, the VN-Index is currently at levels comparable to 1,370 points – similar to late June, which marked the beginning of a strong two-month rally in August and September. In terms of valuation, the VN-Index’s forward P/E ratio for next year stands at around 14.35. Adjusting for the 1,370-point level, the forward P/E drops to approximately 11.88.

“We anticipate technical rebounds in sectors like Securities, Banking, and Real Estate, which have been oversold during the accumulation phase. The VN-Index is expected to reclaim the MA20 level around 1,690 points, with near-term support at 1,600–1,620 points,” MBS analysts commented.

Regarding medium to long-term investment prospects, Dragon Capital’s latest report highlights several fundamental factors supporting continued positive growth in Vietnam’s market during 2025–2026.

Firstly, corporate earnings continue to exceed expectations. Dragon Capital’s analysis of 80 companies shows a 22.4% profit growth in the first nine months, surpassing initial forecasts. Full-year 2025 growth is projected at 21.3%, followed by 16.2% in 2026.

Secondly, market valuations remain attractive, with forward P/E ratios of 12.5–13 for 2025 and 11 for 2026 – lower than many regional peers, despite Vietnam’s superior earnings growth.

Lastly, Vietnam’s upgrade from frontier to emerging market status promises significant re-rating opportunities, as substantial international capital inflows could fuel a new growth cycle.

Major Stock Unexpectedly Swept Up by Brokerage Firm’s Proprietary Trading Desk in December 16 Session

Proprietary trading desks at Vietnamese securities companies collectively net bought VND 478 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.

Market Volatility Intensifies: A Sharp 60-Point Swing Rocks the Stock Market

The VN-Index surged dramatically in the afternoon session on December 16, with a trading range of nearly 60 points. Strong bottom-fishing demand and the leadership of Vin Group stocks, particularly VPL, helped the market break its five-session losing streak. Meanwhile, VPS Securities’ VCK shares disappointed on their debut, falling over 15%.