According to the roadmap, the delisting of MCH shares from UPCoM is a necessary technical step to complete the listing process. Masan Consumer’s final trading session on UPCoM will take place on December 17, 2025, before its official transfer to the new exchange.

The completion of this roadmap reflects the company’s readiness to meet higher standards of transparency and financial governance. It also demonstrates that MCH has successfully met the stringent requirements of Vietnam’s most prestigious and largest stock exchange.

Enhancing International Capital Visibility

In Vietnam’s stock market, HOSE is recognized as the exchange with the highest standards for information disclosure, auditing, transaction monitoring, and risk management. These rigorous criteria make HOSE a hub for long-term capital, particularly foreign investment, while serving as a natural filter for listed companies.

Masan Consumer’s proactive move toward HOSE indicates that the company has fulfilled the essential conditions to operate in a more transparent and closely monitored environment. Notably, this shift was not a sudden decision but part of a long-term strategy first mentioned in 2024, accompanied by a thorough review of governance and reporting systems over multiple quarters. This underscores a well-calculated plan aligned with the company’s broader vision.

For a company with a revenue scale of approximately 1.2 billion USD like Masan Consumer, listing on HOSE offers foundational benefits. The heightened oversight and disclosure requirements further standardize governance, enhance transparency, and ensure consistent market communication.

More importantly, HOSE is a favored destination for foreign investment funds, from active funds to large-scale ETFs, which prioritize companies with substantial market capitalization, stable growth, high profitability, and recurring revenue. Given its focus on essential consumer goods, 98% household penetration in Vietnam, and robust profit and cash flow foundation, MCH is considered one of the few domestic FMCG companies meeting these criteria.

“Following its official listing on HoSE, we anticipate Masan Consumer will likely be considered for inclusion in major indices, starting with VN30 and extending to large-scale passive investment indices like VanEck, Xtrackers, and FTSE Emerging Markets,” said Mr. Hoàng Nam, Director of Research & Analysis at Vietcap.

Additionally, MBS Securities forecasts that during the Q4 2025 index rebalancing in mid-December, MCH could be added to key indices such as the STOXX Vietnam Total Market Liquid Index and MarketVector Vietnam Local Index, given its improved liquidity and capitalization post-listing on HOSE. Under this scenario, MBS estimates that index-tracking ETFs may purchase approximately 1.7 million MCH shares during the rebalancing period.

Essential Consumer Stocks and the Value of Sustainable Cash Flow

During volatile market periods, essential consumer companies often demonstrate superior resilience due to recurring demand and reduced dependence on economic cycles. With a 98% household penetration rate in Vietnam (Kantar 2024) and a portfolio of brands integral to daily life—such as CHIN-SU, Nam Ngư, Omachi, Kokomi, and Wake-Up 247—Masan Consumer boasts a highly stable business model and predictable cash flow, critical for long-term investors.

This stability is evident in its financial performance over the years. From 2017 to 2024, MCH maintained an operating margin above 23%, while net profit from 2022 to 2024 grew at a compounded annual rate of approximately 20%. In 2024 alone, revenue reached around 1.2 billion USD, reinforcing MCH’s position among Vietnam’s leading FMCG companies. Alongside growth, the company has consistently paid cash dividends, totaling approximately 1.5 billion USD from 2018 to 2024, highlighting its sustainable cash flow generation and commitment to shareholder value.

For consumers, Masan Consumer’s products are synonymous with daily meals and routines. For investors, it represents a mature, efficiently operated essential business increasingly aligning with higher governance standards. Thus, MCH’s transition to HOSE is not merely technical but signifies a new development phase where stability and growth coexist, and long-term value is further solidified for committed shareholders.

| Masan Consumer (UPCoM: MCH) is a subsidiary of Masan Group (HOSE: MSN), one of Vietnam’s leading consumer and retail enterprises. With nearly three decades of serving consumers, Masan Consumer has continuously innovated to deliver high-quality products meeting the essential needs of millions of households. The company offers a diverse FMCG portfolio spanning seasonings, convenience foods, beverages, and personal and household care, featuring well-known brands like CHIN-SU, Nam Ngư, Omachi, Kokomi, and Wake-up 247. Masan Consumer’s products are present in over 98% of Vietnamese households and exported to more than 26 countries, cementing its position as one of the region’s most profitable FMCG companies. |

– 14:31 16/12/2025

Nationwide Affordable Housing Projects Break Ground on Special Occasion

On December 19th, a wave of groundbreaking ceremonies will sweep across the nation as numerous social housing projects are set to commence simultaneously. This unprecedented surge in development marks a significant milestone for affordable housing, catering specifically to low-income individuals. The initiative is a celebratory gesture in honor of the 14th National Congress of the Communist Party of Vietnam.

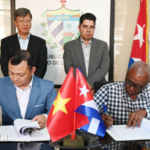

Cuba’s Underground Secret: Vietnam’s Bold Move to Cultivate 2,500 Hectares and Transform It into a “Capital”

Beneath Cuba’s surface lies a treasure far more valuable than oil or rare minerals: a rich, fertile layer of red basalt soil that has captured the attention of Vietnamese agricultural engineers. This natural bounty, teeming with potential, promises to revolutionize farming practices and foster sustainable growth.