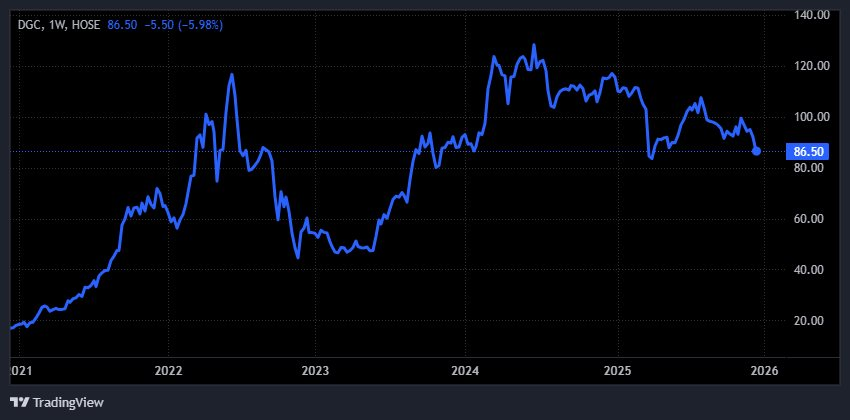

Today, shareholders holding DGC shares of Duc Giang Chemical Joint Stock Company are left perplexed. While the broader market is booming and most stocks are rallying, DGC shareholders find themselves unexpectedly left behind.

Despite no negative news being announced, DGC shares faced intense selling pressure right from the opening bell. The stock price plummeted uncontrollably, quickly hitting the floor at 86,500 VND per share.

What startled many shareholders wasn’t just the decline, but the manner in which it occurred. Selling was decisive and unwavering, while buying interest at the bottom nearly vanished. The buying side gap was swiftly filled by widespread panic, leaving the stock to close with no buyers, as over 4 million shares piled up at the floor price.

Amid the decline, trading volume surged to a record high. Over 18 million DGC shares changed hands, the highest in its listing history, equivalent to nearly 5% of the company’s outstanding shares.

The sharp decline comes just before the company prepares to pay an interim cash dividend for 2025 at a rate of 30%, with each share receiving 3,000 VND, totaling 1,140 billion VND in payments. December 25 will be the final registration date for shareholders, and payment will be made on January 15, 2026.

The steep drop in DGC shares not only surprised investors but also caught many securities firms off guard, as numerous analysts had previously maintained positive outlooks and “buy” recommendations for the stock.

FPT Securities (FPTS) remains optimistic, forecasting DGC’s Q4/2025 business results to continue growing, with net revenue estimated at 2,670 billion VND, up 10.4% YoY, and after-tax profit at 794 billion VND, slightly up 0.8% YoY. According to FPT, revenue is supported by higher selling prices, while profit margins face pressure from rising input costs. Meanwhile, the caustic soda-chlorine project, which began in Q1/2025 and is now 50% complete, is expected to commence operations in Q2/2026 as scheduled.

From another perspective, Agriseco Research anticipates stable growth in DGC’s business results during 2025–2026, driven by improved fertilizer prices and the revised VAT Law boosting profit margins. Additionally, the Duc Giang Nghi Son project is set to begin operations in Q2/2026. Based on this, Agriseco maintains a positive outlook for DGC shares, despite short-term market volatility.

SHS Securities also believes DGC possesses strong mid- to long-term growth drivers. In November 2025, Hanoi People’s Committee approved the investment plan for the Duc Giang Public Works, School, and Housing Complex proposed by Duc Giang Chemical Group, expected to significantly contribute to DGC’s profits over the next three years.

Additionally, the first phase of the Nghi Son Chemical project is slated for commercial operation in Q2/2026, with total investment adjusted to 2,900 billion VND. SHS estimates that in 2026, the caustic soda segment could achieve 50% of its design capacity, generating nearly 800 billion VND in revenue with a 12% profit margin. At full capacity, the project’s revenue could reach 1,600–2,000 billion VND annually.

Furthermore, DGC’s efforts to extend and expand mining fields 25 and 19B, expected to be licensed in Q4/2025, along with diversifying apatite ore supply sources, are seen as enhancing the company’s control over raw materials. On the risk side, the export tax increase on yellow phosphorus (P4) from 2026–2027 led SHS to reduce its 2026 profit forecast by 10%, though this impact is partially offset by the 0% export tax to Japan—a market accounting for about 26% of export revenue in the first half of 2025—under CPTPP.

DGC operates in the chemical production industry, with key products including yellow phosphorus, phosphoric acid (food, electronics, agriculture), fertilizers, detergents, and cleaning agents. DGC holds a significant competitive advantage as one of the leading yellow phosphorus exporters in Southeast Asia, with major customers in the U.S., Japan, and South Korea. In the future, DGC plans to enter the production and distribution of caustic soda-chlorine (Duc Giang – Nghi Son) and alumina (Bauxite – Alumina Dak Nong).

MSH Shares Surge as FPTS Successfully Offloads Nearly 1.2 Million Stocks

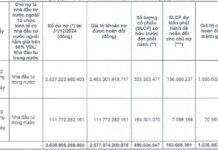

FPTS successfully offloaded nearly 1.2 million registered MSH shares, reducing its ownership stake in May Sông Hồng to 10.665% of the company’s capital.

What Did the CEO of Fat Racing Say About the Record Loss Wiping Out Shareholder Equity?

Fat Racing Corporation (UPCoM: DFF) has plunged into negative equity following a record-breaking loss, leading to trading restrictions on its shares. Company executives attribute the downturn to soaring borrowing costs and a sluggish construction market, which have prolonged the business’s operational decline.

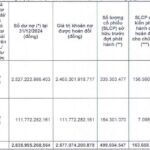

Duc Giang Chemicals Holds Over VND 12,700 Billion in Bank Deposits, Q3/2025 Net Profit Reaches VND 804 Billion

Duc Giang Chemicals reported a net profit of over 804 billion VND in Q3/2025, a 9% increase year-over-year. As of September 30, 2025, the company holds nearly 12,762 billion VND in bank deposits.