According to the General Department of Customs, in November 2025, Vietnam exported over 18,000 tons of pepper, valued at $118 million, marking an increase compared to the same period in 2024.

In the first 11 months of 2025, Vietnam’s pepper exports reached 223,000 tons, worth $1.51 billion, reflecting a 5% decrease in volume but a 24.1% increase in value compared to the same period in 2024. This has surpassed the record of $1.31 billion set in 2024 and exceeded the earlier forecast of $1.5 billion for 2025.

Industry experts predict that pepper exports in 2025 will set a new record. With stable export momentum in the final month, the total export value for 2025 is expected to reach nearly $1.6 billion, the highest ever recorded.

Over the first 11 months of 2025, the average export price of pepper stood at $6,764 per ton, a significant 30.6% increase compared to the same period in 2024.

Many businesses attribute the success of the pepper industry not only to rising global prices but also to their efforts in deep processing. Vietnam remains the world’s largest pepper exporter, playing a crucial role in balancing supply and demand and influencing international price levels.

The trend of “decreased volume but increased value” clearly reflects Vietnam’s strategic shift in the pepper industry. Instead of relying on raw pepper exports, companies have focused on deep processing, enhancing product quality, and adding value, thereby strengthening Vietnam’s position in the global market amid ongoing fluctuations.

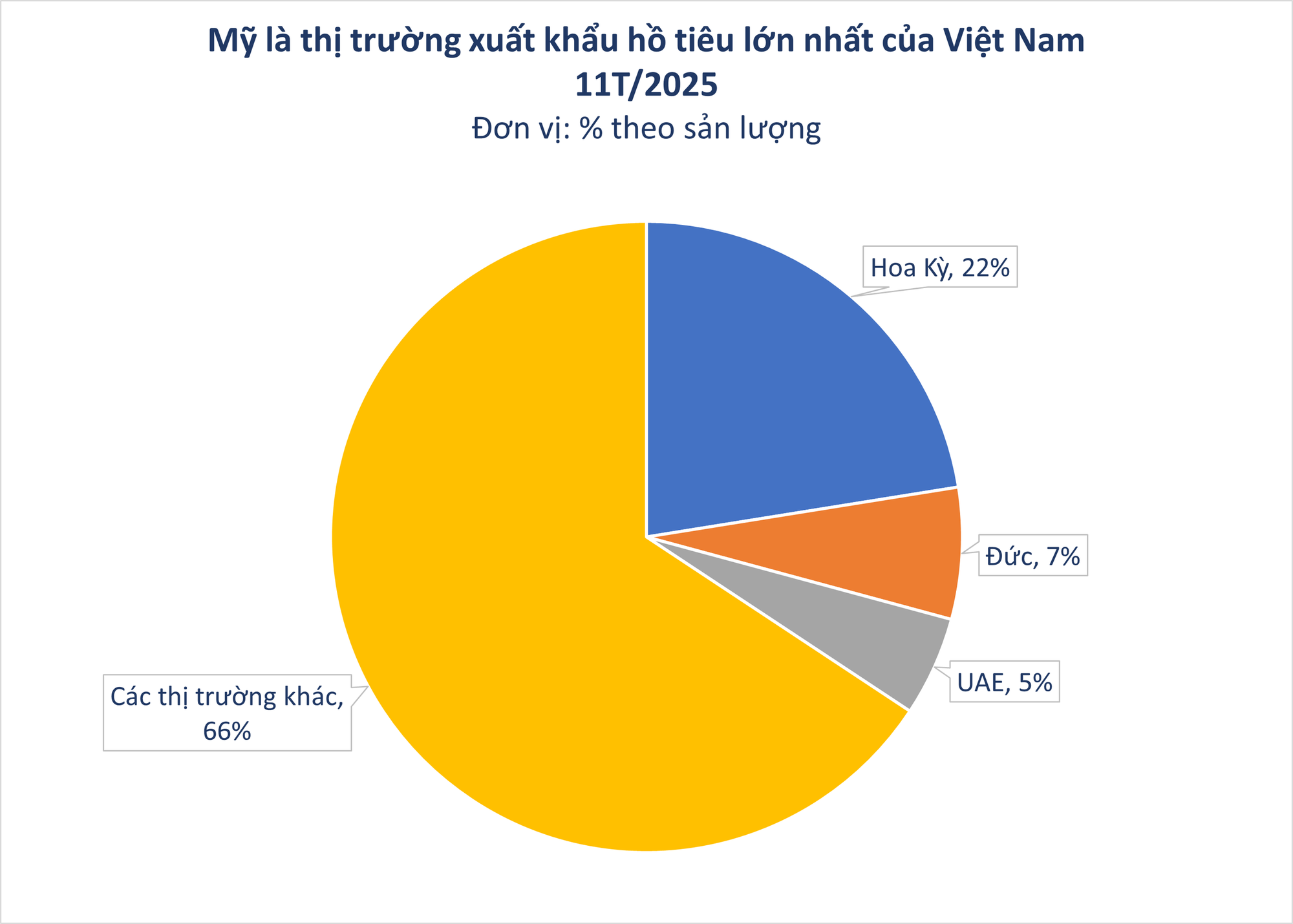

In the first 11 months of 2025, the United States led as the top export market with 50,000 tons, valued at $373 million, representing a 28% decrease in volume and a 1% decrease in value compared to the same period in 2024. Exports to Germany, the second-largest market, decreased by 0.5% in volume but increased by 34.4% in value. The UAE ranked as the third-largest market, accounting for 5% of the market share.

Amidst a volatile landscape, India has emerged as a significant bright spot for Vietnamese pepper. The demand for pepper in India continues to rise rapidly due to its large population, improved income levels, and the expansion of the food processing and hospitality sectors. Vietnam’s opportunity in India is further amplified by the country’s projected 20% decline in domestic production due to adverse weather conditions, compelling importers to increase purchases from abroad. With its abundant supply, consistent quality, and advanced processing capabilities, Vietnam is well-positioned to capitalize on this opportunity and expand its market share.

Experts note that current price fluctuations are driven not only by seasonal factors but also by exchange rates, logistics costs, and climate impacts on production. While short-term prices may decline, the medium to long-term outlook remains positive, with prices expected to stay high due to ongoing climate risks and crop diseases that are not yet effectively managed.

Vietnamese Product Sweeps the U.S. Market: Dominating Competitors’ Combined Share Amid Global Scarcity

By the end of the ninth month, exports of this product had surpassed the total for the entire year of 2024.

The Ultimate Black Gold: Vietnam’s Premium Export that has America and Over 100 Countries Hooked.

“Vietnam is currently the largest supplier to the US market, accounting for 64.4% of total imports of these products into the US. This dominance in the US market showcases Vietnam’s prowess in manufacturing and exporting these goods, solidifying its position as a key player in the global trade landscape.”

Vietnamese Pepper Exports Reach the Billion-Dollar Mark

While global pepper prices plummeted, Vietnam’s “black gold” continued its upward trajectory. With favorable export prices, Vietnamese pepper has hit the remarkable milestone of reaching a billion dollars in value.