Recently, Mrs. Nguyen Thi Hai submitted a notification regarding a related-party share transaction to the State Securities Commission (SSC), Ho Chi Minh City Stock Exchange (HoSE), and 911 Group Joint Stock Company (Stock Code: NO1, HoSE).

Accordingly, Mrs. Hai registered to inherit 4 million NO1 shares with the purpose of transferring ownership through inheritance and reclaiming joint marital assets.

The transaction is expected to be executed via off-exchange transfer, outside the trading system of the Ho Chi Minh City Stock Exchange, from December 17, 2025, to January 15, 2026.

If successful, Mrs. Hai’s NO1 shareholdings will increase from over 1.7 million to more than 5.7 million shares, raising her ownership stake from 7.28% to 23.95% of the capital, making her the largest shareholder of 911 Group.

Illustrative image

Mrs. Hai is the widow of the late Mr. Luu Dinh Tuan, former Chairman of the Board of Directors of 911 Group, and the sister of Mrs. Nguyen Thi Thom, a Board Member.

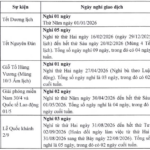

In other developments, 911 Group plans to distribute a 6% cash dividend for 2024 to shareholders on December 29, 2025, equivalent to VND 600 per share.

The dividend payment record date was set for November 28, 2025, with the ex-dividend date being November 27, 2025.

With 24 million NO1 shares outstanding, the Group is estimated to allocate approximately VND 14.4 billion for this dividend payment.

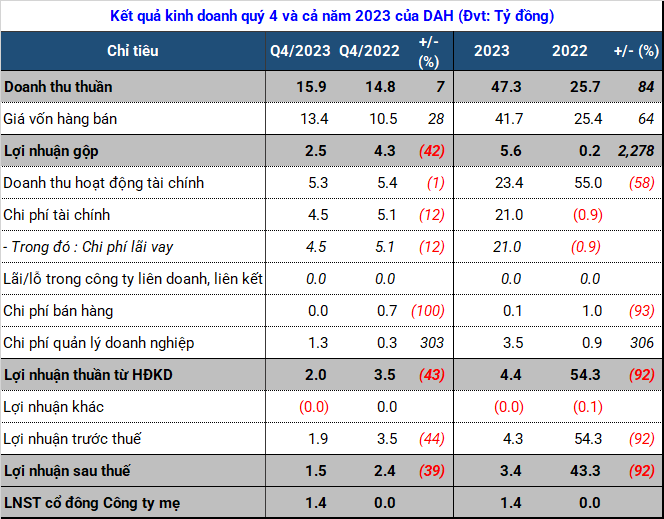

Regarding business performance, 911 Group reported an after-tax profit of nearly VND 198.8 million in Q3/2025, a 96% decline compared to Q3/2024.

According to the Group’s explanation, this was primarily due to a 71% year-on-year drop in Q3/2025 revenue to VND 64.6 billion.

Key factors included reduced market demand (partly attributed to July lunar month consumer culture) and fluctuations in input costs within the machinery and equipment sector. As most goods are imported, USD/VND exchange rate volatility increased selling prices, impacting purchasing power and customer order timelines.

On the enterprise side, significant increases in input costs, machinery import prices, and domestic/international transportation expenses compared to the same period last year compressed gross profit margins. The company has several ongoing orders that will be completed in the next quarter. In Q4/2025, the Group continues to implement new business strategies.

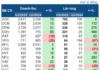

“Hot” Stock Surging 240% Suddenly Faces Margin Call

As of December 12, 2025, the Ho Chi Minh City Stock Exchange (HOSE) has identified 70 stocks ineligible for margin trading.