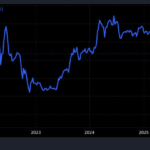

Turbulent times persist for Duc Giang Chemical Group’s shareholders. By the close of the December 18th session, DGC shares plummeted to their lower limit, settling at VND 74,900 per share, marking the third consecutive day of hitting the floor.

Notably, at the end of the session, nearly 22 million shares remained on the sell floor, equivalent to approximately 6% of the company. The staggering sell orders at the ATC session highlight the significant number of shareholders trapped in DGC stock.

Amidst the mounting sell orders, liquidity has virtually frozen, with only 1 million shares traded throughout the session. Foreign investors offloaded nearly 900,000 shares. In just three trading sessions, the company’s market capitalization has evaporated by nearly VND 6.9 trillion.

Regulations mandate that companies must report and disclose information when their stock price hits the floor for five consecutive sessions. Should this decline extend to a fifth session, Duc Giang will be compelled to provide an explanation to regulatory authorities regarding the stock’s abnormal movements.

DGC’s freefall has been a harsh reality check for investors, as the stock was previously regarded as a stellar performer in the chemical sector, boasting consistent revenue and profit growth. The company recently announced a 30% cash dividend for 2025 (VND 3,000 per share), totaling over VND 1.14 trillion. The shareholder record date is December 25th, with dividends payable on January 15th, 2026.

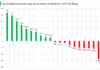

SHS Securities notes that this dividend policy may exert short-term pressure on DGC, particularly as the P4 segment contributed nearly 50% of the company’s revenue in the first half of 2025.

In response to the tax increase, SHS has trimmed its 2026 net profit forecast for DGC by 10%, primarily due to higher tax expenses. The revised projections indicate profit growth rates of 4.3%, 2.8%, and 6.6% for 2025–2027, falling short of earlier expectations.

To mitigate these challenges, DGC may negotiate cost-sharing with existing customers, reduce the export ratio of P4, and shift focus to higher-value products like acids, fertilizers (DAP, MAP), and animal feed additives.

On a positive note, the adverse tax impact is partially offset by the CPTPP agreement. Exports of P4 to Japan—accounting for 26% of DGC’s export revenue in H1/2025—remain tax-free, preserving the company’s competitive edge in this key market.

KB Securities Vietnam anticipates limited negative effects in the medium term, given DGC’s competitive export tax rates compared to China. Additionally, tax rates for Japan and the EU—major clients—will drop to 0% in 2026 and 2027, thanks to existing FTAs.

Company leadership reports that semiconductor customers are willing to share some of the increased tax burden, though negotiations with agricultural sector clients remain challenging.

How is Duc Giang Chemical Group Performing in the Market?

DGC shares of Duc Giang Chemicals Group experienced their second consecutive floor-price drop, triggering a wave of investor sell-offs. The sell queue reached approximately 12 million shares, with no buyers in sight, reflecting investor anxiety despite the company’s fundamentally strong financial performance.

What’s Happening with Đức Giang Chemicals?

DGC, once hailed as the shining star of the chemical sector, has left investors baffled with its sudden plunge during today’s session, raising significant questions about its future trajectory.