Deposit interest rates soar to over 8% per year

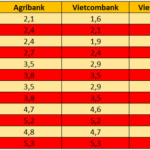

For the first time in nearly a year, all four state-owned banks have collectively raised deposit interest rates, with a 0.5% annual increase across various terms. This adjustment brings the interest rates for deposits of 12 months or more at these banks to levels comparable to late 2023, while shorter-term rates remain approximately 0.5% lower than the current period.

Specifically, Vietcombank, BIDV, and VietinBank have implemented identical over-the-counter interest rates. The 12-month deposit rate has been raised to 5.2% per year; the 6-9 month rate to 3.5% per year; and the 1-month and 3-month rates to 2.1-2.4% per year. Agribank has also set its 12-month deposit rate at 5.2% per year, with slightly higher rates for shorter terms compared to the other three state-owned banks.

Deposit interest rates surge at year-end (Photo: N.M).

As market leaders, the actions of the Big 4 banks not only directly impact depositors but also have the potential to create a ripple effect, influencing the overall interest rate landscape in the coming period.

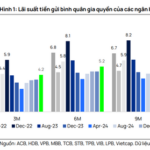

The upward trend in savings interest rates has been widespread over the past two months, with more significant increases observed among lower-tier banks. Since the beginning of December, 24 banks have raised deposit rates, including NCB, VPBank, and Techcombank, which have made two adjustments.

Some institutions, such as PVComBank and NCB, have introduced promotional interest rate programs, offering rates exceeding 8% per year for 12-month deposits.

No policy reversal yet, but risks remain a concern

In an interview with Tien Phong Newspaper, economist Nguyen Tri Hieu suggested that the upward trend in deposit interest rates is likely to continue at least until the Lunar New Year. This is due to the potential for credit growth to reach 18-20% this year, with the possibility of even higher growth next year if GDP expands by double digits. Typically, credit growth is about twice that of GDP growth. With such robust credit expansion, banks are compelled to compete for deposits, putting upward pressure on interest rates. After the Lunar New Year, as the economy enters a slower phase, interest rates may gradually cool down.

However, Mr. Hieu expressed concern that when credit grows rapidly and lending rates cannot decrease, businesses face higher capital costs. In this context, many borrowers may invest in speculative assets to seek profits that offset borrowing costs. This increases risks not only for borrowers but also for banks and the entire financial system.

Mr. Nguyen Minh Tuan, CEO of AFA Capital and co-founder of the Vietnam Financial Advisors Community (VWA), noted that recent interest rate tensions have raised significant market concerns. However, to avoid confusion and overinterpretation, it is crucial to distinguish between market interest rates and policy rates.

According to Mr. Tuan, market interest rates are determined by actual transactions between economic entities. These rates operate in two main segments: short-term and long-term. The short-term segment includes the money market, comprising the retail market (bank deposits and loans to individuals and businesses), the interbank market, and the open market (OMO). The long-term segment is the capital market, where instruments like 5-30 year government bonds and stocks are traded.

In practice, the retail market plays a decisive role. When banks lend more than they can mobilize, they must seek additional funds from the interbank market. If multiple banks face liquidity shortages, interbank rates rise. This is a market-driven phenomenon reflecting short-term supply and demand for funds.

When interbank rates spike, the State Bank of Vietnam intervenes through open market operations or currency swaps. It is important to emphasize that these measures aim to provide short-term liquidity, typically with 7-14 day maturities, rather than easing monetary policy by injecting money into the economy.

“The current pressure stems from credit growing faster than deposits. Total outstanding loans have surpassed 18 trillion VND, while deposit growth has not kept pace. This has pushed the loan-to-deposit ratio (LDR) of many banks close to the 85% safety threshold. When LDR is high, banks must raise deposit rates, borrow from the interbank market, or seek liquidity support from the State Bank. Consequently, interbank rates have reached 7% at times, a rare occurrence in 2023-2024,” said Mr. Tuan.

According to Mr. Tuan, policy rates are a separate issue. Tools such as the deposit rate cap for terms under 6 months, refinancing rates, or discount rates are adjusted only in response to cyclical macroeconomic risks, particularly inflation. The key indicator for potential monetary policy reversal is the Consumer Price Index (CPI). As long as inflation remains below the target range of 4.5-5%, policy tightening is unlikely in the short term.

“The current high interest rates primarily reflect short-term market liquidity pressures, not a shift in monetary policy. As long as inflation is controlled, policy rates are likely to remain stable, even if market rates stay elevated in the near future,” Mr. Tuan concluded.

Small Businesses to Resume Bank Deposits as They Adapt to New Regulations

Vietcap believes that the current pressure to increase deposit interest rates remains manageable, and the absolute interest rate levels generally continue to provide supportive conditions. In the medium term, system liquidity and capital sources are expected to be sustained by four key factors.

December 16: Agribank, Vietcombank, VietinBank, and BIDV Jointly Hike Savings Interest Rates Across All Terms

The four largest banks in the system—Agribank, Vietcombank, VietinBank, and BIDV—have collectively raised their over-the-counter savings interest rates, particularly for long-term deposits. This move not only elevates the overall deposit interest rate landscape but also serves as a significant indicator in the deposit market.

Bank Boosts Savings Interest Rate to 8.3% Annually, Starting from Just 100 Million VND Deposits

Unlock exceptional returns with this bank’s savings account, offering up to 8.3% annual interest on a 12-month term—all with a minimum deposit of just 100 million VND. Maximize your savings effortlessly.