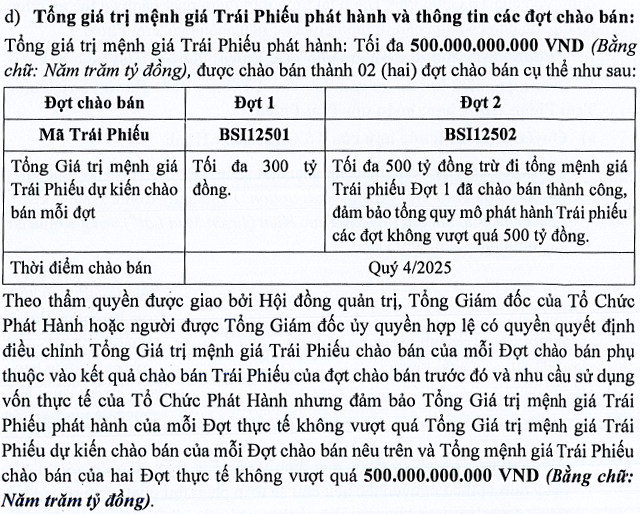

Specifically, BSI plans to issue a maximum of 5,000 corporate bonds with a face value of 100 million VND per bond, totaling up to 500 billion VND. The issuance will be divided into two phases: Phase 1 (BSI12501) for up to 300 billion VND and Phase 2 (BSI12502) for the remaining amount, ensuring the total issuance does not exceed the set limit.

Notably, the issuance is scheduled for Q4/2025, with the year-end approaching, indicating BSI must accelerate efforts to complete this fundraising initiative.

Source: BSI

|

These are “triple-zero” bonds—non-convertible, without warrants, and unsecured—targeted at domestic professional investors with a 1-year term from each issuance date.

Proceeds will refinance bank loans maturing between December 2025 and January 2026. BSI listed 10 short-term loans (up to 12 months) from banks and financial institutions, totaling over 1.3 trillion VND. The company may restructure all or part of the principal and accrued interest.

BSI confirmed compliance with bond issuance regulations, including a recent requirement for credit rating. Vietnam Investment Rating (VIS Rating) assigned an A+ rating with a stable outlook.

As of Q3/2025, BSI’s total assets reached nearly 16.7 trillion VND, up 61% year-to-date. Debt financing accounted for 59% (over 9.9 trillion VND), double the beginning-of-year figure, with no prior bond or long-term debt utilization.

Domestic and foreign banks provided 8.7 trillion VND in loans (max 12 months, <7.2% interest), while individuals and organizations contributed nearly 1.2 trillion VND (under 1 year, <6% interest).

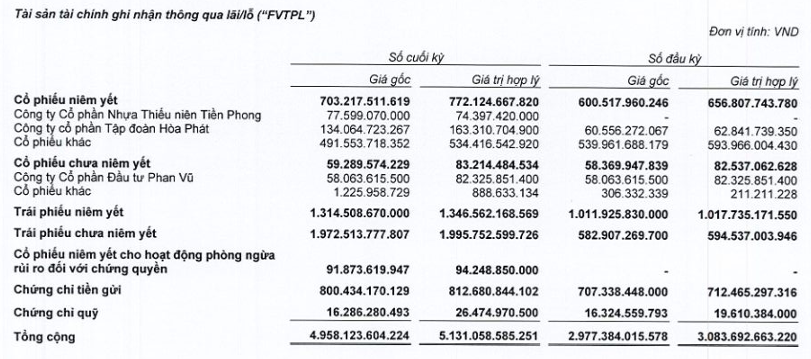

New capital fueled proprietary trading, increasing FVTPL assets from 3.1 trillion VND to 5.1 trillion VND, and lending, boosting outstanding loans from 5.2 trillion VND to 8.3 trillion VND.

The trading portfolio includes ~2 trillion VND in unlisted bonds, 1.3 trillion VND in listed bonds, and 813 billion VND in certificates of deposit. Equity investments feature NTP (Nhựa Thiếu Niên Tiền Phong) and HPG (Hòa Phát Group).

Source: BSI’s Q3/2025 Financial Report

|

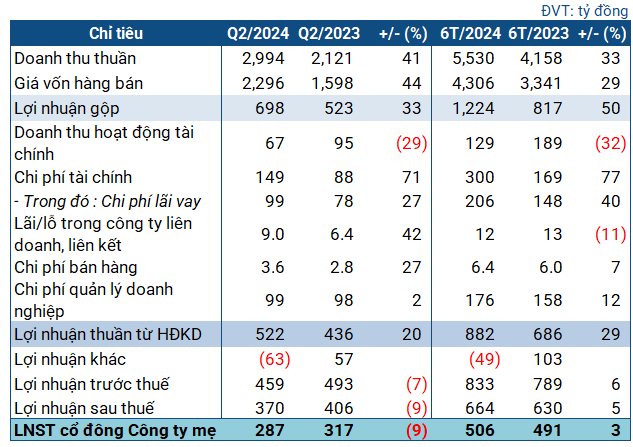

In 9M/2025, BSI generated 1.5 trillion VND in revenue (+40% YoY), driven by proprietary trading, lending, and brokerage. Pre-tax profit rose 23% to 496 billion VND (89% of the 560 billion VND annual target), with net profit at 399 billion VND (+24%).

| BSI’s 9-Month Financial Performance (Recent Years) |

– 5:09 PM, December 18, 2025

An Binh Securities Aims to Raise Capital Beyond 3.000 Billion VND

An Binh Securities has proposed two share issuance plans to its shareholders, totaling 207.3 million shares, aimed at increasing its chartered capital to over 3,000 billion VND.

Tracking the Whale Money Flow on 11/12: VN-Index Drops Below 1,700, Foreign and Proprietary Trading Capital Shift Directions

The 11th/12th session witnessed a negative turn as the VN-Index fell below the 1,700-point mark, closing at 1,698.9 points—a decline of over 20 points from the previous session. Foreign investors continued their net selling streak, offloading more than 514 billion VND, contrasting sharply with the net buying activity of proprietary trading firms, which accumulated nearly 192 billion VND on the HOSE.