Short to Medium-Term Capital Dominates

Mr. Nguyen Ba Hung, Chief Economist at the Asian Development Bank (ADB) in Vietnam, highlights that Vietnam heavily relies on its banking system, with credit volume equivalent to approximately 130% of GDP. However, bank capital is predominantly short to medium-term, with common loan terms not exceeding 7 years. This has led to a significant maturity mismatch, as medium to long-term loans account for about 40% of total outstanding debt.

While bank credit cannot fully meet the economy’s long-term capital needs, the bond market, expected to be a crucial supplementary channel, has yet to fulfill its potential.

The bond market remains underdeveloped.

Mr. Hung notes, “Over half of the current bond issuances have terms between 1-3 years, with bonds of 5-10 years holding a modest share, and virtually no bonds exceeding 10 years. This structure indicates that Vietnam’s bond market primarily provides short to medium-term capital, similar to bank credit, rather than serving as a long-term capital source for businesses.”

Recently, at the “Diverse Capital for Sustainable Development” seminar, Ms. Pham Thi Thanh Tam, Deputy Director of the Financial Institutions Department at the Ministry of Finance, stated that from 2026-2030, the capital mobilization demand for economic development, especially medium to long-term capital, is projected to double compared to 2021-2025. This presents both a challenge and a significant opportunity to raise funds through government and corporate bond markets for production and business activities.

According to Ms. Tam, the demand for medium to long-term capital is expected to double, putting considerable pressure on the bond market. Meanwhile, the investor base remains thin, lacking institutional investors with substantial financial capacity and long-term capital. As commercial banks focus on credit, their investment in government bonds is also constrained.

How to Strengthen the Bond Market?

Ms. Pham Thi Thuy Linh, Head of the Securities Market Development Department at the State Securities Commission, explains that the secondary market for corporate bonds is divided into two segments: listed bonds and privately placed bonds. While listed bonds operate similarly to stocks, privately placed bonds are primarily traded through bilateral agreements, making high liquidity challenging.

Nonetheless, Ms. Linh emphasizes that capital raising through privately placed corporate bonds should align closely with issuance objectives and ensure the financial health of the issuing companies.

According to regulatory guidelines, participants in the private bond market are primarily professional securities investors capable of long-term commitment to companies and their capital-raising goals for project implementation.

Ms. Pham Thi Thanh Tam adds that expanding and strengthening the investor base is crucial for robust bond market development.

“This is an interdisciplinary challenge requiring coordinated efforts between the Ministry of Finance and relevant agencies to establish a solid foundation for the capital market in the coming period,” Ms. Tam remarks.

An Binh Securities (ABS) assesses that Decree 245/2025/ND-CP, effective from September 11, 2025, will introduce fundamental changes to the market. The new regulations tighten issuance conditions, mandating credit ratings for bonds, except in specific cases, and adjust financial criteria more rigorously, with a maximum debt-to-equity ratio of 5 times. Additionally, the approval process for credit institutions is streamlined, and the time for bonds to be traded on the secondary market is significantly reduced from 90 days to 30 days.

ABS anticipates these changes will enhance market transparency and professionalism, bolster investor protection, and improve issuance efficiency and speed. Consequently, the corporate bond market is poised for more stable and sustainable development in the medium to long term.

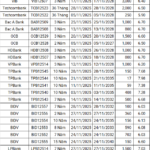

The Vietnam Bond Market Association (VBMA) reports that from the beginning of the year, the total value of early bond buybacks reached 281.674 trillion VND, a 51.8% increase compared to 2024. Banks led the buyback volume, accounting for approximately 69% of the total value, equivalent to 194.236 trillion VND.

Year-End Bond Market Surges: Real Estate Firms Offer Up to 13.5% Interest Rates

As the year-end approaches, a surge in capital demand has driven numerous businesses to explore the bond market. Notably, some real estate companies are raising funds at interest rates as high as 13.5%.

Japan Quang Real Estate Completes Settlement of VND 2.150 Billion Bond Issuance

Japan Quang Real Estate has successfully settled the principal amount of 2.150 trillion VND and nearly 118 billion VND in interest for the bond issuance NQRCB2124001.