I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON DECEMBER 17, 2025

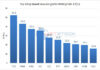

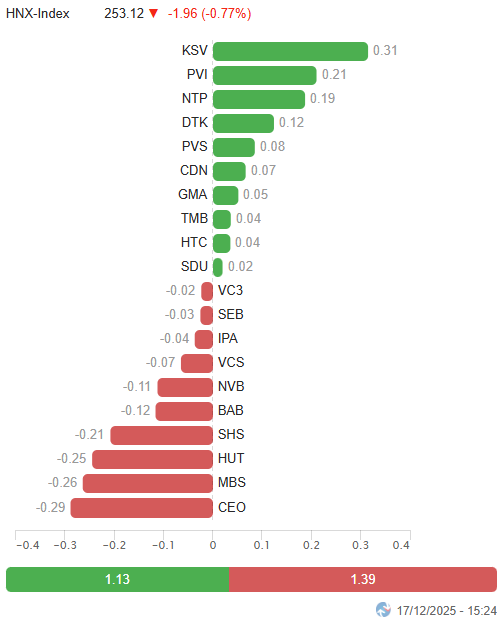

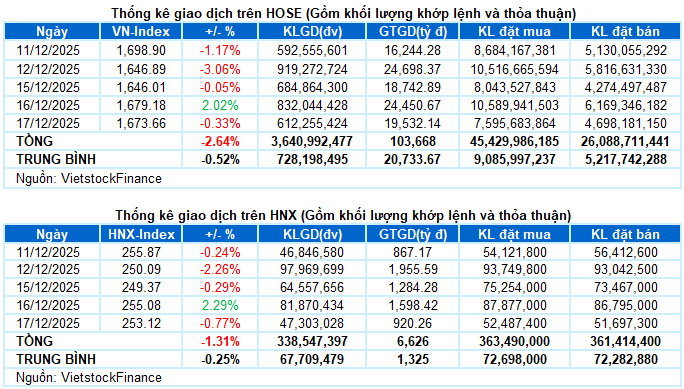

– Key indices adjusted during the December 17 trading session. Specifically, the VN-Index decreased by 0.33%, closing at 1,673.66 points, while the HNX-Index also dropped by 0.77%, settling at 253.12 points.

– Trading volume on the HOSE floor decreased by 34%, reaching nearly 496 million units. Similarly, the HNX floor recorded just over 41 million matched units, a 45.3% decline compared to the previous session.

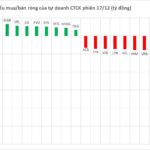

– Foreign investors net sold approximately VND 65 billion on the HOSE and VND 1.5 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

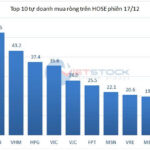

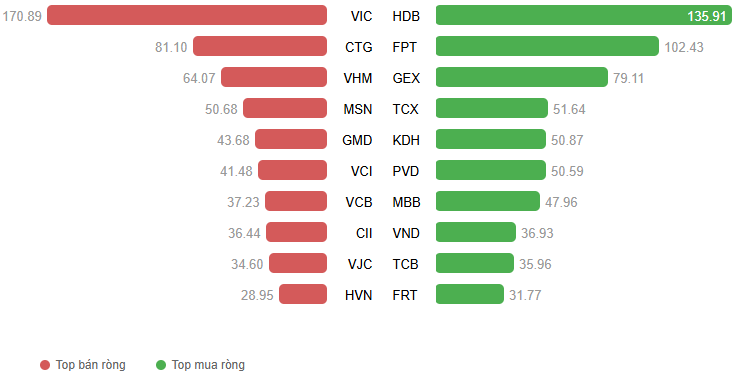

Net Trading Value by Stock Code. Unit: Billion VND

– The market returned to a narrow range of divergence after a strong recovery session. The VN-Index mainly hovered around the 1,680-point mark in the morning session with significantly subdued liquidity, indicating a more cautious investor sentiment. In the afternoon session, the trading range widened with alternating increases and decreases. Sellers ultimately gained the upper hand as widespread declines intensified toward the end of the session. The VN-Index closed at 1,673.66 points, down 0.33% from the previous session.

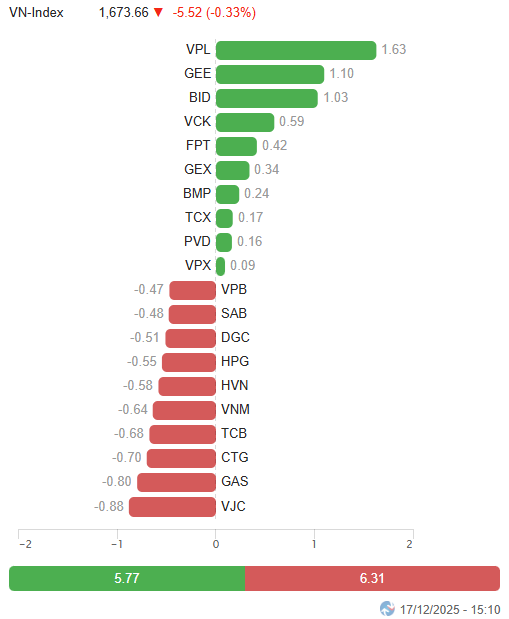

– In terms of impact, VPL was the most positive contributor, adding 1.6 points to the VN-Index. GEE and BID followed, each contributing approximately 1 point. Conversely, VJC, GAS, and CTG were the biggest drags, collectively subtracting 2.4 points from the index.

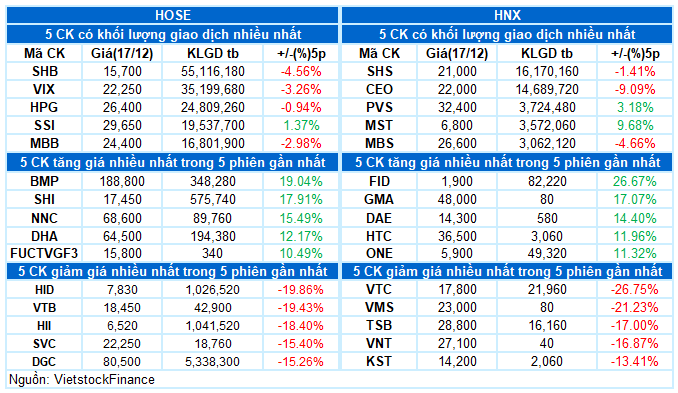

Top Stocks Influencing the Index. Unit: Points

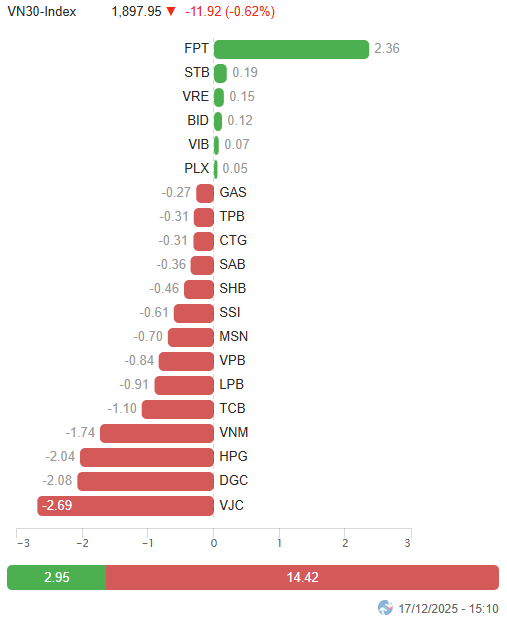

– The VN30-Index fell by nearly 12 points (-0.62%), closing at 1,897.95 points. The breadth favored selling, with 21 decliners, 6 advancers, and 3 unchanged stocks. Notably, DGC hit its second consecutive lower limit, while VJC and SAB faced significant pressure, declining over 3%. On the upside, BID and FPT attracted decent buying interest, rising more than 1%, while PLX, STB, VIB, and VRE maintained slight gains.

Divergent trends dominated industry groups. The communication services sector led the market with a 1.81% increase, as most stocks in the sector performed well, including VGI (+1.88%), FOX (+1.8%), CTR (+1.19%), SGT (+4.76%), YEG, and VTC, all hitting their upper limits.

Other sectors fluctuated within narrow ranges, with mixed gains and losses. For instance, in the industrial and financial sectors, while stocks like GEE, HID, and SHI hit their upper limits, and GEX (+3.69%), VTP (+1.91%), VCG (+1.28%), BMP (+6.31%), VCK (+3.15%), BID (+1.6%), and ABB (+1.97%) saw strong buying interest, many others declined over 1%, including VJC, CII, PC1, VSC, HVN, CDC, TLG, VIX, SHB, SSI, CTG, TCB, TPB, and SHS.

The utilities sector underperformed, adjusting by 1.66%, pressured by leading stocks such as GAS (-2.18%), REE (-1.12%), HDG (-1.03%), VSH (-1.12%), TMP (-4.75%), and DNH, which hit its lower limit.

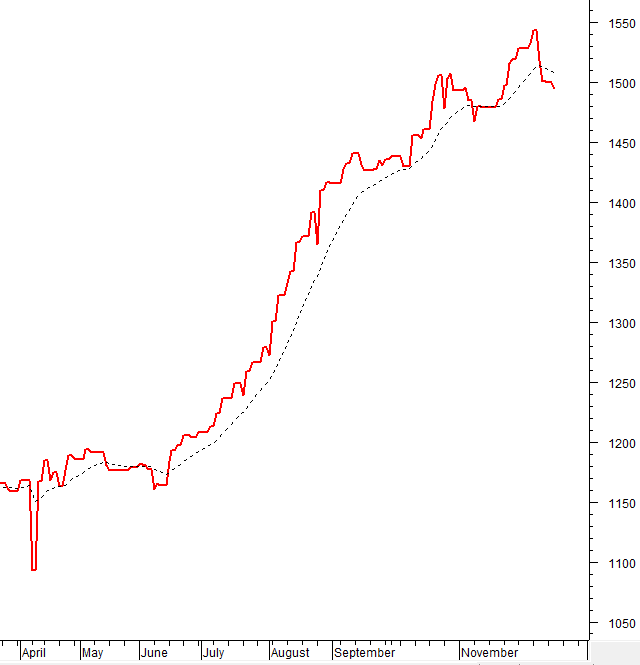

The VN-Index continued to struggle around the 50-day SMA. Fluctuating trading volumes in recent sessions reflect investor uncertainty following the previous volatile period. Currently, the MACD indicator remains in a sell signal, hovering near the zero line. If it falls below this threshold, short-term risks will increase.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – Struggling Around the 50-day SMA

The VN-Index continues to struggle around the 50-day SMA. Fluctuating trading volumes in recent sessions reflect investor uncertainty following the previous volatile period.

Currently, the MACD indicator remains in a sell signal, hovering near the zero line. If it falls below this threshold, short-term risks will increase.

HNX-Index – Adjusting with Low Liquidity

The HNX-Index adjusted, with trading volume significantly below the 20-day average.

The previously breached March 2025 peak (equivalent to the 244-250 point range) provided strong support during the recent shakeout, and this level is expected to remain resilient in the near term.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is currently below the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign Capital Movement: Foreign investors were net sellers in the December 17, 2025, trading session. If foreign investors continue this trend in upcoming sessions, market volatility is likely to persist.

III. MARKET STATISTICS FOR DECEMBER 17, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:22 December 17, 2025

Foreign Investors Reverse Course, Pour Hundreds of Billions into Two Stocks in December 17th Session

Foreign investors’ trading activity was balanced, with a slight net buying trend observed across the market.

Vietnamese Stocks Surge to Become Asia’s Top Performer After 100-Point Plunge

The excitement among investors is palpable, as the vibrant energy has returned to social media platforms, forums, and stock market groups. The buzz is undeniable, with enthusiasts eagerly sharing insights and strategies, reigniting the passion for the financial markets.