POR19 marks an unprecedented development.

On June 7, 2025, the U.S. Department of Commerce (DOC) released its preliminary findings for POR19, unveiling a shocking tax rate. While Thong Thuan Company was found not to be dumping, Stapimex and 22 other companies—including FMC—faced a staggering preliminary tax rate of 35.29%. This calculation method sharply deviated from previous reviews, which typically relied on the average rate of the two mandatory respondents.

The Vietnam Association of Seafood Exporters and Producers (VASEP) described this as the most unexpected development in nearly 20 years of anti-dumping tax reviews. According to VASEP, no Vietnamese company has ever faced a two-digit preliminary tax rate, raising concerns about potential calculation errors, similar to those seen in POR12.

“If this preliminary rate is finalized, Vietnamese shrimp will lose nearly all competitiveness in the U.S. market,” stated VASEP General Secretary Nguyen Hoai Nam at the 2025 Vietnam-U.S. Trade Forum in Ho Chi Minh City.

However, the final decision remains pending. According to the latest schedule, the DOC will announce the official POR19 conclusion on February 16, 2026, instead of late 2025 as previously expected. This delay is primarily due to an extended U.S. government shutdown, which disrupted the DOC’s workflow.

“This is an unprecedented situation, according to legal experts,” shared Mr. Ho Quoc Luc, Chairman of Sao Ta Food (HOSE: FMC). He noted that this anomaly makes it challenging to predict the final tax rate for companies not directly investigated, as there are no comparable precedents.

According to the legal firm advising on the case, both mandatory respondents may face challenges in submitting their documentation, potentially leading to a nationwide tax rate (around 25%—a punitive rate typically applied when documentation is rejected). If only one respondent faces this issue, the remaining companies will be taxed based on the other respondent’s rate. “Thus, the likelihood of these companies facing excessively high rates is low,” Mr. Luc explained.

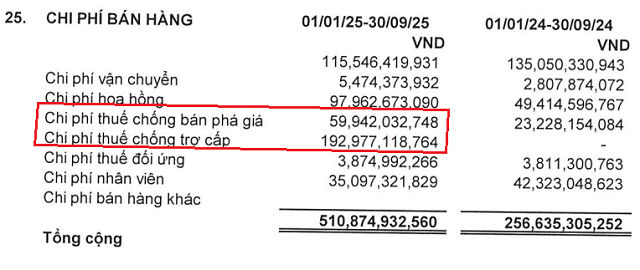

Nevertheless, the immediate impact on business results is unavoidable. In the first nine months of the year, FMC recorded nearly 100 billion VND in anti-dumping taxes, double the previous year. Countervailing duties also surged, driving up selling costs and shrinking profits, despite double-digit growth in both volume and export value.

In response, FMC has proactively adjusted its U.S. export strategy for 2024-2025. The company accelerated deliveries and increased its presence in the U.S. market, not only to maintain orders but also to qualify as a mandatory respondent in the next administrative review (POR20).

Becoming a mandatory respondent ensures that the company’s documentation is directly reviewed by the DOC, rather than being subject to the average rate applied to voluntary respondents. This is a critical step, should the POR19 outcome not align with positive expectations.

FMC’s tax expenses surged by hundreds of billions of VND in the first nine months of 2025. Source: FMC’s Q3/2025 financial report.

|

Final tax rate may not exceed 5%

The POR19 developments coincide with the shrimp industry’s most challenging period in over a decade. Combined with countervailing duties (20%) and anti-subsidy taxes (2.48%), the total tax burden could reach nearly 60%, described by VASEP’s General Secretary as “extremely devastating.”

Despite this, FMC’s leadership sees silver linings. The U.S. imposing high taxes on Indian shrimp—a major supplier to the U.S. market—could create opportunities for other exporters, including Vietnam. “With reduced supply from India, the DOC will struggle to prevent shrimp from other countries from filling the gap,” Mr. Luc analyzed.

From this perspective, FMC’s Chairman believes the final POR19 tax rate will likely be significantly lower than the preliminary figure, possibly even in the single digits. “I believe the final tax rate for Vietnamese shrimp in POR19 will not exceed 10%, or even 5%,” he predicted, emphasizing that the U.S. will remain a top market for Vietnam’s shrimp industry and FMC.

While awaiting the final decision, many companies have adjusted their export strategies, temporarily limiting high-tax products and shifting focus to value-added shrimp. As a result, seafood exports continued to grow. By the end of November, shrimp exports surpassed $4.3 billion, up 21%, reaching an all-time high and pushing total seafood exports to $10.5 billion.

Mr. Ho Quoc Luc predicts a positive outcome for the POR19 review. Photo: PAN Group.

|

2026 growth may fall below double digits

Following 11 positive months, VASEP forecasts that 2025 seafood exports could set a new record at around $11.2–11.3 billion, with double-digit growth compared to the previous year. Mr. Luc considers this an “unexpected achievement,” but notes that 2026 prospects remain uncertain.

According to FMC’s leadership, next year’s outlook hinges on two key factors: consumption in major markets and domestic shrimp supply.

Global shrimp inventories are currently low, sustaining consistent demand, even in the U.S. However, the strength of early 2026 orders will depend on year-end consumption trends in the U.S., Japan, and China—markets directly influencing Vietnamese exporters.

External competition is also intensifying as countries like India seek alternative export markets. Nonetheless, FMC’s Chairman highlights Vietnam’s advantage in value-added products, an area where competitors struggle to keep pace in the short term.

Meanwhile, supply remains a wildcard. Domestic shrimp farming continues to face persistent diseases, keeping raw material costs high. Some companies have resorted to importing semi-finished products to maintain production, but this is only a temporary solution.

A view of FMC’s shrimp farms. Photo: FMC.

|

Given these factors, he anticipates industry growth in 2026 to fall below double digits.

This cautious outlook aligns with analysts’ projections. Bao Viet Securities (BVSC) estimates FMC’s 2026 revenue to remain stable compared to 2025, with profit improvements contingent on reduced U.S. tax pressures and lower input costs.

Amidst uncertainties, Mr. Luc is developing multi-scenario plans. “If POR19 turns favorable, Vietnamese shrimp could quickly re-enter the U.S. market. If not, we remain hopeful for positive outcomes in subsequent reviews,” he stated.

VASEP: Shocked by 35% Anti-Dumping Tax on Vietnamese Shrimp from the U.S.

2025 Shrimp Exports Set New Record

– 10:01 19/12/2025

Vietnam’s Exports to the U.S. Hit an All-Time High

In the first 10 months of the year, Vietnam’s exports to the United States have already surpassed the total for the entirety of 2024.

Unveiling the Majestic 2.14-Hectare “Super” Project East of Hoan Kiem Lake, Set to Break Ground in October

Discover the breathtaking beauty of the East Square of Hoan Kiem Lake through stunning conceptual images. Immerse yourself in the harmonious blend of modern design and timeless charm, where every detail tells a story of elegance and innovation. Explore the envisioned masterpiece that promises to redefine the heart of Hanoi.