SePay eShop is an innovative e-commerce and electronic invoicing software designed to empower users to create their own online stores, manage product catalogs, track revenue, and handle orders seamlessly. Integrated with SePay eInvoice, it enables customers to generate electronic invoices effortlessly. Real-time bank transaction synchronization minimizes errors in reconciliation, ensuring accurate revenue management. Additionally, pairing it with SePay’s Payment Speaker streamlines the entire process—from payment collection to transaction recording and invoice issuance—making operations smoother and more efficient.

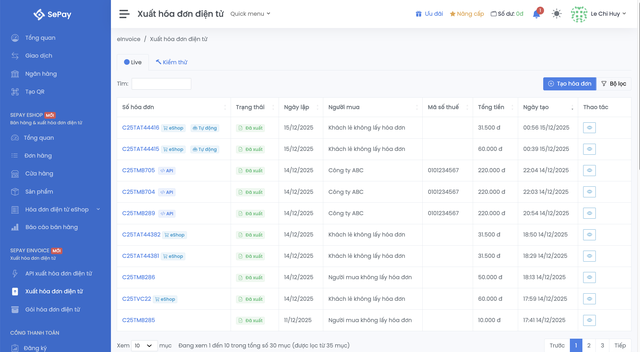

SePay eInvoice is a specialized electronic invoicing solution tailored for businesses already equipped with sales systems, offering seamless API integration for invoice generation. It efficiently handles large volumes of invoices, ensuring stability and convenience. When paired with SePay eShop, it allows for instant electronic invoice issuance during sales, eliminating the need to switch between multiple platforms. Users can also generate invoices directly from their smartphones via my.sepay.vn, without requiring a computer or USB token. The fully online digital signing process ensures security while catering to fast-paced, flexible business models.

By integrating SePay eShop, SePay eInvoice, and other solutions within the SePay ecosystem—such as Payment Speaker and payment gateways—businesses can execute a seamless end-to-end workflow. From sales and payment processing to transaction recording and electronic invoicing, the system supports automated payment confirmations and real-time transaction tracking, ensuring streamlined, transparent, and controllable operations.

The launch of SePay eShop and SePay eInvoice marks a pivotal milestone in the SePay ecosystem, offering businesses and entrepreneurs a streamlined, cost-effective, and transparent solution. Tailored for the evolving demands of digital transformation, it empowers users to operate with agility and efficiency in today’s dynamic business landscape.

SePay Joint Stock Company

Website: sepay.vn

Address: 13 Street No. 38, Van Phuc City Urban Area, Hiep Binh Ward, Ho Chi Minh City.

Contact: 02873.059.589

Da Nang Transitions to Contract Households: VNPAY Supports Digital Invoicing and Payments

On November 12, 2025, VNPAY and the Da Nang Tax Department signed a cooperation agreement to launch the “60-Day Campaign,” aimed at assisting businesses in transitioning from lump-sum tax to self-assessment. This initiative also promotes cashless payments and the adoption of digital solutions in tax management.

Navigating the Transition: How Small Businesses Can Adopt E-Invoicing Under Decree 70

As of June 1, 2025, under Decree 70, businesses with annual revenue of 1 billion VND or more will be required to use electronic invoices connected to tax authorities. This regulation also applies to those using cash registers or subject to tax declaration methods. It marks a significant step toward transparent business operations but presents considerable challenges, particularly for small and individual business owners.