The most glaring warning sign comes from within Samsung itself. According to industry insiders, the South Korean conglomerate’s memory chip division has terminated long-term supply contracts with preferential pricing for Samsung Mobile, opting instead for market-based quarterly pricing adjustments.

This move has left even Samsung’s smartphone division in a precarious position. Sources reveal that TM Roh, head of Samsung Mobile, is urgently seeking meetings with Micron’s CEO to secure DRAM supplies for the Galaxy S26 series, aiming to avoid being price-gouged by its own parent company.

In this context, Apple, Samsung’s chief rival in the premium smartphone market, cannot remain unaffected. The Cupertino giant heavily relies on Samsung and SK hynix for DRAM supplies in its iPhones, iPads, and Macs. The issue lies in the expiration of long-term supply agreements (LTAs) with preferential pricing, reportedly ending in January 2026. With the two largest memory manufacturers poised to adjust prices, Apple has little choice but to absorb higher input costs.

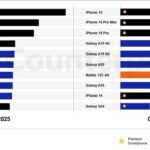

Analysts suggest Apple faces three options: reduce product specifications (unlikely for flagship models), accept lower profit margins (unappealing to shareholders), or pass the increased costs to consumers. The third option appears the most feasible.

While Apple has not officially confirmed, market data strongly indicates that the 2026 iPhone lineup, likely the iPhone 18 series, will debut at higher starting prices. The 2026 retail price war has effectively begun, playing out in component negotiations.

The situation is exacerbated by surging DRAM demand from AI and data centers, coupled with tightening supply. Rumors suggest Samsung may prioritize higher-margin memory lines, limiting internal mobile division supplies. Experts advise consumers to purchase electronics now to avoid higher future prices.

If Apple acquiesces to new DRAM pricing, multiple 2026–2027 products could be impacted, including the iPhone 18, foldable iPhone, MacBook Air M5, affordable MacBook, and OLED-equipped MacBook Pro M6. Price hikes may extend across Apple’s ecosystem.

Apple retains two significant advantages: substantial cash reserves to offset short-term cost increases, and its technology self-sufficiency strategy. In-house A-series SoC and 5G modem designs yield considerable savings. For instance, the iPhone 16e’s C1 modem reportedly saves Apple $10 per unit—a substantial sum when scaled across millions of devices. The upcoming C2 modem is expected to further strengthen this advantage.

However, even with its financial and technological prowess, Apple cannot entirely escape the global component price surge. Sources indicate that consumers planning iPhone upgrades in 2026 should brace for potential price increases, possibly as early as the first half of the year. As the DRAM crisis persists, affordable iPhone pricing may become a relic of the past.

iPhone 18 Leaks Reveal Revolutionary Under-Display Face ID Technology

Dreaming of an iPhone with a flawless, edge-to-edge display that leaves no room for imperfections? That vision is closer than ever to becoming a reality.