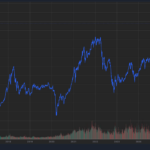

The VN-Index experienced a recovery from April 2025 to October 2025, before entering a consolidation phase until year-end. Compared to other Southeast Asian markets, the VN-Index is currently trading at a higher P/E ratio of 16.4x.

In a recent strategic report, An Binh Securities (ABS) highlights that despite the VN-Index’s higher valuation, its profit growth outlook remains positive. With Vietnam’s GDP projected to lead the region in 2026, the forward P/E ratio is expected to drop to an attractive 12.1x.

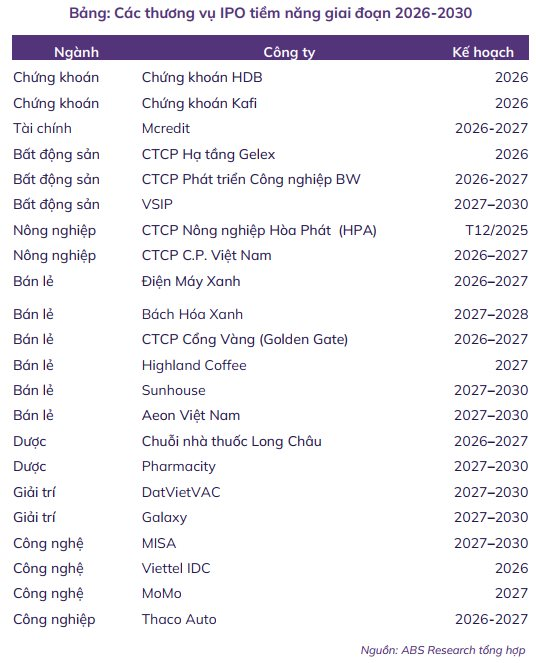

Vietnam continues to implement comprehensive reforms, including improving market access for foreign investors, diversifying sectors, and launching high-quality initial public offerings (IPOs). Between 2025 and 2027, potential IPOs are estimated to reach $47 billion, attracting foreign capital and introducing premium stocks.

Following FTSE’s upgrade of Vietnam’s stock market from “Frontier” to “Secondary Emerging,” analysts predict significant capital inflows from emerging market funds.

ABS forecasts a 26% YoY increase in 2025 net profits for listed companies, driven by strong growth in non-financial sectors. In 2026, profits are expected to rise by 22%, supported by revenue growth and margin improvements.

Bullish Scenario: VN-Index Could Reach 2,188 Points

ABS analysts emphasize that the market is in a long-term uptrend, with periodic corrections. These pullbacks present opportunities to identify stocks aligned with 2026’s outlook.

ABS projects the VN-Index to surpass 2025 highs in 2026, targeting 1,940 points in the base case. Under optimistic scenarios, it could reach 2,040–2,084–2,188 points.

Valuations are supported by improving corporate earnings, low interest rates, and renewed foreign inflows post-FTSE upgrade.

Base Case: Consolidation Between 1,600–1,800 Points

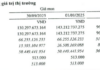

In this scenario, ABS expects the market to consolidate within 1,600–1,800 points, completing a mid-term correction. Liquidity is projected to remain moderate (~$1 billion/session).

Subsequently, the VN-Index is anticipated to resume its primary uptrend toward 1,875–1,940 points, with key support at 1,600.

Bullish Case: Deeper Correction to 1,500–1,300 Points

ABS notes the 2025 rally lacked a significant pullback. A deeper correction to 1,500–1,430 (or 1,350 in extreme cases) could create attractive entry points for long-term investors.

With Vietnam’s economy entering a growth phase, such corrections are viewed as buying opportunities. This scenario targets 2,040–2,084–2,188 points, with support at 1,300.

Two “Bottom Calls” by Mr. Nguyen Duy Hung in 2025

Mr. Nguyen Duy Hung’s insights and analyses on the market are highly regarded and frequently shared among investors across various stock market forums. His expertise has become a valuable resource for those seeking informed perspectives in the financial world.

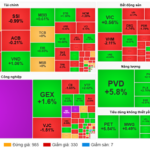

Market Pulse December 17: Selling Pressure Persists, VN-Index Remains in the Red

At the close of trading, the VN-Index fell by 5.52 points (-0.33%), settling at 1,673.66 points, while the HNX-Index dropped by 1.96 points (-0.77%), closing at 253.12 points. Market breadth tilted toward the red, with 400 decliners outpacing 284 advancers. Similarly, the VN30 basket saw red dominate, with 21 losers, 6 gainers, and 3 unchanged stocks.

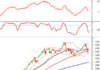

Vietstock Daily 18/12/2025: Still Trapped in a Tug-of-War?

The VN-Index continues to oscillate as it retests the 50-day SMA, reflecting ongoing market indecision. Fluctuating trading volumes in recent sessions underscore investor uncertainty following the previous volatile phase. Meanwhile, the MACD indicator persists in a sell signal, hovering near the zero line. Should it breach this threshold, short-term risks are likely to escalate.