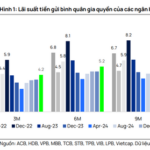

On December 18th, several banks further increased their deposit interest rates. Notably, BIDV adjusted its rates twice within a single week. In their latest deposit rate schedule, BIDV raised rates by 0.3 percentage points across multiple terms, with the highest rate reaching 5.3% per annum for long-term deposits of 36 months.

The market has also seen several banks offering savings rates exceeding 7% per annum. Ms. Khanh Minh (Ho Chi Minh City) expressed surprise when she deposited savings at Cake by VPBank with a listed rate of 6.9% per annum for a 6-month term, plus an additional 0.6 percentage points from a promotional program.

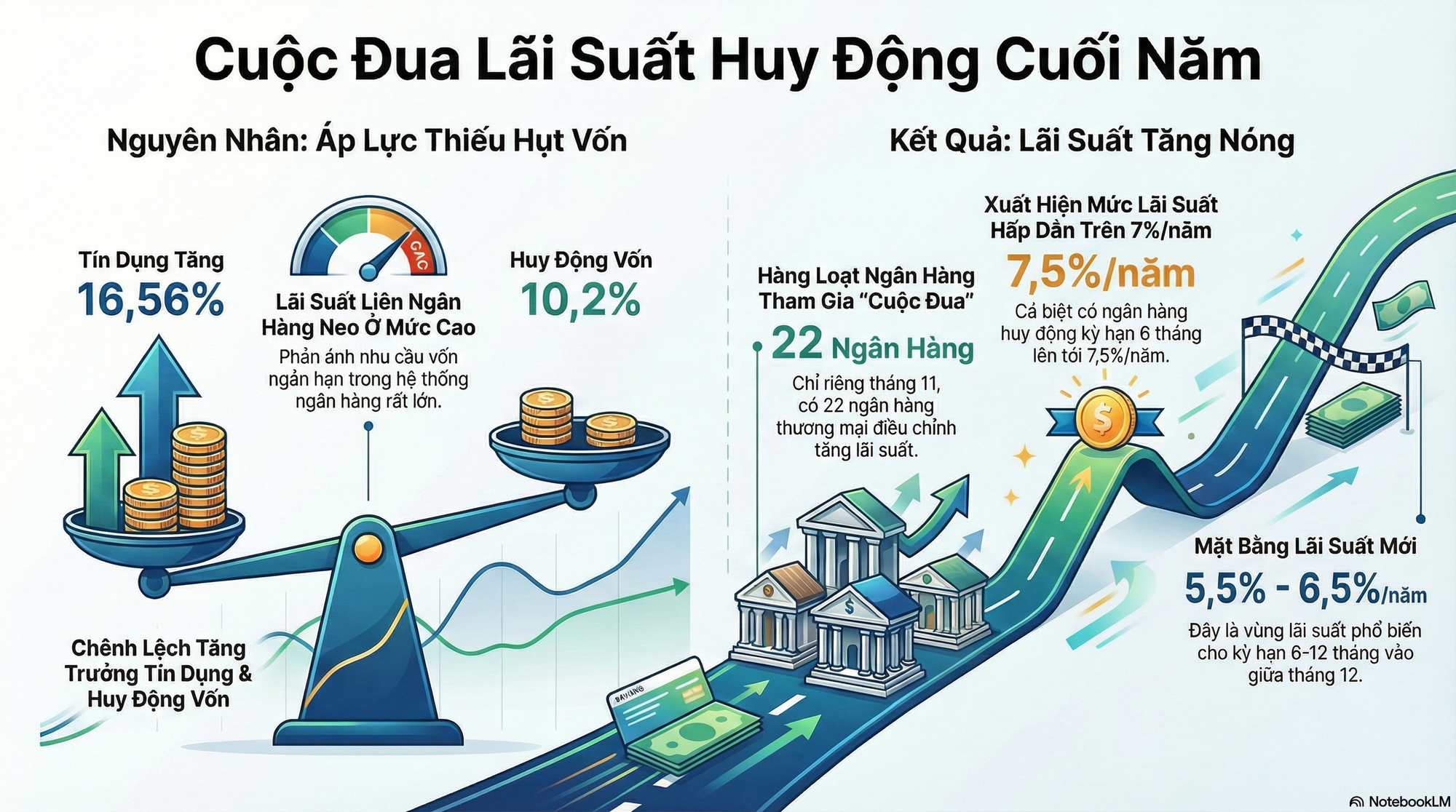

“In total, the interest rate reached 7.5% per annum for a 6-month term, significantly higher than before,” said Ms. Minh.

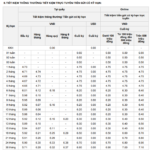

Statistics from the Vietnam Banks Association (VNBA) reveal that in November 2025 alone, 22 commercial banks increased their deposit rates, with common increases ranging from 0.1 to 0.3 percentage points. Major banks raised rates for 6- to 12-month terms to 4.8-5.2% per annum to attract capital for the year-end credit peak.

Mr. Nguyen The Minh, Director of Analysis at Yuanta Securities Vietnam, noted that by mid-December 2025, an additional 15 commercial banks had increased their deposit rates. Currently, deposit rates for 6- to 12-month terms have reached 5.5-6.5% per annum, and this trend is expected to continue for the next few weeks.

According to the State Bank of Vietnam’s report, by the end of November, credit growth was 16.56% compared to the end of last year, while capital mobilization growth was only around 9.6-10.2%. Mr. Minh attributed this imbalance to a temporary shortage of capital in the short term, prompting banks to raise deposit rates.

Graphic: AI – V.Vinh

Additionally, in the interbank market, liquidity pressures remain significant, with interest rates staying high. The overnight VND interest rate has cooled but remains elevated at 5.26%; one-week and two-week rates fluctuate between 5.84% and 6.4%; and the one-month rate stands at a high of 7.42%.

This situation reflects the banking system’s continued high demand for short-term capital, particularly as the gap between credit and deposit growth widens.

Experts predict that in the coming weeks, the State Bank of Vietnam is likely to maintain net injection activities to support liquidity amid rising year-end capital demand. Interbank interest rates may remain stable until the end of December before gradually cooling from early 2026.

Why Are the Big 4 Banks Suddenly Hiking Deposit Interest Rates?

In the final month of the year, competitive deposit interest rates have spread beyond joint-stock commercial banks, with state-owned banks now joining the fray. Experts suggest that these elevated rates primarily reflect short-term liquidity pressures in the market rather than signaling a shift in monetary policy. However, concerns about potential risks remain.