Market liquidity increased compared to the previous session, with the order-matching volume of the VN-Index reaching over 660 million shares, equivalent to a value of more than 20.9 trillion VND; the HNX-Index reached over 57.4 million shares, equivalent to a value of more than 1.02 trillion VND.

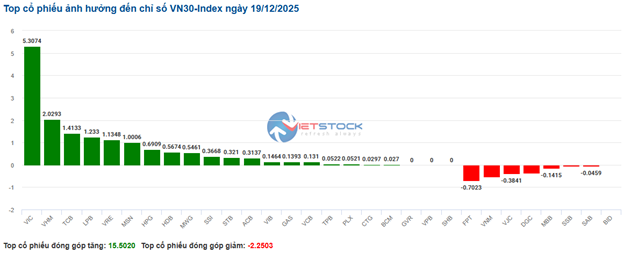

The VN-Index opened the afternoon session with continued tug-of-war dynamics in the first half, but increasing buying pressure helped the index surge and reach 1,705 points before closing. In terms of influence, VHM, VIC, VPL, and VCB were the most positively impactful stocks on the VN-Index, contributing over 16.1 points. Conversely, BID, DGC, GEE, and HVN faced selling pressure, reducing the index by more than 1.5 points.

| Top 10 Stocks Impacting VN-Index on December 19, 2025 (by points) |

Similarly, the HNX-Index showed positive momentum, influenced by stocks like VIF (+6.67%), IDC (+2.2%), SHS (+1.43%), and HHC (+9.6%).

| Top 10 Stocks Impacting HNX-Index on December 19, 2025 (by points) |

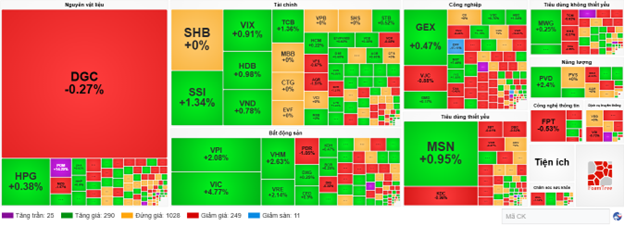

At the close, the market was predominantly green across most sectors. Real estate led the gains with a 3.75% increase, primarily driven by VIC (+4.06%), VHM (+6.95%), VRE (+4.45%), and DXG (+3.19%). Energy and non-essential consumer sectors followed with gains of 2.65% and 2.41%, respectively. Notable performers included BSR (+6.69%), PVD (+1.85%), VTV (+9.92%), PLX (+0.14%), VPL (+5.63%), MWG (+1.59%), FRT (+0.49%), and PNJ (+0.65%).

Conversely, the information technology sector declined by 0.5%, mainly due to FPT (-0.53%), CMG (-0.42%), VEC (-1.55%), and DLG (-2.24%).

Foreign investors turned net buyers with over 521 billion VND on the HOSE, focusing on HPG (344.24 billion), SSI (307.26 billion), BSR (154.6 billion), and VIX (150.56 billion). On the HNX, they net bought over 30 billion VND, concentrating on IDC (23.59 billion), SHS (14.31 billion), HUT (11.25 billion), and VFS (2.53 billion).

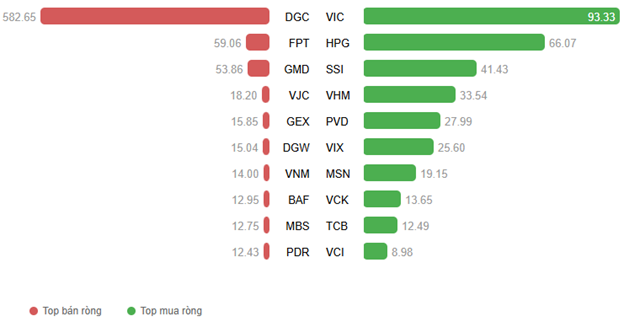

| Foreign Net Buying/Selling Trends |

Morning Session: Sustained Gains

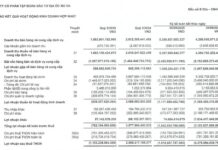

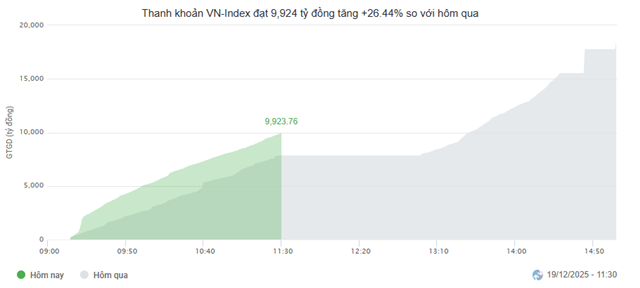

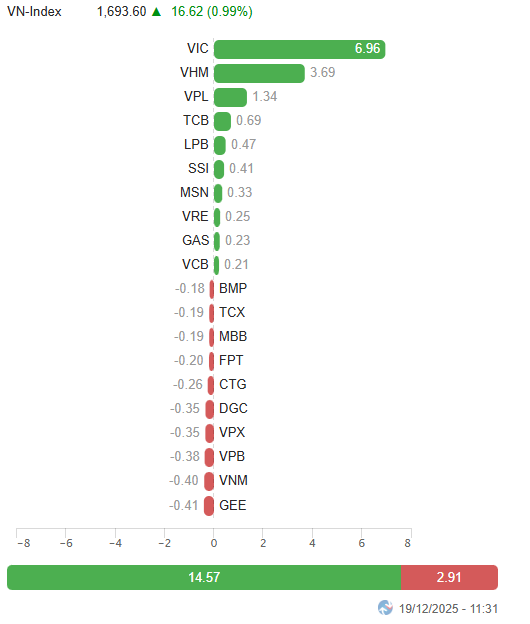

Leading stocks continued to drive market gains in the final morning session. At the midday break, the VN-Index rose over 16 points (+0.99%) to 1,693.6 points, while the HNX-Index increased by 0.34% to 254.08 points. Market breadth was balanced, with 343 decliners and 299 advancers.

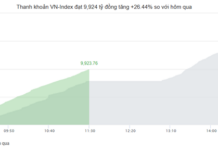

Market liquidity showed signs of improvement compared to the previous session. HOSE trading value reached over 9.9 trillion VND, up 26.44% from the same period yesterday, largely due to a surge in DGC trading, with over 31 million shares changing hands in just half a day. Similarly, HNX trading volume also rose significantly, with over 37 million units traded, equivalent to over 616 billion VND.

Source: VietstockFinance

|

In terms of influence, the top 10 positively impacting stocks contributed a total of 14.57 points to the VN-Index, with VIC alone adding nearly 7 points. Conversely, GEE, VNM, and VPB exerted the most downward pressure, reducing the index by a combined 1.2 points.

Source: VietstockFinance

|

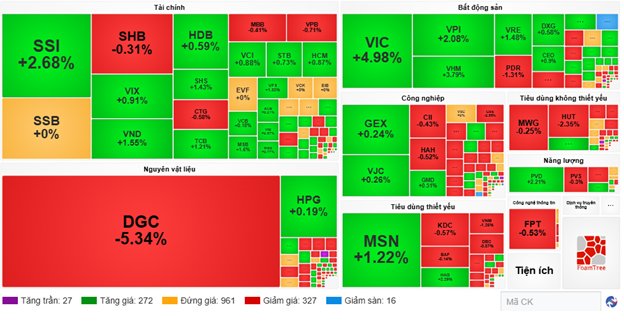

Sector-wise, real estate led with a 2.86% gain, driven by VIC (+4.98%), VPI (+2.08%), VHM (+3.79%), VRE (+1.48%), and NLG (+1.11%).

The financial sector also traded actively, with standout performers including SSI (+2.68%), VIX (+0.91%), VND (+1.55%), SHS (+1.43%), TCB (+1.21%), and MSB (+1.6%). However, some stocks faced selling pressure, such as VPB (-0.71%), TCX (-0.75%), BVH (-1.31%), and VPX (-2.76%).

Conversely, the industrial sector underperformed with a 0.65% decline, influenced by ACV (-0.77%), GEE (-2.55%), MVN (-5.53%), BMP (-5.15%), VTP (-0.99%), PC1 (-1.6%), and VGR (-14.81%).

Source: VietstockFinance

|

Foreign investors continued net selling with over 596.2 billion VND across all three exchanges. Selling pressure was concentrated in DGC, with a value of 582.65 billion VND, far exceeding other stocks. Conversely, VIC and HPG led net buying with values of 93.33 billion and 66.07 billion, respectively.

Source: VietstockFinance

|

10:30 AM: Vingroup Stocks Shine, VN-Index Surges

As of 10:30 AM, the VN-Index rose over 18 points, trading around 1,695.82 points. The HNX-Index increased by more than 1 point, trading around 254 points.

Green dominated among VN30 stocks, with VIC, VHM, TCB, and LPB supporting the market by contributing over 9.9 points to the index. Conversely, FPT, VNM, VJC, and DGC faced selling pressure, reducing the index by nearly 2 points.

Source: VietstockFinance

|

Real estate stocks led the market with a 2.15% gain. Specifically, VIC rose 3.85%, VHM increased 2.53%, VPI gained 2.08%, and VRE advanced 2.47%. Only a few stocks declined, including PDR (-0.79%), KHG (-0.28%), and DIG (-0.28%).

Non-essential consumer stocks also showed mixed performance, but buyers maintained the upper hand. Notable gainers included VPL (+1.35%), MWG (+0.25%), PET (+0.32%), TTF (+1.41%), and HAX (+0.47%). Decliners included DGW (-1.98%), FRT (-0.56%), HUT (-2.35%), and PNJ (-0.54%).

Compared to the opening, buyers gained the upper hand, with 290 advancers and 249 decliners.

9:40 AM: DGC “Escapes Floor” with Over 22 Million Shares Traded in 40 Minutes

In the early session on December 19, as of 9:40 AM, the VN-Index rose slightly by over 6 points to around 1,683 points. The HNX-Index also increased slightly above the reference level to 253 points.

Green dominated the morning session, with real estate stocks like VIC (+2.73%) and VHM (+1.05%) rising positively from the start.

The materials sector was in focus as DGC quickly rebounded from the floor price, rising 5% at one point, but soon reversed to a 2% decline. Over 22 million shares were traded swiftly, despite earlier announcements of margin ratio cuts and lower price limits for the stock.

Leading stocks like LPB, HVN, and VCB supported the index with a combined gain of over 1.8 points. Conversely, VPL, FPT, and GEE exerted downward pressure, but their impact was minimal.

– 15:35 19/12/2025

Dong Tay Land Honored as Southeast Asia’s Agency of Excellence 2025

The prestigious Southeast Asia’s Agencies Excellence 2025 award further solidifies Dong Tay Land’s reputation and standing in the market.

Stock Market Week 15-19/12/2025: Recovery Momentum Hinges on Broader Liquidity Flow

The VN-Index surged powerfully in the final session of the week, reclaiming the psychological threshold of 1,700 points, signaling a determined effort to restore equilibrium after the previous week’s sharp correction. However, the market still requires broader liquidity participation and consensus to establish a more sustainable trend moving forward.