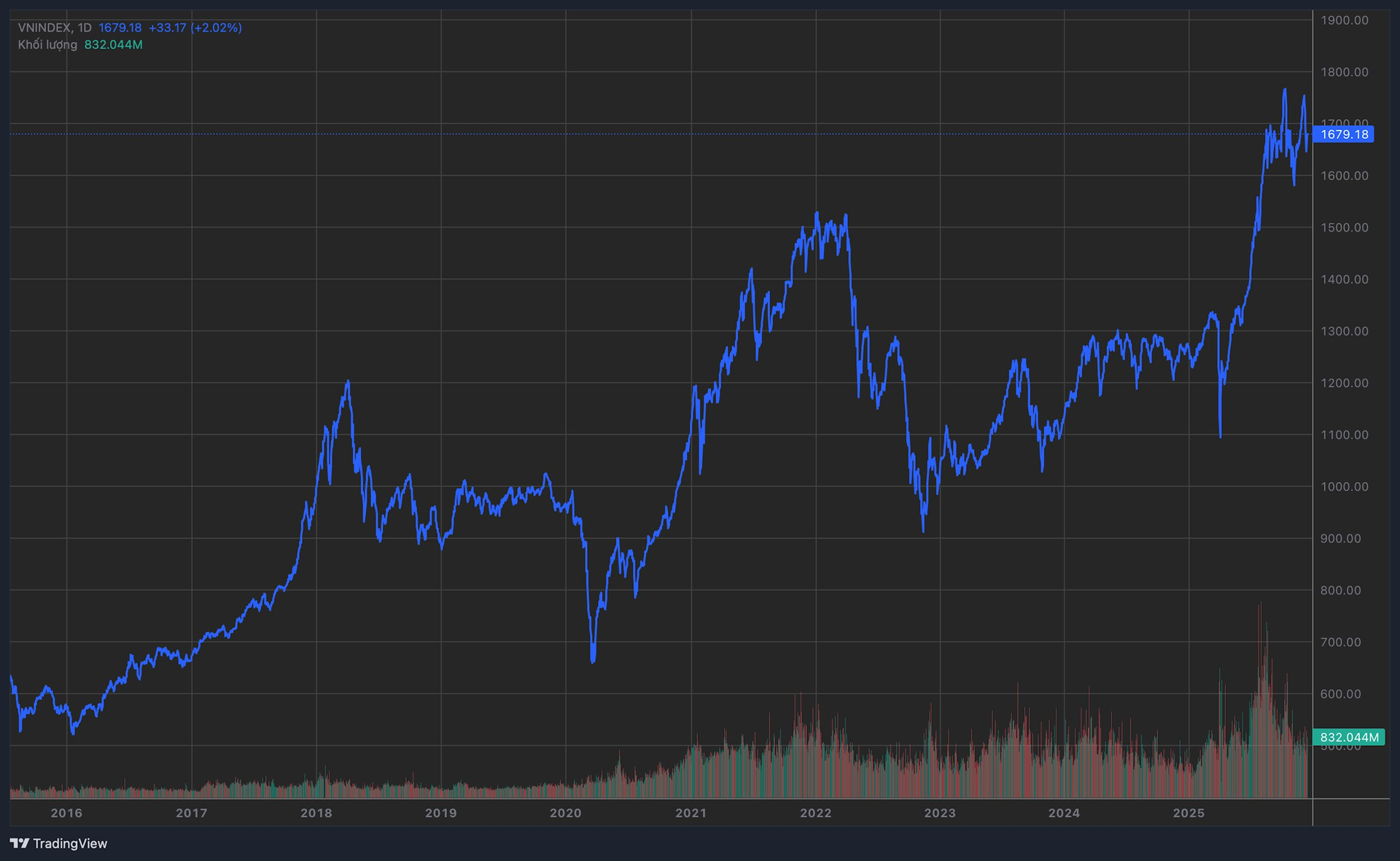

After a steep decline of nearly 100 points over several sessions, Vietnam’s stock market unexpectedly rebounded, temporarily easing the psychological pressure on investors. This recovery quickly sparked hopes that the market had entered a bottoming phase, presenting opportunities for investment after the sharp correction.

According to Nguyen Anh Khoa, Director of Analysis at Agriseco, the strong recovery on December 16 primarily served to alleviate market anxiety following the previous deep losses. The rebound was triggered late in the morning session as short-term pressure from large-cap stocks subsided, with blue-chip stocks trading sideways and significantly narrower fluctuations compared to earlier periods.

Alongside technical factors, the short-term macroeconomic environment also provided psychological support. The cooling of exchange rates and overnight interbank interest rates, coupled with the positive impact of the Fed’s rate cut, helped reduce market anxiety. Additionally, news of several major projects slated for groundbreaking and inauguration on December 19 further boosted short-term expectations.

Attractive valuations in many sectors also triggered bottom-fishing demand. The P/E ratio of non-financial stocks (excluding real estate) has fallen below the lows seen during the sharp correction in April 2025, which was influenced by tariff factors. This indicates that some sectors and stocks have entered relatively attractive valuation zones for medium to long-term investment.

However, Mr. Khoa noted that the current rally remains a technical rebound, lacking sufficient evidence to confirm a sustainable trend reversal. The market will need a few more sessions to rebalance before establishing a more durable trend.

The recovery session positively relieved investor anxiety after a period of rapid decline. Liquidity also spread across various sectors, rather than concentrating on a few blue-chip stocks. Nevertheless, a sustainable upward trend reversal requires further confirmation from liquidity and consistent money flow in subsequent sessions.

One critical signal to confirm a market bottom is the emergence of widespread strong fluctuations followed by a decisive intraday reversal, driving a “blood change” in capital flows. This is typically accompanied by a significant increase in matched liquidity, rising by about 50% or more compared to the average trading sessions in the same period.

Technically, the three-candle pattern formed from December 12 to 16 created a relatively typical Morning Star pattern, suggesting a potential price reversal. However, due to the lack of a clear liquidity breakthrough, we consider this signal suggestive but insufficient to confirm a sustainable trend reversal.

Currently, the VN-Index has fallen 6.4% from its peak, with a P/E of 14.76 and a P/B of 2.04, slightly higher than the 5-year average. According to Agriseco experts, the market is not yet in a “cheap” valuation zone overall. However, the recent correction has created clear differentiation among sectors.

In the context of year-end caution and generally low liquidity, stocks with strong fundamentals and profit growth prospects for 2026 remain suitable for gradual investment. The Banking sector is attractively valued, with its current P/B falling below the 5-year average, while profit prospects are supported by credit growth and improving asset quality.

Additionally, with the 2026 state budget development investment plan expected to reach approximately VND 1,120 trillion, the Construction and Building Materials sectors are anticipated to benefit from substantial workloads. Leading companies in Real Estate and Retail are also presenting investment opportunities as valuations become more reasonable relative to growth potential in the coming year.

Conversely, for stocks that have overheated in previous periods and are heavily dependent on short-term capital flows, Mr. Khoa advises investors to exercise caution. Prioritize monitoring stock accumulation and corporate earnings in subsequent quarters before making investment decisions.

MBS Capital Surge: Breaking the 10,000 Billion Mark – A Year-End Trading Boost!

Recently, at an extraordinary shareholders’ meeting, MBS approved a plan to increase its chartered capital beyond the 10,000 billion VND milestone. This strategic move aims to strengthen the company’s financial foundation, expand its operational scale, and enhance its capacity to serve investors in an increasingly competitive securities market.

Park Residence: Premium High-Rise Apartments Starting at $1,100/m² in Southern Hanoi

Nestled just a 50-minute drive from Hanoi, Park Residence offers young individuals the opportunity to establish their first home at an incredibly affordable price, starting from only 25 million VND per square meter of usable space. This collection of modern apartments is seamlessly integrated within the vibrant, multi-amenity resort urban complex of Sun Urban City.

By 2026, the Stock Market Must Better Serve the Overall Development Needs of the Economy

On the afternoon of December 15, 2025, the State Securities Commission (SSC) held a conference to review the 2025 work and deploy the 2026 work program. Deputy Minister of Finance Nguyễn Đức Chi attended and directed the conference.