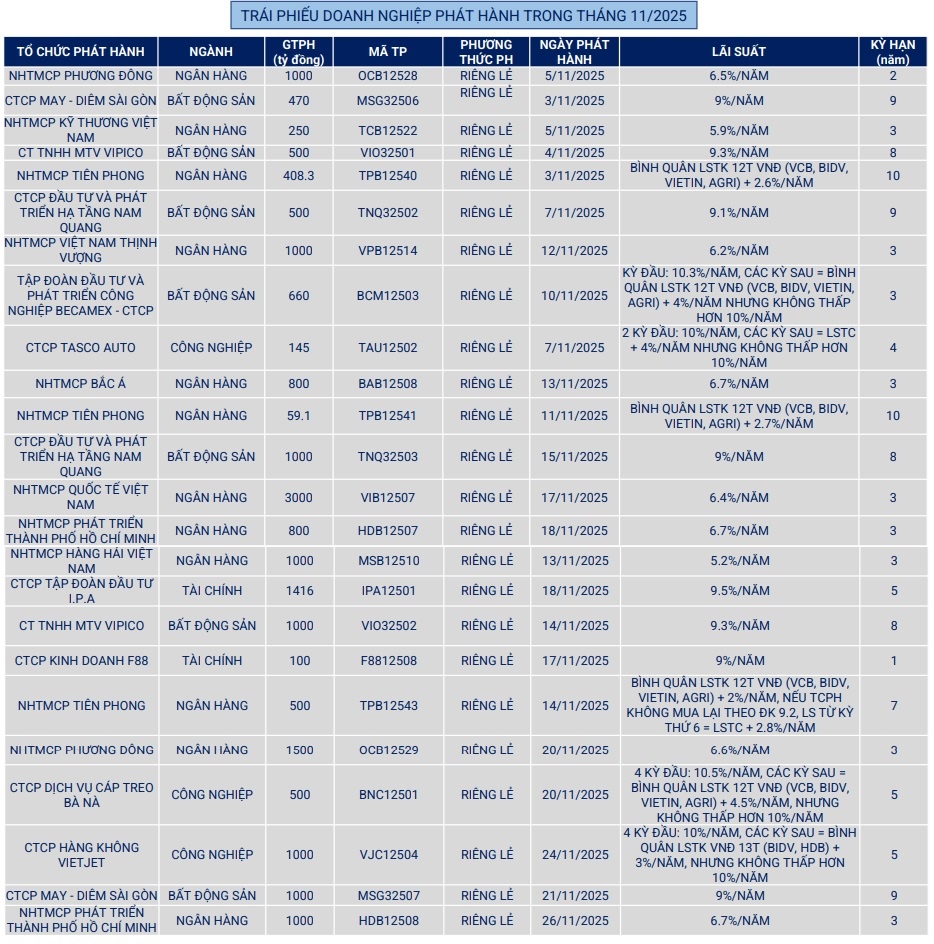

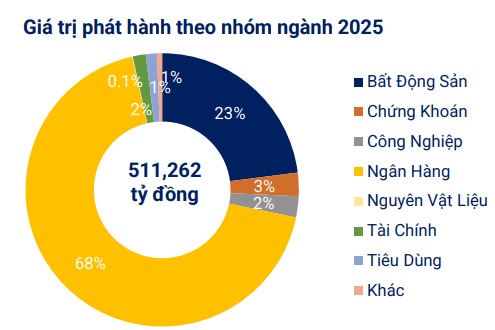

In the first 11 months of the year, the cumulative value of privately issued corporate bonds reached nearly VND 461 trillion, while the value of public offerings stood at approximately VND 50.6 trillion.

Source: VBMA

|

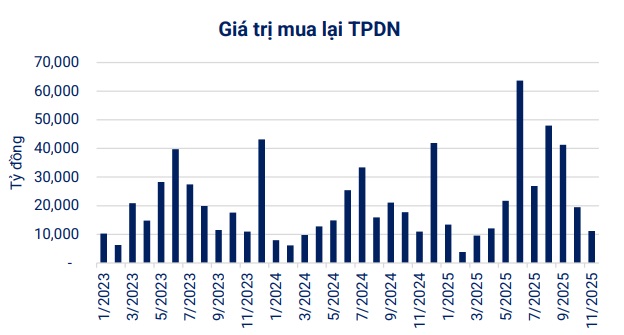

During November, businesses repurchased over VND 11.1 trillion in bonds before maturity, a 2% increase compared to the same period last year. In the final month of 2025, an estimated VND 28 trillion in bonds will mature, with nearly VND 211 trillion set to mature in 2026.

Source: VBMA

|

Regarding unusual disclosure information, in November, three bond codes delayed interest and principal payments, totaling VND 287 billion.

Source: VBMA

|

In the secondary market, the total trading value of privately issued corporate bonds in November exceeded VND 110 trillion, averaging VND 5,524 billion per session, a 25% increase compared to October’s average.

Two notable upcoming bond issuances include BAF Vietnam Agriculture Corporation (HOSE: BAF), whose Board approved a public bond issuance plan for 2025, with a maximum value of VND 1 trillion. These are “3 no” bonds: non-convertible, without warrants, and unsecured. The expected denomination is VND 100 million per bond,

with a 3-year term and a 10% annual interest rate. BAF plans to allocate VND 670 billion of the proceeds to supplement working capital for feed, livestock, and goods payments within its ecosystem. The remaining VND 330 billion will be used to repay principal to credit institutions.

The second issuance is by BIDV (HOSE: BID) in Q4/2025, with a maximum value of VND 9 trillion. These are also “3 no” bonds, with a minimum term of 5 years, an expected denomination of VND 100 million per bond, and a combined fixed and floating interest rate.

– 08:52 17/12/2025

Why Capital Flows into the Bond Market Aren’t Sparking a Frenzy

According to the Asian Development Bank (ADB), Vietnam’s economy will require an additional $250–350 billion in investment capital over the next five years, presenting a significant opportunity for capital mobilization through the bond market. While the bond market is seen as a critical channel to alleviate pressure on the banking system, it currently faces persistent challenges related to maturity structures, investor diversity, and liquidity.

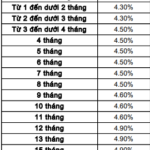

Sacombank Interest Rates December 2025: Continued Rise, 18-Month Online Deposits Offer Highest Returns

As we step into December 2025, Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) continues to raise deposit interest rates for terms ranging from 1 to 36 months. The increase fluctuates between 0.3% and 0.55% per annum.

How Will Rising Interest Rates Impact the Real Estate Market?

At the Vietnam Real Estate Conference 2025 (VRES 2025), Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, shared insights, stating that the current slight increase in deposit interest rates is merely a technical adjustment to restore the capital base following the significant decline in 2024. Home loan interest rates remain within a supportive range for transactions.

Banks Go All-In: High-Interest Rates Lure Depositors

Banks are relentlessly hiking deposit interest rates as the year draws to a close. The fierce competition to offer the highest rates intensifies as banks scramble to meet soaring capital demands, with staff aggressively pursuing customers to secure top-tier returns.