Leading banks such as Agribank, Vietcombank, BIDV, and Vietinbank have collectively adjusted their deposit interest rates, both over the counter and online.

Specifically, Vietcombank, BIDV, and VietinBank have implemented identical interest rates for over-the-counter deposits. The 1-month term rate has increased to 2.1%/year, the 3-month term to 2.4%/year, the 9-month term to 3.5%/year, and the 12-month term has risen by 0.5 percentage points to 5.2%/year. For terms exceeding 12 months, the rate has increased to 5.3%/year.

Agribank, however, offers slightly different rates for over-the-counter deposits: 2.4%/year for 1-month terms, 2.7%/year for 3-month terms, 3.8%/year for 9-month terms, and 5.2%/year for 12-month terms.

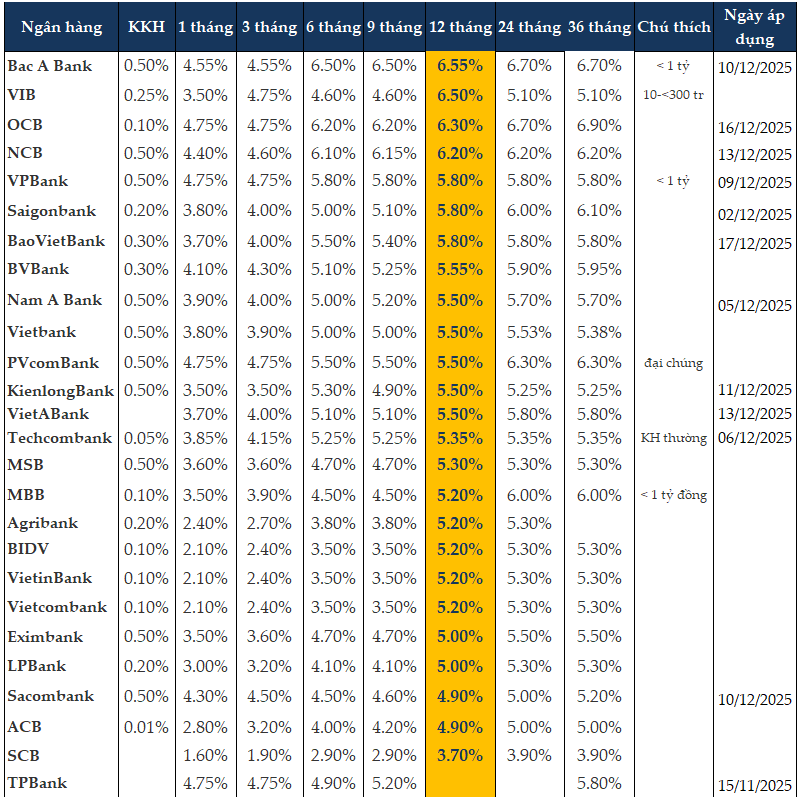

Since September, private banks have gradually increased deposit interest rates. From early December onwards, several banks have announced adjustments, including PVCombank, OCB, BaoVietBank, NCB, BVBank, KienlongBank, Techcombank, VPBank, ACB, Sacombank, and SHB.

|

Personal savings deposit rates at foreign banks as of December 17, 2025

|

According to experts, the year-end increase in deposit interest rates is a seasonal trend, as banks bolster capital for lending activities.

VCBS forecasts that deposit interest rates may continue to rise slightly due to two factors: peak season liquidity pressures and exchange rate risks amid heightened year-end foreign currency demand for imports.

– 10:10 17/12/2025

December 16: Agribank, Vietcombank, VietinBank, and BIDV Jointly Hike Savings Interest Rates Across All Terms

The four largest banks in the system—Agribank, Vietcombank, VietinBank, and BIDV—have collectively raised their over-the-counter savings interest rates, particularly for long-term deposits. This move not only elevates the overall deposit interest rate landscape but also serves as a significant indicator in the deposit market.