The final phase of 2022-2023 marked a significant turning point for Vietnam’s corporate bond market, as a series of payment defaults, particularly in the real estate sector, shook investor confidence. Entering the 2024-2025 period, the market has shown signs of recovery, though growth is no longer as rapid as before. Instead, issuance activity has become more selective, with lower risk appetite and higher demands for issuer quality.

The 2025 corporate bond market shows promising signs of recovery.

According to FiinGroup’s October 2025 Corporate Bond Market Report, the final months of 2025 have seen positive improvements in liquidity, with market structure shifting toward greater stability and sustainability. However, this recovery is uneven, accompanied by a rigorous screening process. Only companies with strong financial capabilities, clear cash flows, and transparent debt repayment plans are able to access capital through bond issuance.

Investors Return with Greater Caution

One of the most notable changes in the current bond market is the shift in investor behavior. During the 2020-2021 period, many investors were willing to accept higher risks for attractive interest rates. Today, safety and repayment capacity are top priorities.

Criteria such as a history of timely payments, stable cash-generating business models, transparency in information disclosure, and issuer reputation have become critical filters in decision-making. This reflects a fundamental shift in market approach, as investors prioritize capital preservation and long-term sustainability over short-term yields.

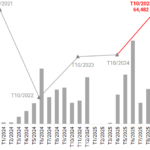

The Vietnam Bond Market Association’s (VBMA) Q3/2025 report indicates that while private placements still dominate issuance value, public offerings are seeing significant growth in both issuance volume and capital raised. This trend highlights companies’ increasing focus on transparency, legal compliance, and broader investor reach, amid a tighter regulatory environment compared to previous periods.

Proportion of private and public bond issuances in recent years, according to VBMA’s Q3/2025 report.

Notably, the market is moving toward a more balanced dynamic between private and public bond issuances. While private placements previously dominated, primarily serving professional investors, public offerings are regaining attention due to stricter legal requirements, higher transparency, and wider accessibility to individual investors. However, this return is marked by caution, with a clear “choose wisely” mindset.

Bonds with Strong Payment Histories Attract Capital

Amid lingering market risks, companies maintaining a flawless payment history, even during the most challenging periods, are becoming preferred choices for investment. Upholding financial discipline during market volatility is seen as a critical test, reflecting a company’s risk management capabilities and economic resilience.

Capital is increasingly flowing to sectors outside real estate, particularly consumer finance and alternative financial services, which offer faster cash cycles and less dependence on long asset market cycles, reducing short- and medium-term liquidity pressures. F88 is a notable example, launching its first public bond offering after years of private placements. The company plans to issue 10 million bonds with a face value of VND 100,000 each, totaling VND 1,000 billion, in three tranches during 2026, starting January 10, 2026.

F88 launches its first public bond offering.

F88’s bonds are attracting attention not only for their fixed 10% annual interest rate, higher than market averages, but also for the company’s consistent payment history. Since 2019, F88 has issued nearly VND 5,300 billion in private bonds and redeemed almost VND 4,500 billion at maturity, maintaining a 100% repayment rate. Even in 2023, amid macroeconomic challenges and a nationwide corporate bond crisis, F88 fulfilled all interest payment obligations for outstanding bonds.

As the market recovers, corporate bonds are no longer just about high yields but about evaluating issuers’ financial strength and credibility. Investor caution post-crisis is forcing market self-selection, directing capital toward companies with clear cash flows, transparent information, and reliable repayment records. In the long term, this defensive approach will contribute to a more stable foundation for the corporate bond market, replacing the risky high-growth cycles of the past.

What Type of Bonds Are Most Sought After by Investors?

The resurgence of the corporate bond market post-crisis has been marked by heightened caution. With confidence hanging in the balance, investors are scrutinizing bonds for robust financial fundamentals. What constitutes a solid financial foundation in their eyes?

Real Estate Sector Attracts Trillions of Dong from Bonds in October

Real estate businesses secured a staggering VND 33 trillion through private bond issuances in October 2025, marking the highest monthly total ever recorded.