Soaring Capital Demand Revives Vietnam’s Bond Market

Year-end financial pressures often intensify for businesses, requiring them to meet multiple obligations simultaneously. Some face delayed cash inflows, further straining their capital balancing act.

To ensure stability during these critical months, many companies turn to various fundraising channels, including the bond market.

The Vietnam Bond Market Association (VBMA) recently released its November 2025 bond market report. According to VBMA data compiled from HNX and SSC (based on issuance and repurchase dates from HNX’s platform, subject to updates), as of November 30, 2025, 24 corporate bond issuances totaling VND 19,608 billion were recorded.

In December 2025, banks, real estate firms, financial institutions, and consumer companies actively issued bonds, with some reaching trillions of dong.

Banks, for instance, are boosting bond issuance to maintain short-term capital ratios for medium-term loans. On December 10, 2025, Techcombank successfully issued VND 2,000 billion in TCB12525 bonds with a 36-month tenure, maturing on December 10, 2028, at a 6.5% annual interest rate.

Earlier, on December 3, 2025, Techcombank issued TCB12524 bonds worth VND 2,000 billion, also with a 36-month tenure and a fixed 6.5% annual interest rate, including a buyback clause.

VPBank issued VND 3,000 billion on December 12, 2025, with a 3-year tenure, maturing on December 12, 2028, at a fixed 6.5% annual nominal rate.

Additionally, on December 3, 2025, VPBank issued 500 VPB12515 bonds domestically, each valued at VND 1 billion, totaling VND 500 billion. These 5-year bonds offer a 6.4% annual interest rate, maturing on December 3, 2030.

Illustrative image

In the financial sector, Encapital Fintech issued 2,800 ECF12502 bonds, each valued at VND 100 million, totaling VND 280 billion. These 24-month bonds, issued on December 8, 2025, offer a 9.5% annual interest rate, maturing on December 8, 2027.

On the same day, APG Securities issued 3,000 APG12501 bonds, each valued at VND 100 million, totaling VND 300 billion. These 24-month bonds offer an 8% annual interest rate.

According to APG’s December 3, 2025 resolution, the proceeds will refinance four BIDV loans maturing in December 2025.

Real Estate Firm Leads with Double-Digit Interest Rates

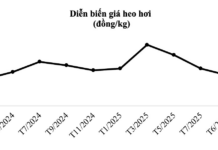

HNX data shows that recent corporate bond issuance rates have primarily ranged from 6% to 8% annually.

However, surging capital demand has pushed some companies to offer double-digit rates to attract investors.

On December 8, 2025, Becamex Group issued VND 900 billion in BCM12504 bonds with a 3-year tenure at a 10.3% annual interest rate.

In the construction sector, Tam Trinh Construction issued 11,000 TAT32502 bonds on December 5, 2025, each valued at VND 100 million, totaling VND 1,100 billion. Earlier, they issued VND 900 billion in TAT32501 bonds with a 96-month tenure, maturing on November 28, 2033, both at a 9.2% annual rate.

Within a week, Tam Trinh Construction raised VND 2,000 billion via bonds.

Some companies have secured funding at 12% or higher. Thai Son Construction issued VND 4,000 billion in TSO12502 bonds on November 28, 2025, with a 24-month tenure at 12% annually.

Vingroup issued 10,000 VIC12511 bonds, each valued at VND 100 million, totaling VND 1,000 billion, with a 36-month tenure at 12% annually, maturing on November 27, 2028.

Khải Hoàn Land’s bonds, offering 13.5% annually, have drawn significant investor attention. On December 3, 2025, they issued 800 KHG12502 bonds, each valued at VND 100 million, totaling VND 80 billion, with a 60-month tenure, maturing on December 3, 2030.

This marks Khải Hoàn Land’s second issuance in 2025. On October 2, 2025, they issued KHG12501 bonds totaling VND 80 billion at the same 13.5% rate.

How Will Rising Interest Rates Impact the Real Estate Market?

At the Vietnam Real Estate Conference 2025 (VRES 2025), Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, shared insights, stating that the current slight increase in deposit interest rates is merely a technical adjustment to restore the capital base following the significant decline in 2024. Home loan interest rates remain within a supportive range for transactions.

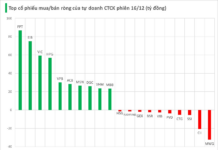

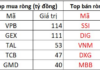

Market Experts: Stocks Feel Like a Massive “Sale Off” – Already “Cheap” Shares Could Get Even Cheaper

Amidst a steep market downturn, liquidity on HoSE has remained stagnant at a moderate level of approximately VND 22 trillion, attributed to systemic liquidity shortages and mounting pressure from rising interest rates.