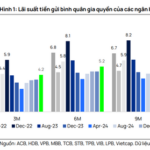

In mid-December 2025, the deposit market witnessed a wave of interest rate hikes across numerous commercial banks. Increased liquidity pressure, coupled with credit growth outpacing deposit mobilization, compelled banks to aggressively attract deposits from individuals to balance their capital.

Long-Term Deposit Incentives

On December 18, the Bank for Investment and Development of Vietnam (BIDV) announced another upward revision to its deposit interest rates. Notably, within just one week, BIDV adjusted its rates twice. According to the latest schedule, interest rates for various terms increased by 0.3 percentage points, with the highest rate reaching 5.3% per annum for deposits of 36 months or more.

Not limited to state-owned banks, an increasing number of private commercial banks are offering savings rates exceeding 7% per annum. Ms. Le Khanh Minh (Ho Chi Minh City) expressed surprise at the 6.9% per annum rate for a 6-month term deposit at Cake by VPBank, plus an additional 0.6 percentage points from a promotional program. “My total interest rate reached 7.5% per annum for a 6-month term, significantly higher than before,” she compared.

At another commercial bank, Mrs. Tran Thi Diem was advised by a bank employee to switch her 1-month term deposit to a longer term to enjoy higher interest rates. “You can switch your 1-month deposit to a 6-month term to earn 6.9% per annum,” the employee suggested when Mrs. Diem came to renew her deposit on December 17.

According to Mrs. Diem, for several months, she had deposited 500 million VND at this bank with a 1-month term at a 4.6% per annum rate. Recently, the bank increased the deposit rate for 1-5 month terms to 4.75% per annum. “When offered a 6.9% per annum rate for a 6-month term and 7.1% per annum for a 12-month term, I decided to switch to a 6-month deposit for a higher interest rate,” she explained.

At P. Bank (headquartered in Ho Chi Minh City), customers were also advised to deposit with competitive interest rates: 4.75% per annum for 1 month, 7.25% per annum for 6 months, and up to 7.4% per annum for over 12 months. Meanwhile, a bank headquartered in Hanoi actively encouraged customers to switch from 1-3 month terms to 6 or 12 months with rates up to 7.9% per annum…

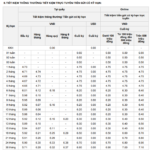

Statistics from the Vietnam Banks Association (VNBA) show that in November 2025 alone, 22 commercial banks increased their deposit rates, with common increases of 0.1-0.3 percentage points. Some major banks raised rates for 6-12 month terms to 4.8%-5.2% per annum to prepare capital for the year-end credit peak.

Since early December 2025, the trend of rising deposit rates has continued to spread. Some banks are offering the highest rates in the market, such as Vikki Bank with 6.5%-6.7% per annum for 6-13 month terms, and Bac A Bank with 6.2%-6.7% per annum for long terms. Meanwhile, state-owned banks (Agribank, BIDV, Vietcombank, VietinBank) primarily increased rates for short terms, maintaining long-term rates around 5% per annum.

Deposit interest rates at many banks have surpassed 6% per annum. Photo: DUY PHÚ

Will Deposit Rates Continue to Rise?

Mr. Nguyen The Minh, Director of Analysis at Yuanta Vietnam Securities, reported that by mid-December 2025, approximately 15 more commercial banks had increased their deposit rates. The interest rate floor for 6-12 month terms has risen to 5.5%-6.5% per annum, and this trend may persist for several more weeks.

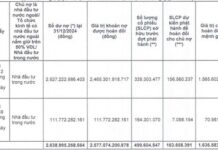

According to the State Bank’s report, by the end of November 2025, system-wide credit grew by 16.56% compared to the previous year-end, while deposit mobilization growth reached only about 9.6%-10.2%. Mr. Minh noted that this disparity led to a temporary capital imbalance in the short term, forcing banks to raise deposit rates to compensate.

In the interbank market, the overnight VND interest rate, though cooled, remains around 5.26% per annum, with 1-week and 2-week rates fluctuating between 5.84%-6.4% per annum, and the 1-month rate reaching 7.42% per annum. This reflects the banking system’s high demand for short-term capital, especially as the gap between credit growth and deposit mobilization widens.

A bank CEO in Ho Chi Minh City revealed that the system’s outstanding loans currently exceed deposits by about 5%. Meanwhile, year-end loan demand is surging, and individuals tend to withdraw funds for year-end spending, intensifying liquidity pressure. “This compels many banks to raise deposit rates to attract capital and balance cash flow,” he commented.

Bank leaders noted that short-term lending rates in the interbank market have surpassed 7% per annum, but borrowing is not always feasible due to tightened limits or sudden suspension of disbursements. Consequently, many banks are increasing both short-term and long-term deposit rates to proactively source capital from individuals.

Additionally, the use of short-term funds for medium and long-term lending this year has been substantial, pushing this ratio close to the State Bank’s 30% threshold. To ease compliance pressure, banks are raising short-term rates to attract more short-term capital into the system.

Regarding the overall picture, Mr. Nguyen Quoc Hung, Vice Chairman of the Vietnam Banks Association, attributed this year’s credit growth to accelerated public investment disbursement. The Government, Prime Minister, and ministries, sectors, and localities have issued strong directives, helping many projects achieve high disbursement rates.

Furthermore, production and business activities in industries such as manufacturing, construction materials, consumer goods, and small and medium-sized enterprises show signs of recovery, driving increased credit demand. Despite global trade pressures, agriculture, forestry, fisheries, and processing industries remain crucial to economic growth, further boosting loan demand.

Mr. Hung observed that year-end loan demand typically rises, prompting some banks to increase deposit rates by 0.5-1 percentage points. Lending rates may subsequently face upward pressure, but banks need to restructure portfolios and selectively lend to mitigate risks.

Credit Growth May Reach 20%

According to Mr. Nguyen Quoc Hung, by early December 2025, system-wide credit growth had surpassed 16%, exceeding initial targets. The Vice Chairman of the Vietnam Banks Association forecasts that by year-end, industry-wide credit growth could reach 19%-20%. However, the State Bank will base its policies on actual developments to flexibly manage both economic growth support and system liquidity and safety.

Small Businesses to Resume Bank Deposits as They Adapt to New Regulations

Vietcap believes that the current pressure to raise deposit interest rates remains manageable, and the absolute interest rate levels generally continue to provide support. In the medium term, system liquidity and capital sources are expected to be sustained by four key factors.

Why Are the Big 4 Banks Suddenly Hiking Deposit Interest Rates?

In the final month of the year, competitive deposit interest rates have spread beyond joint-stock commercial banks, with state-owned banks now joining the fray. Experts suggest that these elevated rates primarily reflect short-term liquidity pressures in the market rather than signaling a shift in monetary policy. However, concerns about potential risks remain.

Small Businesses to Resume Bank Deposits as They Adapt to New Regulations

Vietcap believes that the current pressure to increase deposit interest rates remains manageable, and the absolute interest rate levels generally continue to provide supportive conditions. In the medium term, system liquidity and capital sources are expected to be sustained by four key factors.