HD Securities (HDS) is experiencing significant leadership changes as three major shareholders simultaneously divest their stakes. Notably, the identities of the new shareholders remain undisclosed.

Specifically, Vina Dai Phuoc JSC reported the transfer of its entire 16.5 million shares, equivalent to 11.3% of HDS’s charter capital, on December 18, 2025. As a result, the company no longer holds any shares in HDS.

Interestingly, Vina Dai Phuoc only became a major shareholder of HD Securities on October 20, 2025, after acquiring the aforementioned shares from Vietory JSC.

Following the sale of shares to Vina Dai Phuoc, Vietory JSC reduced its ownership from 25.57 million shares (17.5% of capital) to 9.075 million shares (6.2% of capital).

Established in 2007, Vina Dai Phuoc JSC operates in the real estate sector. As of January 2023, the company increased its charter capital to nearly VND 1,654 billion. Currently, the company has two legal representatives: Mr. Vu Hoai (CEO) and Mr. Nguyen Khanh Trung (Chairman of the Board).

The company is the developer of the SwanBay eco-tourism urban area in Nhon Trach District, Dong Nai Province.

As of Q2/2025, DIC Corp (HoSE: DIG) held only 0.1% of Vina Dai Phuoc’s charter capital, equivalent to VND 1.6 billion.

A day earlier, Huynh Phat Investment LLC also divested its entire 25.57 million shares (17.5% of capital) on December 17, 2025, ceasing to be an HDS shareholder.

Huynh Phat Investment became a major HDS shareholder in March 2025 after acquiring shares from Aurora Ocean LLC.

Founded in October 2021 with a charter capital of VND 8 billion, Huynh Phat Investment initially had Mr. Huynh Minh Tan (born 1979) as its legal representative. The company increased its capital to VND 50 billion in October 2024.

After two leadership changes, Mr. Nguyen Hoang Nhat Di (born 1989) became the Director and legal representative in December 2024.

In June 2025, the company raised its charter capital from VND 120 billion to VND 150 billion. Mr. Nguyen Hoang Nhat Di holds 80%, and Tran Minh Quoc holds 20%. At that time, the company had only 2 employees.

The third major shareholder to divest from HD Securities is Dynamic & Development Investment JSC. The company transferred its entire 15.5 million shares (10.61% of capital) on December 16, 2025.

Established in March 2021, Dynamic & Development Investment JSC specializes in debt trading services.

At inception, the company had a charter capital of VND 200 billion, with Flex Financial Investment LLC holding 98% and individuals Pham Huu Hoa and Pham Tien Thanh each holding 1%.

In October 2022, the company increased its capital to VND 948 billion. Currently, Mr. Nguyen Duc Bien serves as CEO and legal representative.

As of October 2025, Dynamic & Development Investment JSC held 22.8% of Sovico Khanh Hoa LLC, equivalent to VND 422.5 billion.

Aside from the three divesting shareholders, as of June 30, 2025, HDS’s other major shareholders include HDBank (30%), Blue Sky Vietnam Investment LLC (13.78%), and Huy Phong Investment & Trading Services LLC (7.99%).

In other developments, HDS shareholders recently approved two capital increase plans via share issuance.

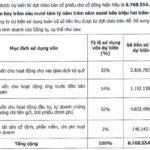

First, HDS will offer 876.85 million shares to existing shareholders at VND 10,000 per share, expected in 2025-2026.

The rights ratio is 1:6, allowing shareholders to purchase 6 new shares for every 1 share held. The rights are transferable once. Shareholders with restricted shares can still exercise their rights. The new shares will be unrestricted, and HDS expects to raise VND 8,768.5 billion.

Second, HDS will issue over 73 million shares as dividends. The ratio is 2:1, with shareholders receiving 1 new share for every 2 held.

The dividend shares will be unrestricted, funded by VND 1,004 billion in undistributed profits from the audited 2024 financial statements.

According to the announced timeline, HDS will implement both issuance plans simultaneously. The submission of offering documents to existing shareholders and dividend share issuance documents will occur concurrently.

The shareholder record date for both the rights offering and dividend share issuance will be the same.

Major Shareholder of HD Securities Divests 10% Stake

HD Securities Corporation (HDS) has announced a significant transaction, transferring over 10% of the charter capital of Dynamic & Development Investment Corporation.

Historic Stock Peak Triggers Mass Exodus: VDP Leaders and Insiders Rush to Offload Holdings

Recently, a wave of sell-off intentions has emerged among key figures at VIDIPHA Pharmaceutical Joint Stock Company (Vidipha, HOSE: VDP), with multiple leaders and their family members registering to offload their entire stake. Adding to this, institutional shareholder Nutri Korea has also signaled plans to divest a significant portion of its holdings.

Securities Firm Re-Enters Capital Raising Game: Boosts Share Issuance to 950 Million, Targeting Nearly VND 11 Trillion in Chartered Capital

Previously, the company announced a resolution to halt the implementation of its plan to offer and sell shares to existing shareholders for the purpose of increasing its chartered capital.