Recently, VEIL—a billion-dollar fund under Dragon Capital—announced a share buyback plan to meet shareholder liquidity needs through a Tender Offer mechanism. The current offer is capped at 10% of issued common shares, with two more rounds expected within the next 12 months, each up to 10%, potentially totaling 30% of the fund’s equity.

Exit options include: (1) Cash Exit Option—receive cash at the offer price (3% discount to NAV); (2) Exchange Option—convert to Vietnam Equity (UCITS) Fund (VEF), requiring a minimum subscription of 100,000 GBP and available only in eligible jurisdictions; (3) In Specie Option—receive the underlying portfolio directly, restricted to professional investors or qualified partners.

According to KBSV Research, several factors drive this move. First, shareholder pressure: at the June 2025 AGM, over 20% of votes supported fund termination, prompting the board to offer liquidity solutions. Second, underwhelming performance: VEIL’s NAV rose just 21% year-to-date through November 2025, lagging the VN-Index’s 31% gain.

Third, the fund’s London-listed shares often trade at a 15% discount to NAV, inflicting losses on direct sellers. The 3% discount offer is seen as optimal for profit realization. Fourth, macroeconomic risks and FDI outflows: foreign capital exited Vietnam by over $5 billion in 2025, with Trade War 2.0 threats potentially weakening Vietnam’s FDI appeal amid volatile tariff news.

Fifth, currency risk: holding VND-denominated assets while reporting in USD/GBP exposes foreign investors to significant exchange rate risk, especially with a strengthening USD/GBP.

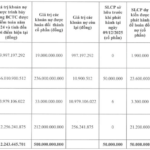

KBSV Research estimates the total withdrawal could reach 14.3 trillion VND ($545 million) if all three rounds are executed—substantial compared to 2024’s $3.7 billion and 2025’s $5 billion net outflows (11-15% of two-year totals). However, relative to overall market volume, particularly with foreign transactions at just 9% year-to-date, the impact is limited.

This marks Dragon Capital’s third such move in two years (8.1% in 2024, 12.8% in 2025), yet each round’s volume equates to 1-3 days of foreign selling during peak outflow periods, lacking market dominance. KBSV Research believes the event’s impact will be modest, especially if shareholders opt for non-cash exits, reducing sell pressure. VEIL’s 15.5% year-to-date NAV growth (USD terms) suggests withdrawal demand stems from a small minority (20%) seeking short-term rebalancing, not broader dissatisfaction.

Mid-term, Vietnam’s market remains promising regionally, driven by upgrade prospects and attractive valuations relative to earnings growth expectations.

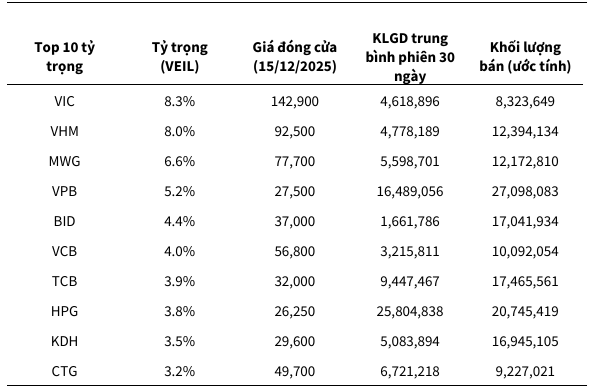

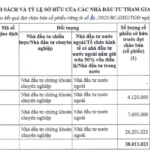

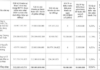

VEIL’s top 10 holdings include Vietnam’s blue-chip leaders: VIC, VHM, MWG, VPB, BID, VCB, TCB, HPG, KDH, and CTG. Under the 30% withdrawal scenario, millions of shares per stock could be sold.

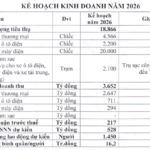

|

Estimated Sales Volume Under 30% Withdrawal Scenario

Source: KBSV Research

|

– 16:59 17/12/2025

Dragon Capital Faces Pressure to Liquidate Up to $500 Million in Assets Amid Shareholder Exit Demands

With a maximum script of 30% of total shares and an offer price discounted by 3% compared to NAV, the estimated repurchase value of the foreign fund VEIL is approximately 14.3 trillion VND (545 million USD).

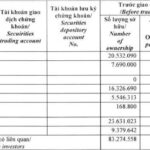

Powerful Individual Buying Drives Investment Fund Transactions

During the week of December 8–12, 2025, investment fund trading remained relatively subdued. However, the market witnessed a notable highlight as significant buying pressure concentrated on a real estate stock.