Looking ahead to 2025, the market has shown several positive liquidity signals, yet the year-end is closing with a somewhat volatile state. From your perspective, what is the most critical characteristic of this year’s market in terms of capital flow and investor behavior?

Dr. Ho Sy Hoa: Judging solely by the index, 2025 could be considered a recovery year. However, the more notable aspect is the clear return of capital. The average daily trading value across the market reached approximately VND 27 trillion per session, a 40% increase compared to 2024, with liquidity peaking at VND 70–80 trillion at certain times.

2025 can be divided into three phases. The first phase saw a slight rise in the VN-Index before the tariff period, followed by a strong upward trend post-tariffs from April to September. The third phase witnessed significant divergence among sectors and stocks. Alongside the surge in trading value, this indicates renewed investor interest, albeit with a cautious approach.

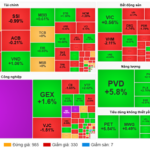

The market’s recovery has been uneven, with capital heavily concentrated in specific sectors and stocks, while others remain sluggish. This is not an easy growth cycle but a period of both upward movement and intense filtering.

Dr. Ho Sy Hoa, Director of Research & Investment Advisory at DNSE

|

What macroeconomic factors have most significantly influenced the market in 2025, leading to increasing divergence?

Dr. Ho Sy Hoa: 2025 has been influenced by multiple macroeconomic factors, most notably exchange rates and interest rates. Starting around April 2025, during the tariff period, the U.S. Dollar Index (DXY) trended downward, yet the USD/VND exchange rate continued to rise. Notably, the free-market exchange rate depreciated by approximately 7% compared to the beginning of the year.

This was primarily due to: a significant gap between domestic and global gold prices; insufficient foreign exchange supply despite Vietnam’s trade surplus; increased profit repatriation by FDI enterprises; and a tendency to hoard USD abroad due to attractive USD interest rates.

These factors heightened tensions in the foreign exchange market, negatively impacting investor sentiment and making foreign capital more cautious. However, Vietnam remains attractive in the long term, with positive economic growth and controlled inflation.

Toward the end of 2025, liquidity pressures emerged, affecting system-wide interest rates. The interbank interest rate (1-week term) remained high at around 7.5%, primarily due to slow deposit growth and rapid credit expansion, which strained system liquidity and directly impacted interbank rates, deposit rates, and lending rates.

Interest rates are highly sensitive in financial markets, significantly influencing investor sentiment.

Given this foundation, do you see 2026 as a “new phase” for the market or merely a continuation of the current accumulation phase?

Dr. Ho Sy Hoa: I believe 2026 will be more of a pivotal year, with a clear breakout trend yet to materialize. Under the baseline scenario, if foreign capital inflows are positive, the VN-Index could range between 1,816 and 2,040 points, based on a 17–18% profit growth for the market. However, the focus should not be on the index but on the market’s dynamics, which depend heavily on foreign investors and macroeconomic conditions in 2026.

2026 will be shaped by two opposing forces: rising interest rate pressures and the expectation of Vietnam’s market upgrade. The interplay of these factors will determine the market’s rhythm and structure throughout the year.

Between these two factors, can the market upgrade opportunity drive the 2026 market trend?

Dr. Ho Sy Hoa: Rising interest rates are always unfavorable for the stock market, especially in the short term. Current forecasts suggest deposit rates could increase by 50 basis points in 2026 if deposit growth continues to lag credit growth. This will impact lending rates, increase capital costs, and pressure corporate profit margins, affecting the stock market.

However, the impact of interest rates varies. Companies with healthy financial structures and stable cash flows will be less affected than those with high leverage. Thus, rising rates will not only pose a general risk but also increase market divergence.

While interest rates create short-term pressure, market upgrades are a medium to long-term story. Upgrades have significant structural implications, potentially attracting long-term capital from index-tracking funds and global investors.

However, upgrades do not immediately create short-term waves. Their impact typically unfolds in stages, from expectation and preparation to actual capital inflows. Therefore, the effects of upgrades should be viewed in a broader context rather than expecting immediate changes.

Given these opposing forces, how should investors approach the market and manage risks in 2026?

Dr. Ho Sy Hoa: 2026 will be a challenging investment year. Investors should base their strategies on macroeconomic analysis, institutional factors, foreign capital inflow timing, and selecting companies aligned with specific macroeconomic scenarios.

Divergence will be a key feature, and success will favor those who understand their position in the cycle rather than focusing solely on short-term index fluctuations.

Macroeconomic analysis, market opportunities, and potential sectors for 2026 will be discussed in DNSE’s upcoming livestream on December 29th

|

|

DNSE Securities will host a special livestream, “2026 Investment Outlook – Balance and Opportunities,” at 3 PM on December 29, 2025, broadcast on their Fanpage and YouTube channel. The event features top experts: Mr. Nguyen Tuan Anh, Founder of FinPeace; Mr. Nguyen Thanh Trung, Founder & CEO of FinSuccess; and Dr. Ho Sy Hoa, Director of Research & Investment Advisory at DNSE. They will provide comprehensive insights, market forecasts, and highlight potential sectors for 2026. Investors can submit questions or topics of interest for expert analysis during the livestream here |

– 06:58 19/12/2025

VN-Index Poised to Surpass Previous Peak in 2024, Bullish Scenario Targets 2,188 Points

The ABS analytics team asserts that the overall market is currently in a long-term uptrend spanning multiple years.

Market Pulse December 17: Selling Pressure Persists, VN-Index Remains in the Red

At the close of trading, the VN-Index fell by 5.52 points (-0.33%), settling at 1,673.66 points, while the HNX-Index dropped by 1.96 points (-0.77%), closing at 253.12 points. Market breadth tilted toward the red, with 400 decliners outpacing 284 advancers. Similarly, the VN30 basket saw red dominate, with 21 losers, 6 gainers, and 3 unchanged stocks.

Vietnamese Stocks Surge to Become Asia’s Top Performer After 100-Point Plunge

The excitement among investors is palpable, as the vibrant energy has returned to social media platforms, forums, and stock market groups. The buzz is undeniable, with enthusiasts eagerly sharing insights and strategies, reigniting the passion for the financial markets.